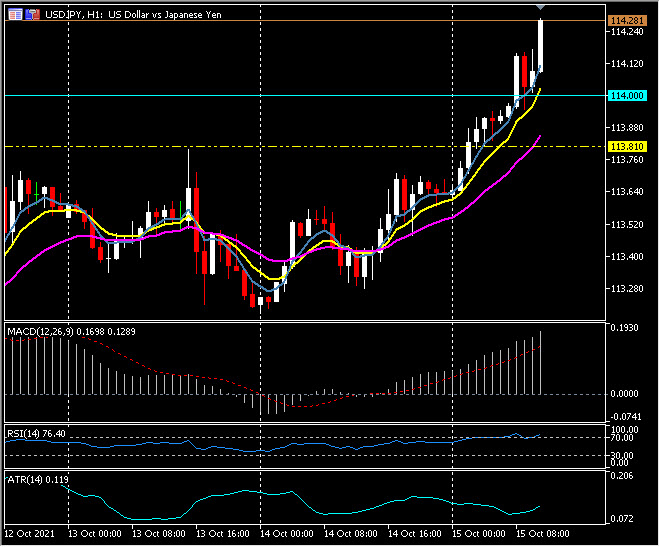

USDJPY, H1

Join me LIVE later on our Facebook and YouTube channels from 12:20 GMT as the final key data of a very exciting week is released.

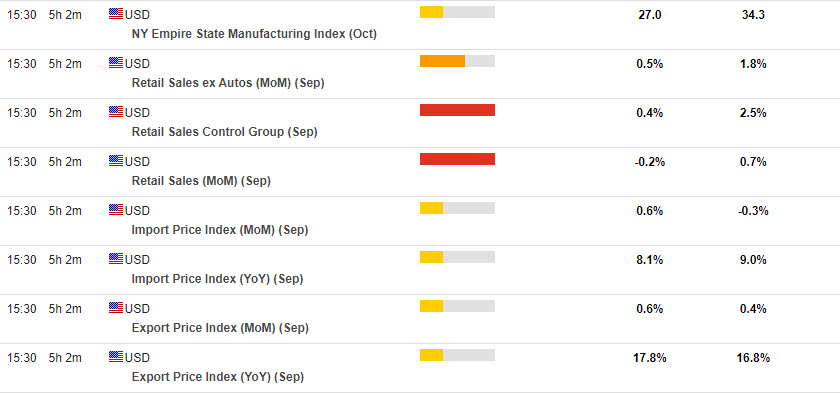

US Retail Sales: Expectations are for a -0.2% decline in retail sales for September, along with a 0.5% ex-auto gain, following respective August increases of 0.7% and 1.8%. The headline should be hit from declining vehicle sales, as well as from a continued unwind of the lift from Q1 stimulus. Unit vehicle sales fell -6.4% to a 17-month low of 12.2 mln thanks to ongoing semiconductor shortages and delayed unloading at ports, following a 13.0 mln pace in August and a 16-year high of 18.3 mln in April. Expectations are for a 1.5% increase for the CPI gasoline index that should support service station sales. Retail sales are expected to stabilize through Q4 following the post-stimulus pull-back, though service sector activity should continue to expand. Real consumer spending is expected to grow at a lean 1.7% rate in Q3 and a 3.3% pace in Q4, after rates of 12.0% in Q2 and 11.4% in Q1.

US Empire State: The Empire State index should ease to 27.0 in October, after rebounding 16.0 points to 34.3 in September from 18.3 in August, versus a 43.0 all-time high in July and a 7-month low of 3.5 in January. Nearly every component rose in September. But the complications from supply chain disruptions, along with inflation and labour market shortages, likely weighed on producer sentiment.

US Trade Price: Imports and exports are expected to climb 0.6% and 0.6% respectively in September, after August swings of -0.3% for imports and 0.4% for exports. On a 12-month basis, import prices posted an 8.1% y/y clip in August, with export prices at a 16.8% pace. Ex-petroleum import prices are expected to rise 0.4%, while ex-agriculture export prices increase 0.8%. Oil prices moderated in August after a 9-month stretch of big gains, though there has been a steep climb in energy prices into October, and a wide array of price gains attributable to global capacity constraints and supply chain disruptions. A downtrend in the value of the Dollar into 2021 also aggravated the outsized trade price climb since December, though recent dollar gains may cap price increases into Q4. Trade price gains have contributed to the shift in market focus toward upside inflation risk in 2021, though these fears should diminish into 2022 as some price overshoots with supply chain distortions should moderate.

It’s been a BIG week with the YEN very much on the backfoot. USDJPY broke 114.00 to touch 35-month high at 114.26, GBPJPY is over 156.00 at five-and-a-half year highs and EURJPY 132.50 & AUDJPY 84.70 are at three-and-a-half year highs. The Japanese currency is registering as the biggest loser among the G10+ group of currencies both over the last week and the last month, with the yen underperforming amid rising tide of sovereign bond yields thanks to the BoJ’s yield curve control policy, which is keeping the 10-year JGB benchmark yield rooted near 0%, alongside ongoing dovish, overall, signalling from BoJ policymakers (BoJ’s Noguchi, for instance, said yesterday addition easing may be necessary, while Governor Kuroda argued that prevailing inflationary forces in the U.S. will prove to be transitory). Another factor, more relevant to prevailing conditions, is the risk-on tone in global equity markets. The Japanese currency is a low yielding currency of a surplus economy, and tends to weaken during risk-on phases in global markets, and strengthen during times of pronounced and sustained risk aversion.

The Oil rally continues (UKOIL hit $85.00 a barrel) as the energy crunch continues and the Earnings Season gets off to a block buster start as the Wall Street banks all beat expectations driving US Equity markets to bounce over 1.7%.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.