- USD (USDIndex 93.60) slips 0.6% (-1.0% from last week’s highs) Weak industrial production.

- PBOC breaks silence on Evergrande -“can contain contagion”: Risks are (1) other Real Estate Co’s & (2) Wider Economy.

- US Yields (10yr closed 1.576%) now at 1.60% in Asian trades.

- Equities moved strongly higher into close. USA500 +33.0 (+0.75%) at 4471 (Dow +1.0%) – Big movers AMZN & MasterCard +3.3%, TSLA +3.0% & BAC +2.8%, FB -1.15%, MRNA -2.31%. USA500.F dips to 4446. Asian equities lower on China news. VIX closed -2.56% at 17.00 (8 week low) – trades up at 17.35 now.

- USOil back to test new 7-yr highs, trades at $82.75.

- Gold slipped on higher yields down to $1763 now from Thursday’s test of $1800.

- FX markets USD remains bid – EURUSD 1.1573 Cable holds 1.3720 (Bailey ‘will have to act’ to curb inflation) & USDJPY higher again at 114.25.

Week Ahead – Inflation and PMI data dominate the economic releases, Earnings highlights include: Johnson & Johnson, Procter & Gamble, Netflix, (Squid Games to add $900m in Revenue?) Verizon, IBM, Intel, Tesla, (Musk joined 200+ VW exec’s over weekend) & AT&T.

European Open – The December 10-year Bund future is down -53 ticks at 169.05, underperforming versus Treasury futures and pointing to another sharp rise in cash yields at the start of the session. Comments from BoE’s Bailey, will add to pressure in the European part of the session. UK money markets are increasingly pricing in a move from the BoE this year, which is leaving bond market traders worrying about stagflation risks. DAX and FTSE 100 futures are currently down -0.1%.

Today – US Building Permits & Housing Starts, ECB’s Elderson, Panetta, Lane, BoE’s Bailey, Fed’s Harker, Daly, Bostic, Waller. Earnings –

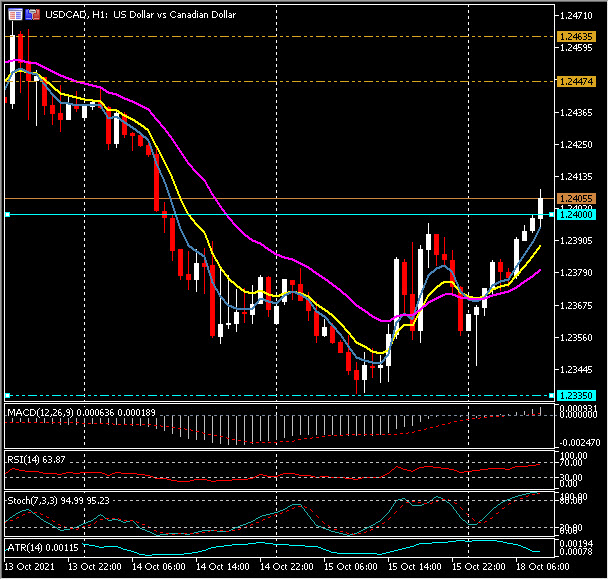

Biggest FX Mover @ (06:30 GMT) USDCAD (+0.28%) Rallied from 1.2335 lows on Friday to test 1.2400 now. Faster MAs aligned higher, MACD signal line & histogram trending higher & over 0 line, RSI 64.00 & moving higher, Stochs. 95 and OB. H1 ATR 0.0012, Daily ATR 0.00826.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.