- USD (USDIndex 93.70) recovers from test of 2-week low (93.47) Yields stronger, Equities closed strongly on good Earnings, Netflix beat big time (Subs 4.38m vs 3.86m. – globally now 213.6m) Squid Game watched in 142 million households in 94 countries. Biden expects a deal on infra budget, Chinese housing prices slow, and NK fired more missiles (non-ballistic today) into S. China Sea.

- US Yields (10yr closed higher at 1.6350) & touched 1.662 earlier – now 1.6495%

- Equities moved higher gaining momentum USA500 +33 (+0.74%) at 4519 (NASDAQ +0.71%) – Big movers – J&J +2.34% & APPL 1.18% – USA500.F higher into 4503. Asian equities higher (Nikkei +0.76%) VIX closed down again at 15.57 (a new 8-week low – VXN – (which measures Nasdaq volatility) – at lowest since February 2020)

- USOil down from 7-yr high, at $83.00 after private inventories – trades at $81.00

- Gold holds at $1775 now from yesterday’s high of $1785 and low of $1767.

- FX markets – a recovering USD has – EURUSD 1.1640, Cable down from 1.3800+ after CPI data at 1.3785 & a weaker YEN, USDJPY – 4-year highs – 114.70.

Overnight – UK CPI a tick weaker than expected (3.1% vs 3.2%) PPI in line. German PPI much stronger than expected @ 2.3% vs 1.1%.

European Open – The December 10-year bund future is down 35 ticks, underperforming versus Treasury futures. Yields moved broadly higher across Europe yesterday and while ECB officials are doing their best to keep rate hike speculation at bay, they are fighting an uphill battle, especially as the BoE is preparing for an early lift off on rates. The surprise misses for UK CPI could dull the expectation.

Today – EZ Final CPI, Canadian CPI, ECB’s Elderson, Fed’s Bullard, Earnings – Verizon, Tesla, IBM, Abbot, AMSL, Nestle (already out – a big beat especially for Pet food Division)

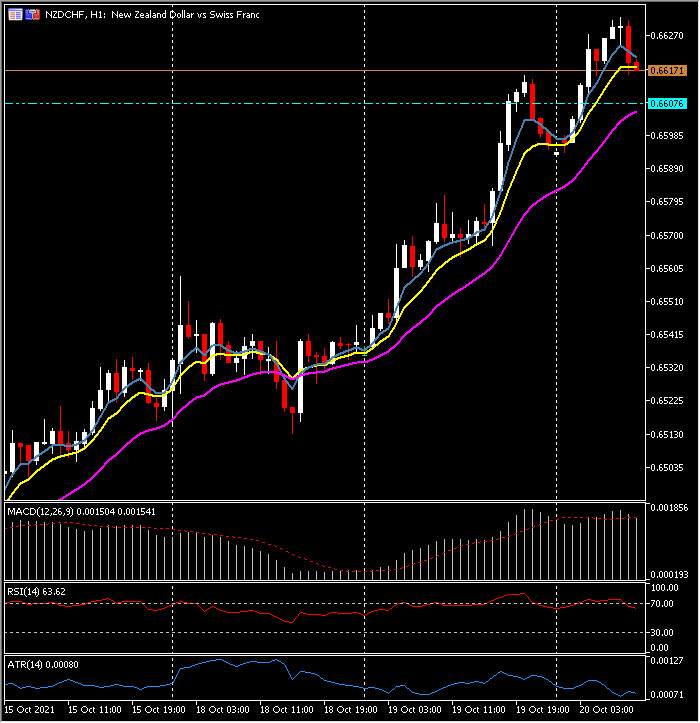

Biggest FX Mover @ (06:30 GMT) NZDCHF (+0.40%) 5th consecutive day higher today (from 0.6425) breached 0.6600 earlier, and testing 0.6630 now. Faster MAs aligned higher, MACD signal line & histogram trending higher, RSI 65.00 OB but still moving higher, H1 ATR 0.0008, Daily ATR 0.0054.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.