AT&T, the US telecommunications giant will report its 3rd quarter financial report on Thursday, October 21 before the market open. AT&T is the world’s largest telecommunications company (ranked 9th in the Fortune 500 companies with revenue of $172 billion in 2020). The giant has three core businesses namely telecommunications, entertainment and business communications.

AT&T continues to be aggressive in business planning where the company continues to invest in upgrading 5G infrastructure across the United States for their core telecommunications business, rolling out 5G+ services in several major cities. AT&T continues to innovate in their communications business where AT&T has partnered with General Motors to offer in-vehicle communications services and also partnered with Cisco System in enhancing Internet of Things (IoT) services especially to the business sector.

Zacks market analysts project returns from communications at $28 billion, down from $34 billion last year.

Meanwhile, the entertainment sector under WarnerMedia is expected to continue to report positive growth, especially from “online streaming” platform HBO Max. AT&T projects 70 billion HBO Max users by the end of the year. Despite the projected positive growth, HBO Max faces stiff competition in the domestic market where consumers are starting to turn to main competitor Amazon Prime Video, forcing HBO Max to offer a low monthly charge reduction for 6 months, this is expected to hurt HBO Max’s revenue. AT&T is expected to remain positive with the growth of its entertainment sector post Covid-19 where sports events and live entertainment events will be re-organized and it is expected to increase revenue from the advertising sector again. Zacks market analysts project returns from communications at $8.3 billion, up from $7.5 billion last year.

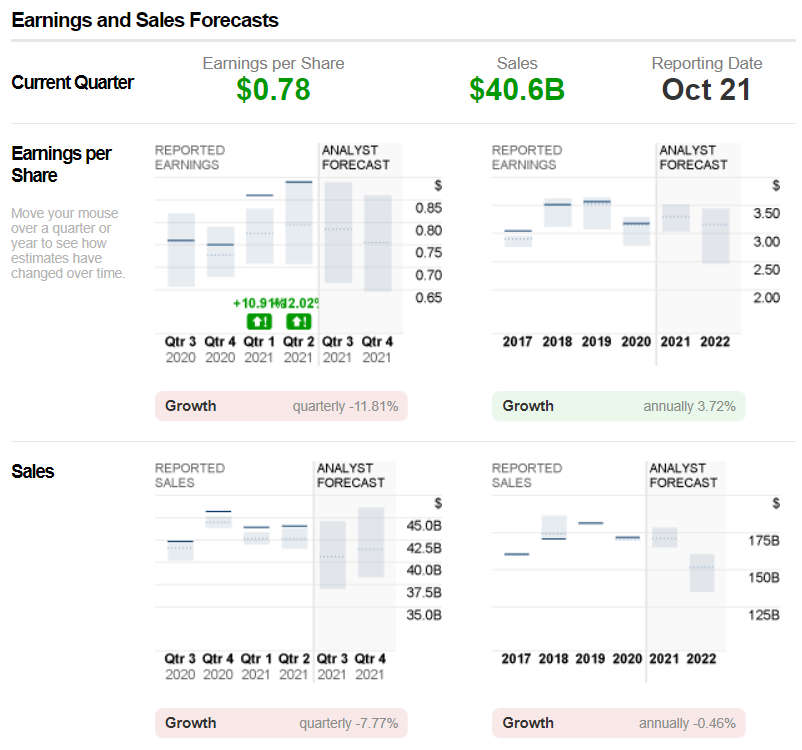

In its 2nd quarter report last July, AT&T reported earnings that exceeded analyst projections where it reported return per share (EPS) at $0.89 up 7.2% from the same quarter last year. For the 3rd quarter, market analysts surveyed by CNN Business projected overall revenue for AT&T to be at $40.6 billion, down from $42.3 billion a year earlier with earnings per share at $0.78, up from $0.76 in the same quarter last year. AT&T reported consistent quarterly reports that either met or exceeded projections by market analysts over the past 4 quarters.

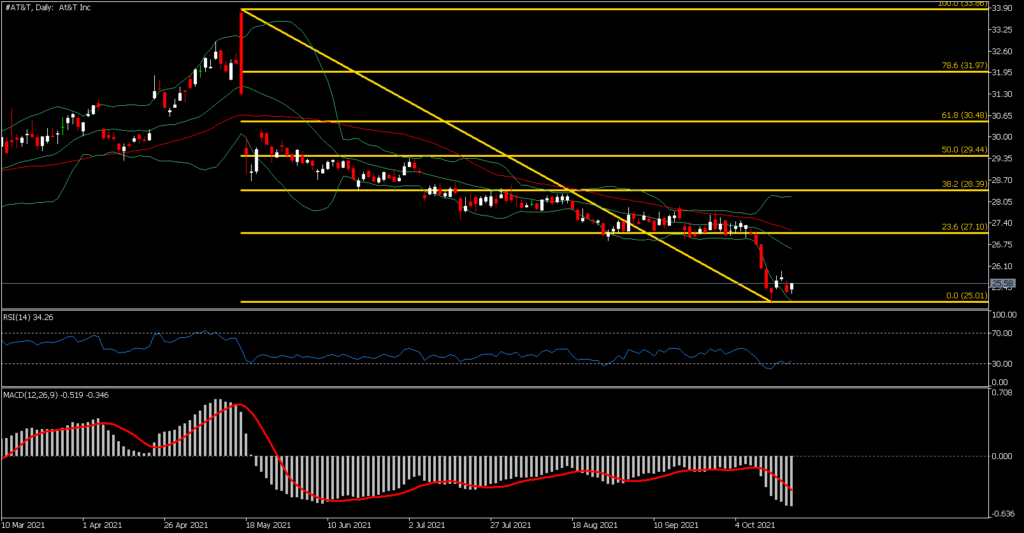

Although AT&T’s quarterly report (MT5: #AT&T) recorded consistent results over the past 4 quarters, its share price showed the opposite movement. AT&T shares struggled to stay strong, recording a continuous decline since the Covid-19 outburst in March 2020. It is currently traded at the lowest area seen since 2009. It is in stark contrast to the movements of the USA30 and USA500 which recorded record highs and price increases. It is currently trading at $25.58, down more than 35% from a record high in 2019 at $39.75. AT&T shares have also been down for 5 consecutive months since May 2021. October 2013 lows at $ 25.01 now is the nearest support level with a Fibo level of 23.6% at $27.10 to be the nearest resistant. Medium term and long term momentum are showing that bears are still dominating AT&T stocks with RSI still far from the neutral level of 50 and the MACD line signal still heading downwards.

Currently, Zacks places AT&T in category #3 which is Hold while 18 of the 29 analysts counted by CNN Business also place AT&T shares in the Hold category, with 3 placing Sell, 1 Underperform, 2 Outperform and 5 more in Buy.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Regional Market Analyst – Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.