- USD (USDIndex 93.70) rallies a whole number and more from 93.47), Claims at new pandemic low, Housing data and Earnings were strong. Overnight – AUD & JPY PMI data better than expected & UK Retail sales big miss (-0.2% vs +0.6%).

- Evergrande (+5.4%) The $83.5m payment appears to have been met, avoiding immediate default, next payments due Oct 29. – Ease contagion fears in China – rally in Chinese property stocks.

- Yields stronger again (10yr hits 1.705) and now 1.677% – still heading for a weekly rise as markets position for a turn at central banks.

- Equities, reached ATH’s (Nikkei +0.7%), with USA500 at 4551 (NASDAQ shed its losses quickly and finished with a 0.62% gain at 15,215, just shy of its record of 15,374 from September 7) – Big movers – Snap -22% & Intel -9%, AT&T -0.58%, Netflix +4%, Tesla +3.5%)- VIX contract is at 18.82. GER30 and UK100 futures still higher on the day.

- UK retail sales dropped for a second month in September.

- Japan’s headline inflation rate lifted out of negative territory for the first time in 18 months.

- USOil down to $80.81 following a US National Oceanic and Atmospheric Administration which is calling for warmer than average winter temperatures this winter.

- Gold holds at 4-day highs – $1793

- FX markets – CAD, AUD and NZD gained, while USD and JPY were steady to lower, leaving USDJPY at 113.98. – EURUSD 1.1635, Cable down to 1.3781.

European Open: The December 10-year Bund future is down 13 ticks at 168.12, underperforming versus US futures, although the 30-year future has rallied sharply. In cash markets the 10-year Treasury yield is down -2.4% at 1.677%, still heading for a weekly rise as markets position for a turn at central banks. DAX and FTSE 100 futures are currently up 0.24% and 0.27% respectively, while US futures are in the red, with a -0.5% decline in the NASDAQ future leading the way. Earnings and company reports remain in focus and while news that Evergrande paid the coupon on a USD bond ahead of the default-deadline helped to ease contagion fears in China, other company reports weighed on the NASDAQ.

Today – Earnings will remain in focus today, but markets will also watch scheduled comments from Fed’s Powell, while preliminary PMI reports for the Eurozone and the UK and US are in focus. The earnings calendar features reports from Honeywell, American Express, HCA Healthcare, Roper Technologies, Schlumberger, Barclays, V.F. Corp., Regions Financial, Seagate Technology, and Cleveland Cliffs.

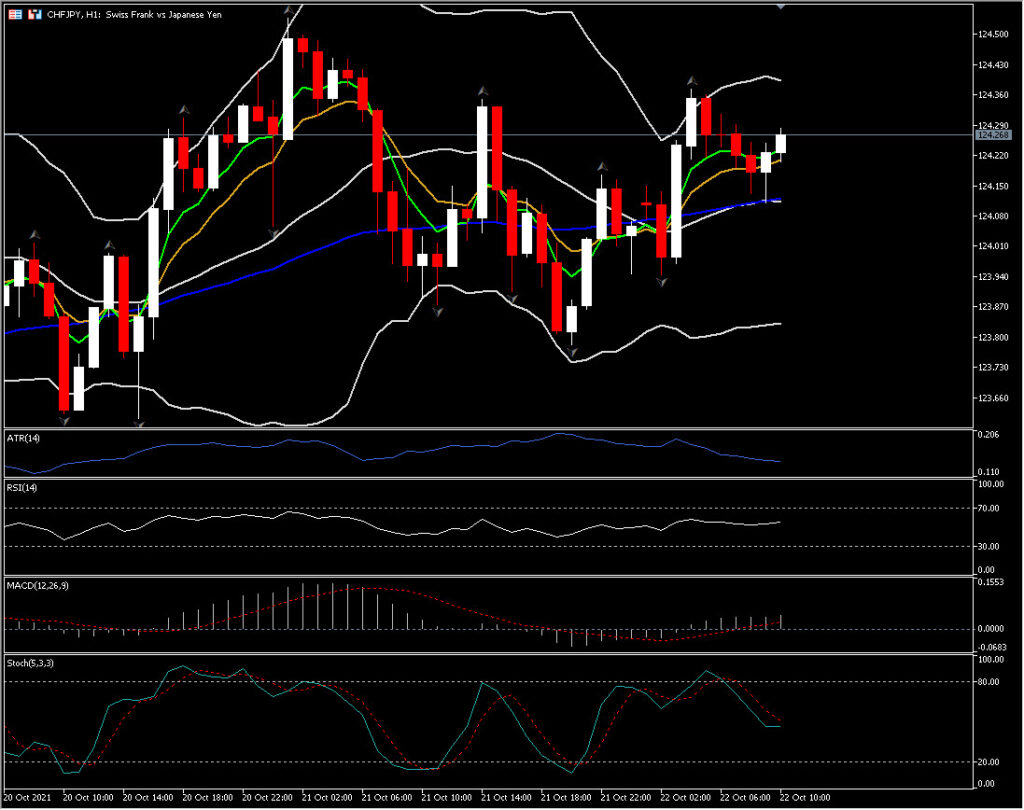

Biggest FX Mover @ (06:30 GMT) CHFJPY (+0.34%) Rebound of 124. 10 (PP & 20- & 50-period SMA) this morning. Faster MAs aligned higher, MACD signal lines rise and RSI 57.00 as Stochastic post a bullish cross. H1 ATR 0.139, Daily ATR 0.745.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.