Microsoft’s first-quarter fiscal 2022 earnings report is due on October 26, 2021.Considering the previous quarterly report, this guide will forecast the company’s first-quarter earnings report. Expectations will be high when Microsoft Corporation releases results on October 26. The pandemic shutdown boosted demand for Microsoft’s goods, and the business reached the $2 trillion mark in June, only the second corporation in history to do so [1].

When Microsoft’s FY21 Q4 earnings were published, the company’s results exceeded Wall Street’s expectations. While analysts expected $44.10 billion in sales, the IT giant brought in $46.2 billion in the fourth quarter of its fiscal year. Microsoft’s Office products and cloud services grew by 25% year over year, leading to a better-than-expected quarter. In addition, Microsoft’s Intelligent Cloud sales increased by 30% year over year to $17.4 billion, owing to Azure’s 51%, which saw cloud services and server products expand by 34% [2].

Strong demand for the firm’s consumption-based services led to a 12% gain in Enterprise Services revenue. The company ascribed to growth in Microsoft Consulting Services and Premier Support Services. The More Personal Computing industry grew by 9%, while some sectors witnessed declines in growth both year over year and compared to the third quarter of FY21. Despite a slowing in Xbox growth, gaming revenue was up 11%, with Xbox Series X and S hardware being credited with a 172% rise in Xbox hardware revenue [2].

Microsoft anticipates revenue from Windows commercial products and cloud services to rise in the double digits in the coming quarter, owing to strong demand for Microsoft 365 and enhanced security solutions. The Microsoft Power Platform’s healthy uptake is expected to have helped the top line in the upcoming quarter. For fiscal 2021, the company’s next-generation business process automation platform, Power platform, saw sales increase by 83% year over year [3].

The company’s fiscal first-quarter results are likely to be boosted by continued success in its cloud computing platform, Azure. Due to the increased digital transformation of corporate businesses throughout the world, Azure has seen significant adoption. Increased adoption of the Game Pass subscription service and Xbox Live monthly active users are expected to help Microsoft’s gaming division. In addition, following the conclusion of the acquisition, additional ZeniMax Media gaming titles were added to the Game Pass list, which is likely to have attracted more users [3].

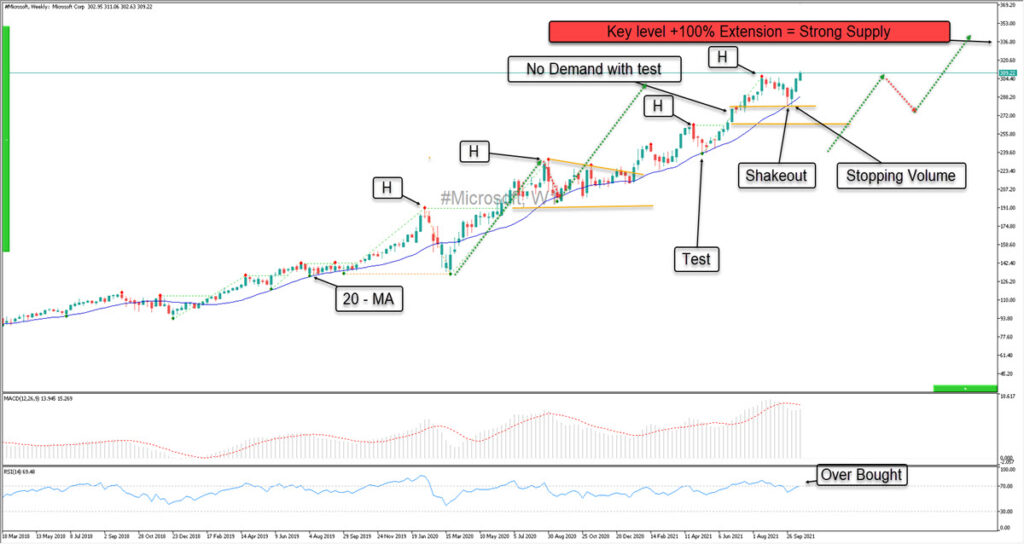

MSFT is currently trading at its highest level at 310. After dipping towards the 280 level earlier in October, MSFT climbed and surpassed its previous high of 304. Since the beginning of the year, MSFT has been in an uptrend, and with positive news surrounding the company, the trend will likely continue in the last two months of 2021.

The price is well above the 100-day MA on the daily chart, and the MACD is pointing upwards. This signifies a bullish trend. The next resistance for MSFT lies around 318. If it manages to cross this level, then the stock could go towards the 330 mark. On the other hand, the stock’s support lies around 303. If the price breaches this level, it could further dip towards 280, the level it saw earlier in October [4].

- https://www.bloomberg.com/news/articles/2021-06-22/microsoft-rallies-to-join-apple-in-exclusive-2-trillion-club

- https://www.microsoft.com/en-us/Investor/earnings/FY-2021-Q4/press-release-webcast

- https://www.nasdaq.com/articles/what-to-expect-ahead-of-microsoft-msft-q1-earnings-release-2021-10-21

- https://finance.yahoo.com/quote/MSFT/

Click here to access our Economic Calendar

Adnan Rehman

Market Analyst – Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.