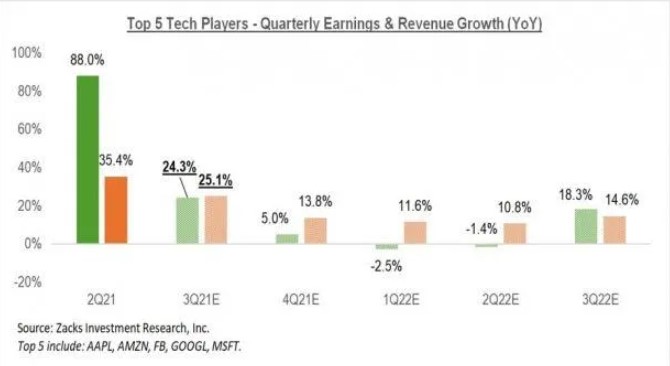

FAANG is the acronym formed by the trade names of the five largest technology companies listed on Nasdaq. Among these 5 companies is Alphabet Inc, which is listed twice on Nasdaq (GOOG and GOOGL) and is therefore the most viable to have the biggest growth of the FAANG for this season. The FAANG currently represent around 22.9% of the total capitalization of the S&P500, and this week 4 out of 5 of these companies are reporting earnings.

“We continue to rate Google as our top FAANG of 2021 given the cyclical recovery exposure versus its peers with tough comparisons” – BofA.

Alphabet Inc. (#Alphabet) is recognized worldwide for being an American multinational and mainly for being the parent company of Google which includes its main internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search and YouTube. In addition to encompassing Google, it also develops products and services related to the Internet, software, consumer electronics, and electronic devices, and it is a holding company that is dedicated to the business of acquisition and operation of different companies, including companies in sectors such as biotechnology, health, telecommunications and home automation such as Access, Calico, CapitalG, GV, Verily, Waymo, etc.

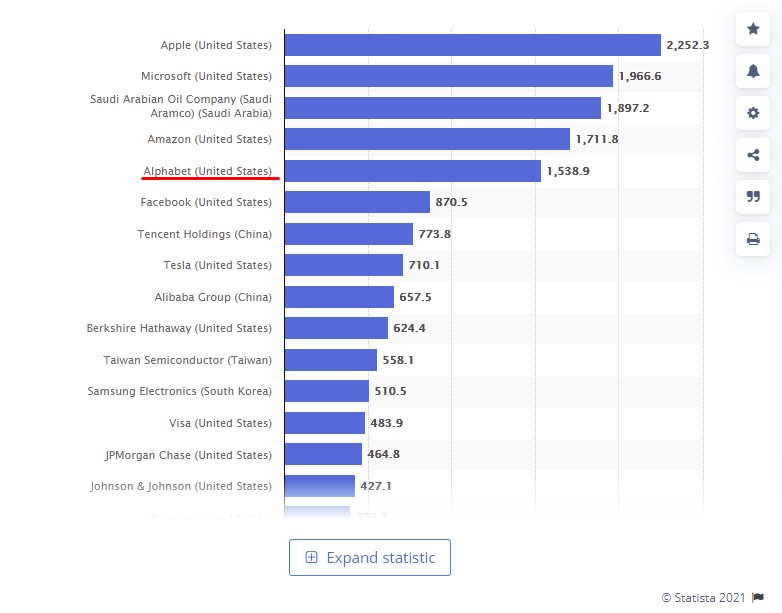

Alphabet was founded in 2015 by Lawrence E. Page and Sergey Mikhaylovich Brin. The company has a capitalization of $1,834.46B and has a total of 666,755,000 outstanding shares, making it the 5th largest company in the world. It has approximately 135,301 workers worldwide and its main headquarters are at 1600 Amphitheater Parkway, Mountain View CA, USA.

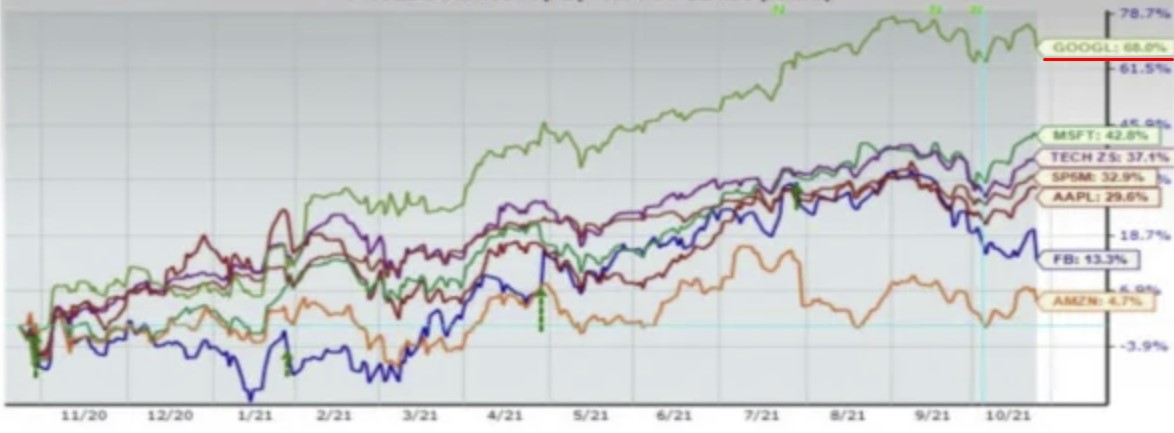

Alphabet plans to release its quarterly report for the end of the fiscal Sep 2021 quarter on Tuesday, October 26 after market close. Estimates are expected to be exceeded as it has in the last 4 quarters. GOOGL has performed tremendously this year with 68.95% returns in 12 months and 0.59% in the last 3 months.

“Despite the addition of IDFA [Identifier for Advertising] and supply chain uncertainty in Q4, we remain constructive on stocks.” – Justin Post BofA

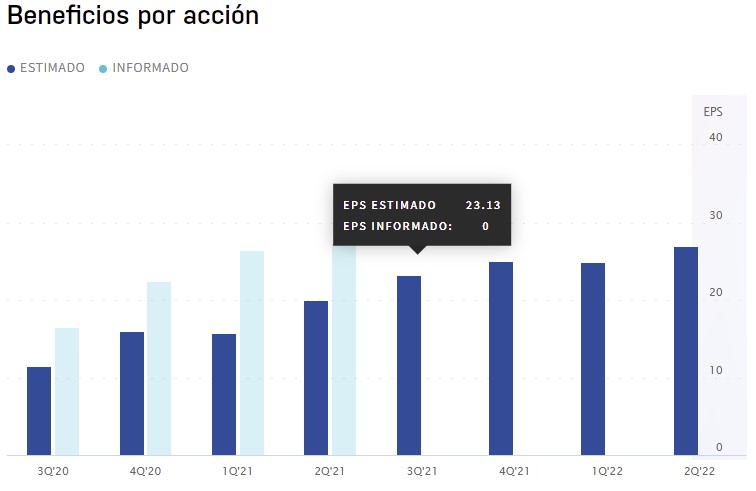

Alphabet Inc. is ranked #2 by Zacks (Buy) at #103 out of #251 in the Top 41% Internet-Services Industry Rank with an ESP of 7.71%, most accurate EPS estimate of $24.91 and a consensus estimate EPS of $23.13.

Seeking Alpha foresees EPS of $23.37 which would be +42.49% over the previous year with an estimated profit of $63.35B with 21 revisions up and 3 down in the last 90 days.

“Alphabet Inc. was among the biggest contributors to performance during the third quarter. Alphabet is a leading Internet search provider, benefiting from the shift in share of advertising dollars from traditional media such as television, radio, and newspapers to digital platforms. The company is a leader in the implementation of AI, autonomous vehicles and cloud computing, and owns the property of high-traffic YouTube. Alphabet contributed to performance with a strong quarterly report highlighted by revenue growth that beat consensus expectations across all segments. The company’s core search revenue has increased 10% in the last two years, and cloud computing has increased 8%. YouTube’s results also exceeded expectations. Discussing the quarterly results, Alphabet management said that retail, entertainment and travel were particularly strong end markets. The fixed cost structure of Alphabet’s search service resulted in profitability as a result of better than expected revenue growth.” -Alger Spectra Fund Investor Letter

Alphabet is very solid in the search sector as the search engine has been improved thanks to the introduction of the technology of unified multitasking models (MUM) backed by IA and LaMDA, giving better results to user searches in addition to the increase of searches on mobile devices. On the other hand, there is the part about the improvement in its portfolio of advertising services, Google is increasing the ads of local services gaining ground in this area although there may be new regulatory challenges. All of this, however, promises a beneficial quarter for the company.

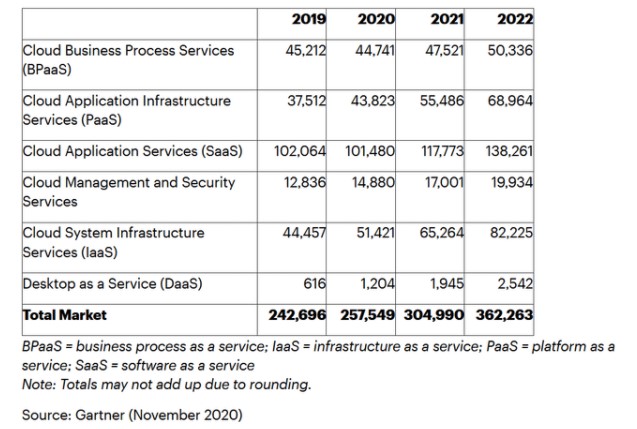

One point worth considering is the Google Cloud business, as it is the linchpin of Alphabet’s growth thanks to the strengthening of its Google Cloud Platform and Google Workspace cloud service offerings. Segment revenues were $4.6 billion in the second quarter representing 7.5% of total revenues. For this quarter, the Zacks Consensus Estimate for Google Cloud revenue is set at $5.01 billion, suggesting growth of 45.5% over the reported figure for the prior-year quarter. Therefore, Alphabet has the necessary elements to accelerate the growth of the cloud segment, but it should be noted that Alphabet already has a global IT infrastructure on par with Amazon and Microsoft leaders in this business segment, reports SeekingAlpha.

Alphabet has had to face several challenges including concerns with ad tracking technology and the phasing out of cookies, while Google paid Russia more than 32 million rubles ($455,079) in fines for failing to remove content that Moscow considers illegal. Google reported via an Android post that it will cut app store fees in half for most developers. Instead of dropping from 30% to 15% after 12 months, the service fees for subscriptions in the Google Play store will be 15% from the day developers join, the company announced.

“Digital subscriptions have become one of the fastest growing models for developers, but we know that subscription companies face specific challenges in customer acquisition and retention.” “We have worked with our partners in the dating industries, fitness, education and others to understand the nuances of their businesses. Our current service fee drops from 30% to 15% after 12 months of a recurring subscription. But we’ve heard that the loss of customers makes it difficult for underwriting companies to benefit from that reduced fee. So we’re keeping things simple to make sure they can.” – Sameer Samat, vice president of product management at Google

It is likely that the company’s efforts encircled companies within Alphabet such as the expansion of Nest, the push in the broadcast market of GoogleTV, the union with Cisco Systems to support interoperability among its customers and users, the expansion of the Early Rider program, which is a driverless transportation service from Waymo, as well as its strength in the development of digital payments and healthcare, affect the results of this Q3 in a beneficial way.

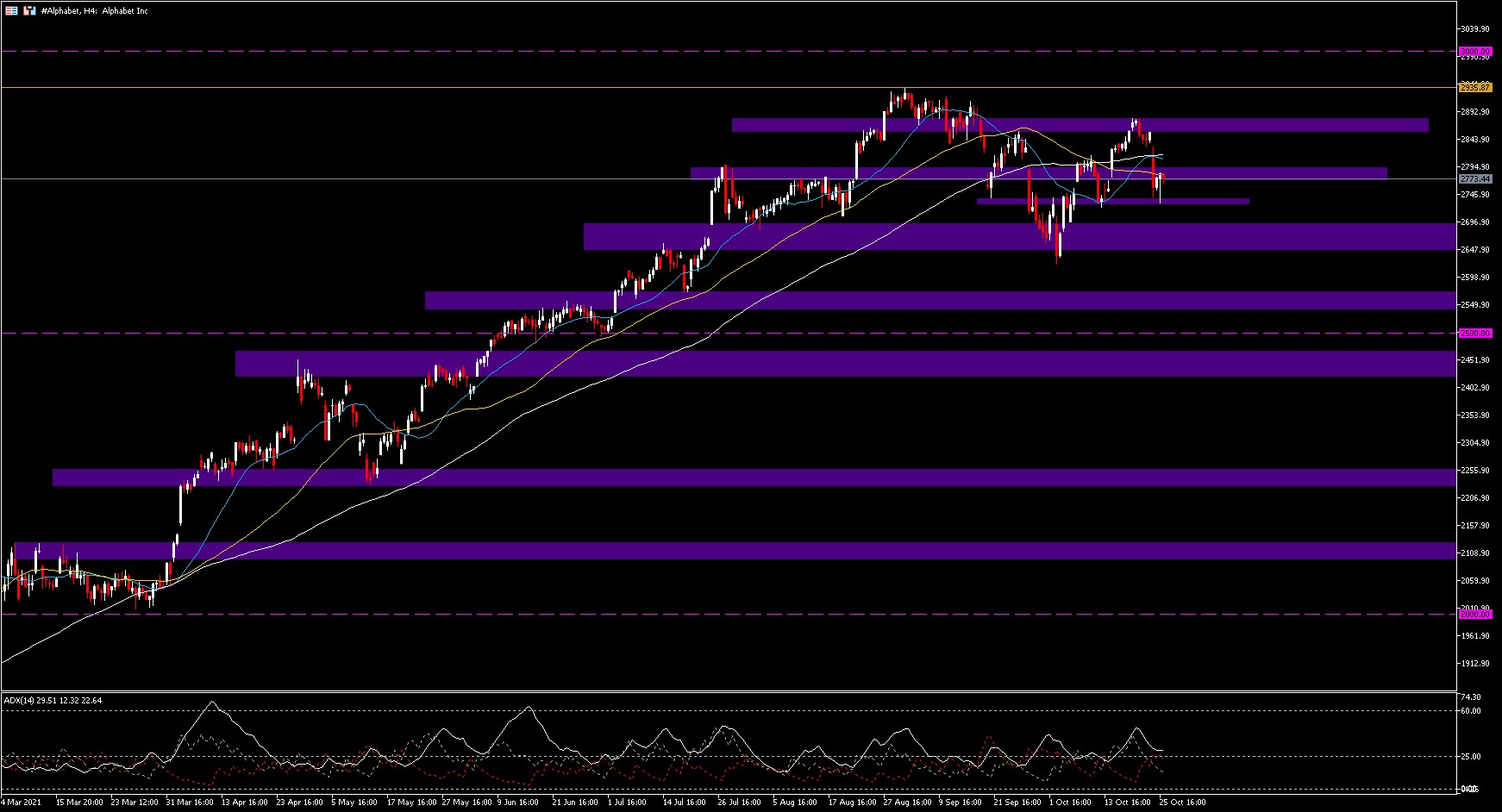

Technical Analysis – Alphabet H4

Alphabet has maintained a bullish rally since its inception. At the beginning of the year it entered the range after breaking its psychological support of 2000, until 2116, ending up breaking the range to the upside and managing to mark a maximum up to 2439.60 and then falling back to its support marking a minimum at the beginning of May at 2230. From this minimum the price has continued with a strong upward trend, managing to overcome and maintain the psychological level of 2500.

As of today it remains above 2700 with a current price of 2773.44, which has pushed the price up and marked a new all-time high at 2778.70. The price could continue to rise to the next psychological level at 2800, which it is already very close to, and if maintained it could rally to the next resistance that marks the FE 161.8 at 2939.54 approaching to the psychological level of 3000.

Aldo Zapien.

Market Analyst – HF Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.