Amazon (#Amazon) – The online retail giant with a market capitalization of $1.68 trillion (after Apple, Microsoft, and Alphabet) is due to report third-quarter results on Thursday, Oct. 28 after the market close, with Zacks forecasting a return per share of $8.72, down from $12.37 in the year-ago quarter. Sales are expected to be $111.85 billion, higher than the $96.15 billion in the same quarter a year ago.

Since the Covid-19 outbreak, the online retail business has continued to grow, however, after the easing of lockdown measures consumers seem to be returning to their old ways of living again. This trend can be seen in Amazon’s revenue for the past quarter, which was lower than analysts expected. As a result, the company’s share price has dropped more than 7% since its Q2 report, with the company commenting that this slowing growth may continue for the next few quarters compared to the period of the pandemic last year.

In addition to retail, the cloud business has also been one of the beneficiaries of the Covid-19 pandemic, with Amazon Web Services (AWS), Amazon’s cloud division, last quarter generating $14.8 billion in revenue and selling 13% of $113.08 billion in total sales in Q2. The expansion of the new บริการใหม่ของ AWS include the addition of new users Arctic Wolf Networks, Sun Life, and a partnership with Wyndham Hotels & Resorts to develop services for 21 hotel brands, which are all expected to contribute to cloud revenue. Continued growth is expected in Q3, with Zacks expecting AWS revenue in Q3 to be $15.5 billion, while the Amazon Prime streaming division, which operates in 22 countries, generated $7.9 billion in the past quarter, an increase of 28% compared to the same period of the previous year.

Another key change that could affect Q3 results is the departure of Jeff Bezos as CEO in Q2 , replaced by cloud computing head Andy Jassy.

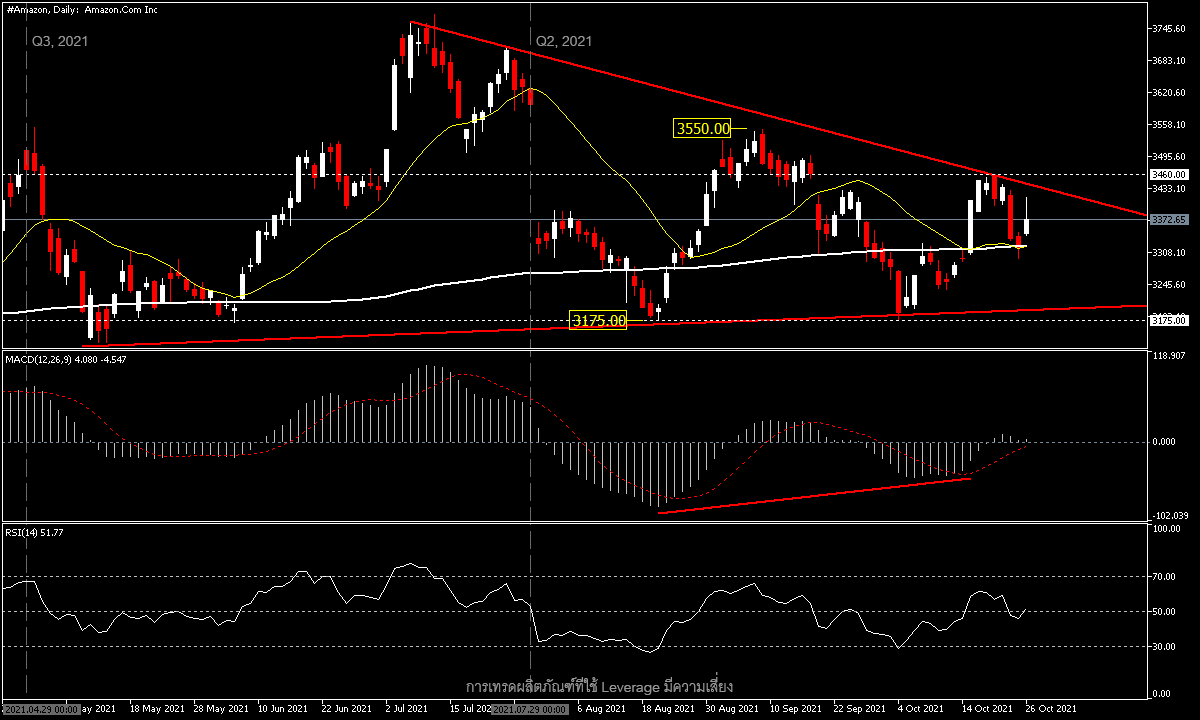

Amazon’s share price from year-to-year is up 3.66%; after falling from the all-time high zone ($3,773.00) from the Q2 report, it is now trading in the $3376.00 zone in the triangle above the MA20 and MA200. The narrowing of the price in the triangle indicates an unclear direction and the momentum is decreasing. This is consistent with the MACD moving near the 0 line and the RSI near the 50 level. We may see the company’s share price breaking out of this triangle. But if the earnings are close to the expected numbers, the share price may continue to swing within the triangle frame. It has a first support at the MA200 at $3,320.00 and a low zone at $3,175.00, while the baseline is at $3,460.00 and quarter high zone $3,550.00.

The factors that could put pressure on the company’s stock price later include inflationary pressures and Fed movements, while supply chain problems and recent shortages in semiconductors are also likely to affect the sales of related products especially during the upcoming major shopping season.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.