- USD (USDIndex 93.82) V. choppy session as Yield spreads narrowed to March 2020 lows (2&5yr higher, 10&30yr lower) – catalysts Inflation worries, surprise ending of QE, earlier rates hikes suggested from BOC. Stocks down, Oil sank. Durable Goods missed but not as bad as expected, Trade balance at record $96.3 bn.

- US Yields (10yr crashed into close at 1.529) lifted in Asian now 1.57%.

- Equities lower – USA500 -23 (-0.51%) at 4551 (DOW -0.75%) – Big movers – MSFT +4.21%, GOOGL + 4.96%, EXXON -2.6%, JPM -2.08% – USA500.F back to 4545. Asian equities weaker.

- USOil down on Inventories more than a double build – at 4.3m vs 2.0m & draw down last week of 400k barrels. Low $79.39 earlier from $83.70 on Monday.

- Gold recovers from $1783 low yesterday to breach $1800 now.

- FX markets – EURUSD 1.1600, Cable 1.3750, USDJPY now 113.70

ECB Preview: The central bank is widely expected to keep policy settings on hold today, after Lagarde signalled last month that the important decisions on the future of PEPP and possible changes to the older APP programmes won’t be taken until December. Still, markets will be hoping for some signals on the flavour of the discussion at the presser. The departure (by year end) of Bundesbank President Weidmann – the most hawkish and traditional central banker at the council – fueled speculation of a further strengthening of the older APP asset purchase programs. The ECB’s mandate will still have to be respected, but by keeping some flexibility for emergency situations the ECB could still send a dovish signal, even if it confirms in December that PEPP will end on time in March next year – as is widely expected.

European Open The December 10-year Bund future is up 4 ticks, but the 30-year future is moving higher long Gilt futures are rallying, as markets turn pessimistic on the growth outlook. DAX and FTSE 100 futures are managing slight gains though in line with US futures.

Today – German Unemployment, EZ Consumer Confidence, US GDP, PCE Prices Advance, Weekly Claims, ECB Policy Announcement and Press Conference Earnings- Airbus, AB InBev, Carlsberg, Evolution Gaming, Nokia, Saint Gobain; Shell; Amazon, Apple, Comcast, Merck, Caterpillar, Mastercard, Yum!, Shopify.

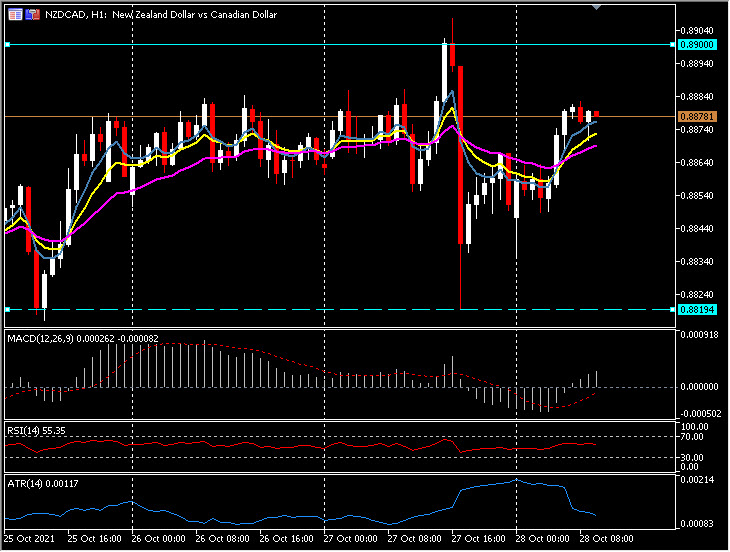

Biggest FX Mover @ (06:30 GMT) NZDCAD (+0.37%) Recovering from BOC shock yesterday down to 0.8820 back to 0.8880 now. Faster MAs aligned higher, MACD signal line & histogram rising, RSI 55 & rising. H1 ATR 0.0012, Daily ATR 0.0062.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.