Moderna Company (#Moderna) plans to report its third-quarter earnings report tomorrow before the market open. It is a US-based pharmaceutical and biotechnology company that focuses on mRNA technology and development, including the development of drugs to treat various diseases and vaccines that have specifically helped curb the outbreak of new coronavirus infections.

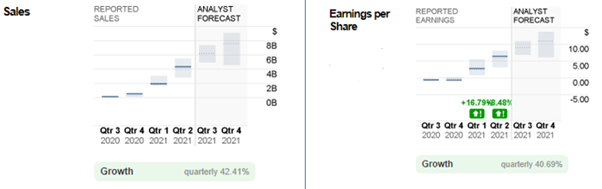

In the last quarter, Moderna’s performance was in line with analyst expectations. The company’s sales reached $4.4 billion, a significant improvement from the $67 million in the same period in 2020. Net income from the same period last year was, $1.17 billion to $28 billion. Earnings per share (EPS) has remained positive throughout 2021, last reported at $6.46 ($0.31 in the same period last year), and earnings unexpectedly were 7.49%. These satisfactory results are mainly due to the sales of its coronavirus vaccine.

Figure 1: Moderna’s quarterly reported sales and earnings per share.

In the forthcoming earnings announcement, the market estimates that Moderna’s reported sales will continue to increase to $6.2 billion, with earnings per share at $9.09, both representing an increase of nearly 41% from the previous quarter. In the same quarter last year, the company reported sales of approximately $158 million, while earnings per share were lower than analysts’ expectations, at $0.59. In view of the increased costs and expenses associated with the development of candidate vaccines, the net loss exceeded $230,000. In any case, the company is currently ranked #3 (hold) by Zacks.

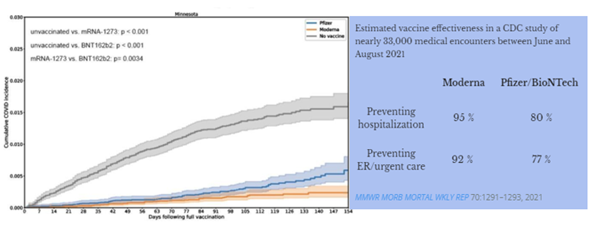

On the positive side, Moderna’s mRNA vaccine has been particularly sought after by wealthy countries to a large extent. A clinical study proved that it can provide the best effect on the most threatening variant, Delta, compared to similar products. As the initial dose of immunity begins to weaken, boosters are now being introduced for immunocompromised adults to extend the immunity lifespan, which may drive demand for vaccines higher and benefit the company. In its latest financial framework, Moderna expects to provide 800 million to 1 billion doses of vaccine in 2021, and 2 billion to 3 billion doses of vaccine in 2022. The gains from its partners AstraZeneca and Merck, which use the company’s mRNA technology to develop therapies, can also be seen as positive factors for Moderna’s future growth.

On the downside, restrictions on the use of the Moderna vaccine in Finland and Sweden may mean that the company’s market share has been reduced to 74 countries, far behind Pfizer/BioNTech (103 countries). In addition, the US decision to postpone the approval of the Moderna vaccine (possibly postponed to January 2022) may adversely affect the current situation. Nevertheless, the company’s future performance is closely related to the global coronavirus development (daily new confirmed cases, hospitalization, death, death risk, etc.) and vaccination rates. So far, according to Our World in Data, the total number of vaccine doses administered worldwide has exceeded 7.04 billion, and 49.5% of the world’s population (3.6% of the population in low-income countries) have been vaccinated at least once.

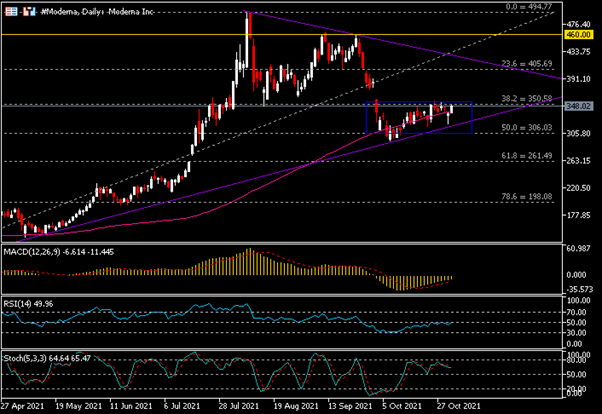

The daily chart shows that the #Moderna stock price has been trading in the range of $65 since it gapped and formed a bearish candle on October 1. Overnight, the company’s shares closed above the 100-day SMA (pink). The $350 serves as immediate resistance. Breaking this level will provide an opportunity for the stock price to test the median estimate provided by analysts, which is $375 and then $405 (or 23.6% Fibonacci retracement level). From a macro perspective, it can be seen that the latter and the downward trend line of the symmetrical triangle form a solid confluence zone.

On the other hand, the uptrend line of the triangle and $306 (50.0% Fibonacci retracement level) form a solid support. The successful closing of the candle below this level will attract more selling pressure to test the next support levels of $260 (61.8% Fibonacci retracement level) and $198 (78.6% Fibonacci retracement level). The indicators are still mixed: the MACD fast and slow line is higher but still below the 0 axis; RSI remains neutral at the 50 level, while the stochastic indicator forms a death cross below the overbought area.

Click here to view the economic calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.