Berkshire Hathaway Inc., Warren Buffet’s holdings in various industries such as retail, energy, insurance, manufacturing, utilities and railroads are expected to release third-quarter 2021 earnings on November 5, after market close. In the second quarter report, Berkshire Hathaway Inc. recorded an operating profit of $6.69 billion, up 21% year-on-year, while net profit grew 6.8% year-on-year to $28 billion, all benefiting from the easing of restrictions that allowed increased shipping and transport activities.

Other business branches such as utilities and energy, with the current energy crisis conditions, are very likely to contribute greatly to the company’s revenue, despite the disruption caused by hurricane Ida earlier this year. But natural gas pipelines, including effects from business acquisitions and real estate brokerage businesses, are likely to contribute higher benefits and revenues.

Not to mention the insurance business which is recovering after the rapid development of vaccinations and the decline in virus transmission, although overshadowed by increases in insurance costs and higher loss adjustment, health insurance benefits and insurance coverage costs. The transportation business is expected to benefit from higher freight volumes and lower costs due to increased productivity. Manufacturing, service and retail businesses are also expected to benefit from higher customer demand.

In a way, all of Berkshire Hathaway Inc.’s businesses experienced a recovery along with the recovery in demand, so it is not surprising that in the third quarter report, their income increased, despite the looming risks amid the uncertainty of the pandemic, such as selling and service costs, interest expenses, freight rail transportation costs, utility costs and sales energy and other miscellaneous expenses as well as higher interest expense.

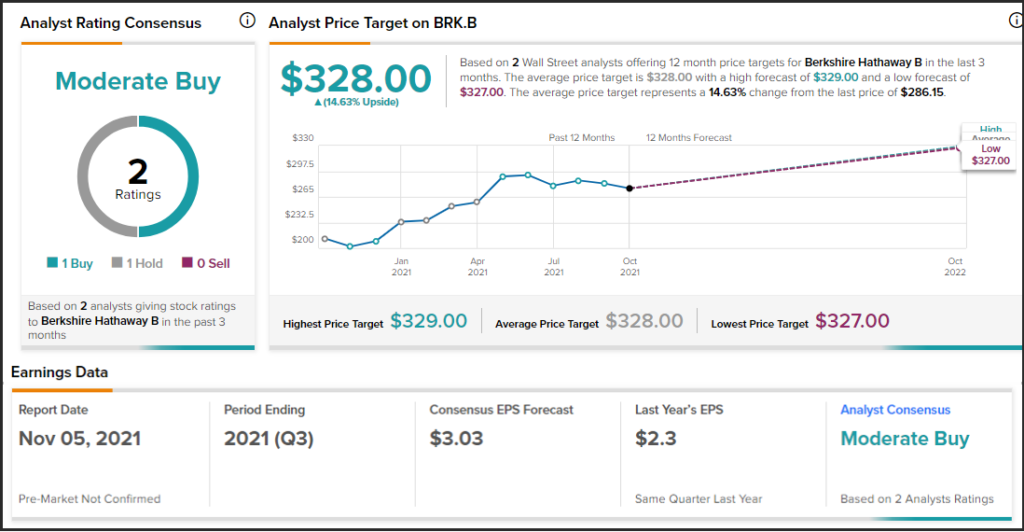

The Zacks Consensus forecast for the third quarter of 2021 is pegged at $3.01 per share, representing a 30.8% increase from the figure reported in the same quarter last year. The combination of ESP and Berkshire Hathaway’s earnings forecast is positive and Zacks rates it #2 (Buy).

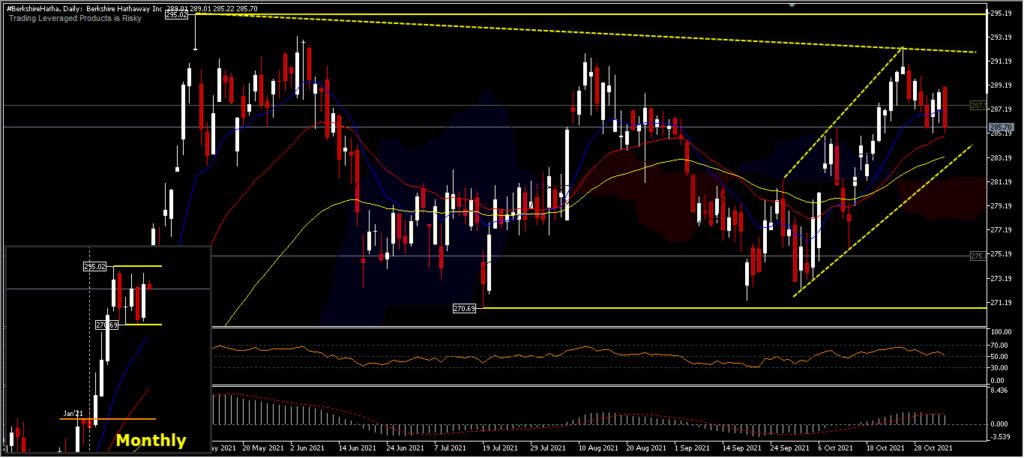

The total share price growth of Berkshire Hathaway from January 2021 to October 2021 was 24.45%, reaching highs over $287, and at the time of writing it is trading at around $285. The stock price hit a historic peak of $295.02 on May 10, 2021, and has never gone higher since, although in July the rally resumed from a low of $270.69 but only posted a lower high of $291.82, then dropped to $271.34 and rallied again for the second time by recording prices that were almost the same as the previous high of $292.21. So the total price movement of this asset in the last 6 months is only between $270.69 and $295.02.

At the start of November, the upward momentum seems to have stalled and the price is seen approaching minor resistance which was breached earlier at $285.60 near the 20-day EMA, although the price structure is still in the ascending channel. The RSI and MACD indicators are still in a positive position for an upward path, but it is clear that this measurement tool reflects prices that are starting to weaken due to profit taking as they approach the third quarter earnings report.

While the resistance holds at $292.21, then the potential for correction to the south will test the 50-day EMA (yellow line) near the ascending trendline first before correcting further to the support level and on the upside will retest the nearest peak. It should be noted, that for the past 6 months, the price of this asset has been floating and is well reflected by the flat Kumo, which represents an established asset position, so there is no possibility of excessive volatile movements. Whatever the results of the earnings report, it is likely to have an impact on the stock price, but not jeopardize the future prospects of the company.

Berkshire Hathaway (BRK.B) shares, according to Tipranks, are at a moderate buy consensus rating, based on 1 Buy and 1 Hold, with a projected average price of $328 implying a potential gain of around 14% from current levels. Consensus EPS is at $3.03, higher than the previous EPS at $2.3.

A strong earnings report will provide assurance for investors to maintain their portfolios in these assets and the stock price, although corrected, may still be quite strong. Meanwhile, reports that may be unfavorable tend to extend asset prices in flat conditions longer. A good report will lead to a stronger long-term stock price and Buffett’s wealth will certainly increase from the stock holdings of banks and companies that recently reported surprising Q3 earnings.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.