GBPUSD, H1

There are several factors that have affected the GBPUSD and made it weak, including expansionary policy by the Bank of England, sharp re-pricing of potential interest rate moves and strained relations with the European Union due to the Northern Ireland Protocol and fishing rights.

UK economic growth data released in the London session led to a limited reaction in the markets. Positive news is that September’s GDP expanded by 0.6% m/m though, while preliminary figures for the third quarter showed a 6.6% y/y growth rate, less than expected.

On the other hand, the US Dollar continues to benefit from US inflation data. These indicators showed that the consumer price index is at its highest levels in 30 years and reinforced expectations that the Federal Reserve will tighten monetary policy sooner than most other major central banks.

Technical Analysis

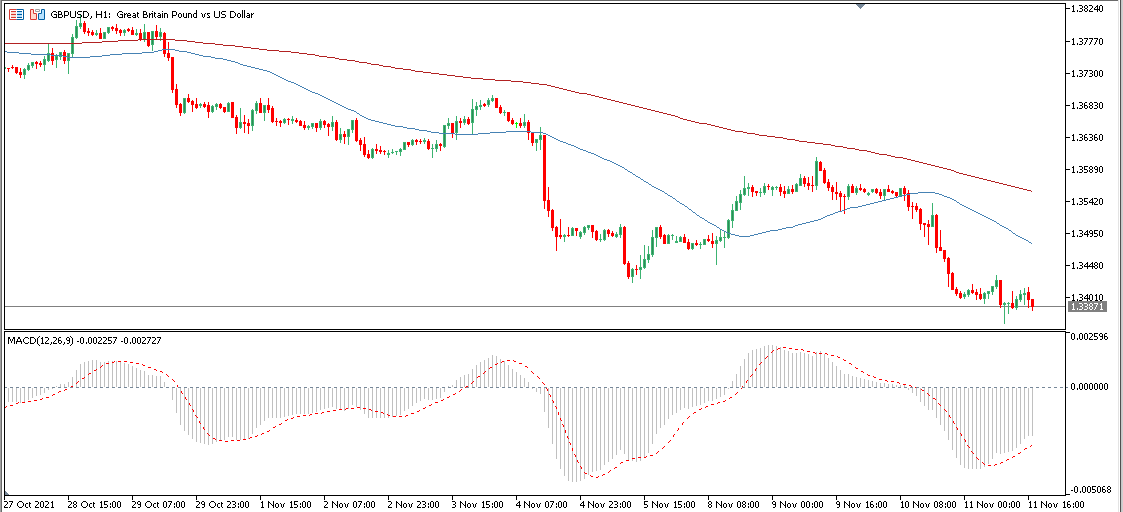

On an hourly time frame, the GBPUSD has been in a bearish channel since October 29 which is confirmed by the presence of the 200 SMA (red) above the 50 SMA (blue). The highest resistance was reached at 1.38314. The lowest support reached by the currency pair is the current price at 1.33871.

MACD signal line and histogram are below the 0 line and are continuing to rise.

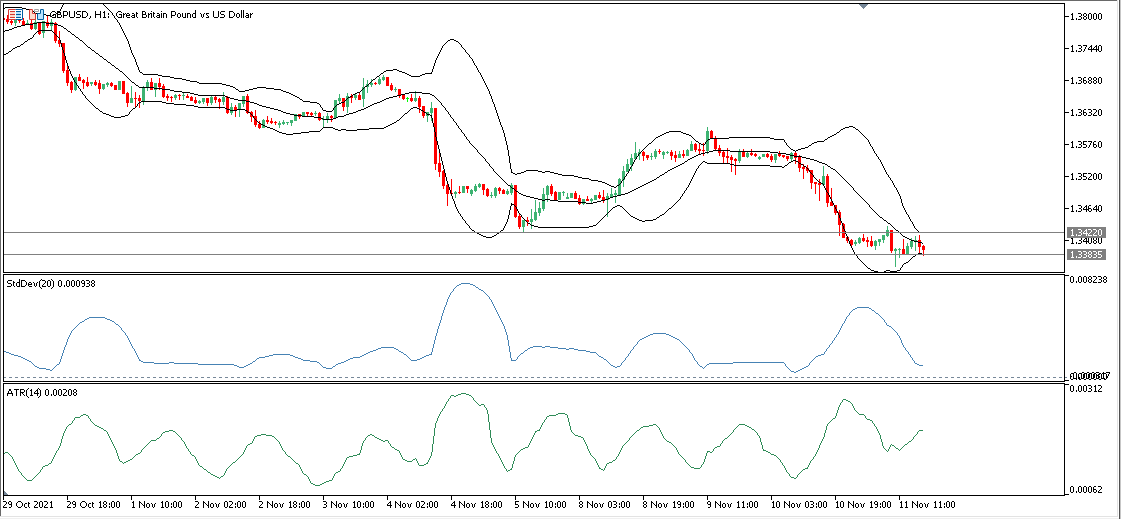

The Bollinger Bands indicator here shows that the upper band and the lower band are approaching each other as the upper band of the volatility channel is located at 1.34220 and the lower band of the volatility channel is located at 1.33835 and this indicates a period of low volatility. Standard Deviation (20) at 0.000938 is oversold and Average True Range (14) is at 0.00208

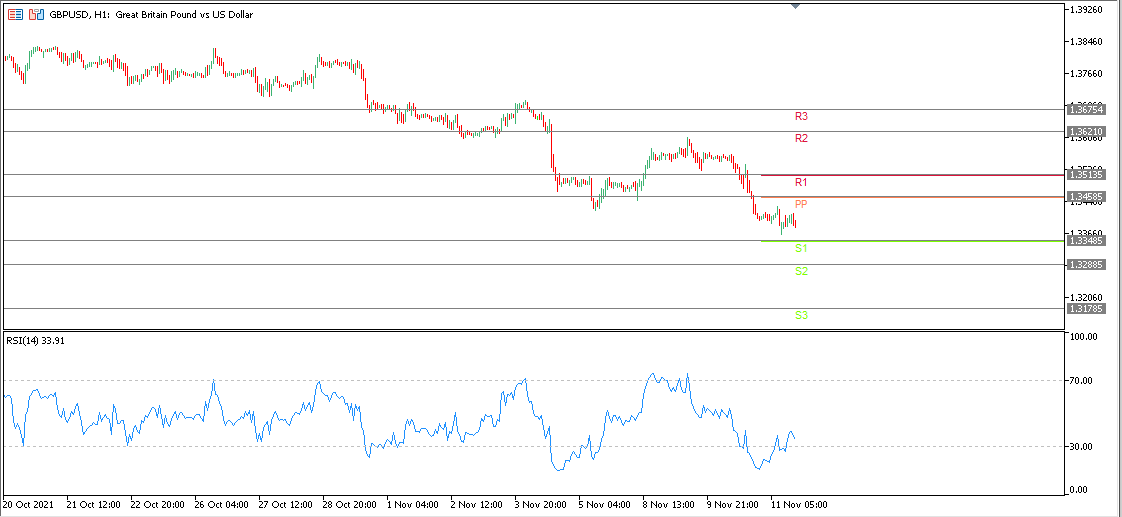

In the following image, we find the pivot point, resistances and supports, where the main pivot point is located at 1.34585. The first, second and third resistances, respectively, are located at 1.35135, 1.36210 and 1.36754, while the first, second and third support are at 1.33485, 1.32885 and 1.31785, respectively. The RSI is at 33.91 and is pointing down, indicating the continuation of the decline.

In the following image, we find the pivot point, resistances and supports, where the main pivot point is located at 1.34585. The first, second and third resistances, respectively, are located at 1.35135, 1.36210 and 1.36754, while the first, second and third support are at 1.33485, 1.32885 and 1.31785, respectively. The RSI is at 33.91 and is pointing down, indicating the continuation of the decline.

Click here to access Hot Forex’s economic calendar

Islam Salman

Market Analyst – Middle East

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.