-

- USD (USDIndex 02) spiked to 95.25 (new 16-mth high) on Friday. The consumer sentiment data (10-yr low)and JOLTS provided mixed views, with confidence plunging, 1-year inflation rising, and a slip in job openings, but a record 4.4 mln workers quitting their jobs.

- Stocks hold higher after spike on Friday, amid strong earnings and dip buyers supported, along with a more calm trade in Treasuries. Asian markets also found buyer, Treasury futures re-open positively. China bourses struggled despite a stronger retail sales number.

- Japan Q3 contracted -0.8% q/q, much more than anticipated -add to speculation that Kisihida will provide a big stimulus package to support the economy.

- US Yields(10yr trades at 55%, down 0.9bp). Treasury yields have taken a break from their manic gains seen last week, supportive of the equity market, while hopes that inflation is temporary, and that supply chains will improve into the new year have helped investor sentiment as well.

- Equities steady to Friday’s highs, Dow +0.5%, NASDAQ led the way +1% USA500 +0.7%, Nikkei lifting 0.4%.

- Big movers; TSLA dip -2.8% (Musk has already offloaded a combined $6.9 billion), J&J +2%, Toshiba -1.0%, Disney -7%. (Disney’s streaming growth disappoints).

- Johnson & Johnson: split of the company into two divisions, one being consumer health products, the other focuses on pharmaceuticals and medical devices. J&J’s shares are up 2% in early trade. Toshiba TOSYY 1.43% said it planned to split into three by March 2024 in response to shareholder pressure for a more-focused structure, following a similar path taken by fellow industrial conglomerate General Electric Co.

- US-EU: agreed to end a festering dispute over US steel and aluminum tariffs imposed in 2018, removing a burden on transatlantic relations and averting a spike in EU retaliatory tariffs. – tariffs of 25% on steel and 10% aluminum, while allowing “limited volumes” of EU-produced metals into the United States duty-free.

- USOil– slipped below $80.00, hit by a strengthening USD and speculation that Biden’s administration might release oil from the US Strategic Petroleum Reserve to cool prices.

- Gold reversed to 1856 from 1868.79 – inflation keeps Gold supported.

- FX markets – EURUSD & GBPUSD stack to 1448 earlier & 1.3420, USDJPYto 113.98. TRY at the record low level9.99.

- Focus today:Virtual meeting Link between Chinese leader Xi Jinping and US President Joe Biden later in the day, with hopes of an easing in ongoing tensions across a range of issues including tariffs imposed on China under former President Donald Trump.

Today – The data calendar today includes Eurozone trade numbers, but markets will be more interested in comments from ECB speakers today as ECB’s Lagarde faces questions from lawmakers

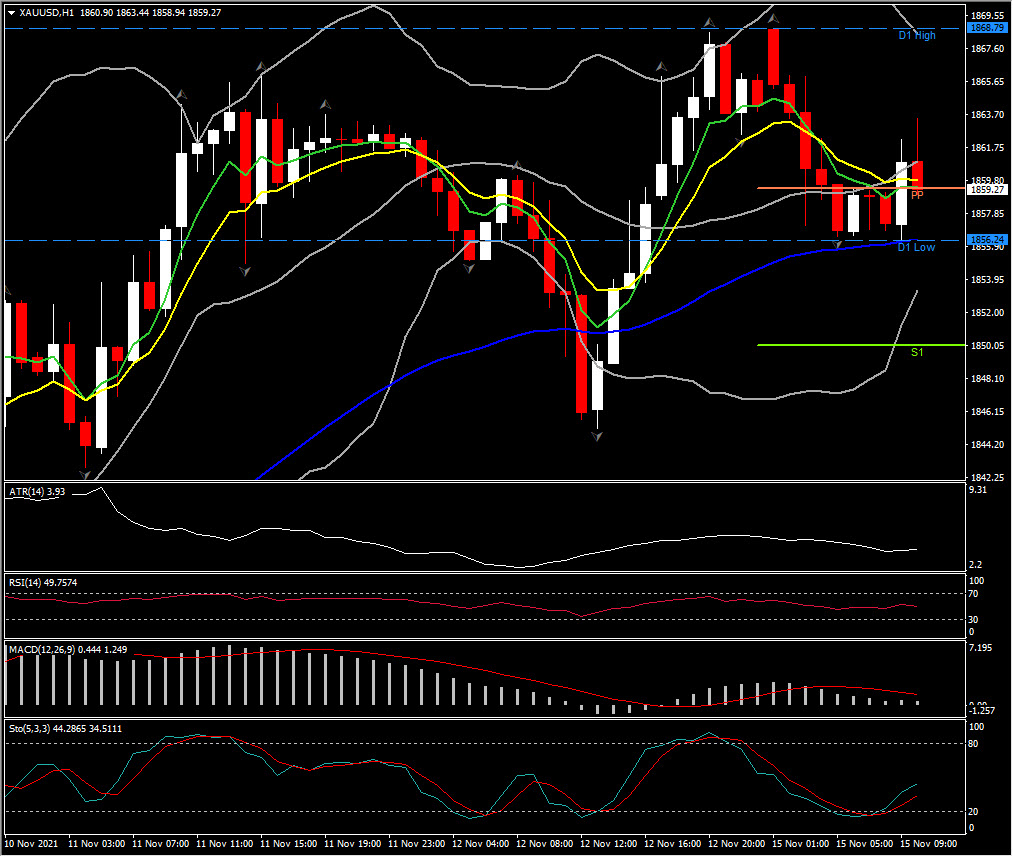

Biggest FX Mover @ (07:30 GMT) XAUUSD declined from 1868.79 to 1856.24 but remains well 1835 support. Faster MAs flattened, MACD signal line & histogram steadied at 0 line, RSI 49 & neutral, indicating consolidation intraday. H1 ATR 3.96, Daily ATR 22.49.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.Hi – yes