#NVIDIA is scheduled to release its third-quarter earnings report on November 17, 2021 at 10:00PM GMT.

NVIDIA

NVIDIA Corporation is a manufacturer of desktop computers, graphics processors, and mobile technologies. The company was founded by CurtisPriem, Jensen Huang, and Chris Malachowsky in 1993. The company is headquartered in Santa Clara, California. NVIDIA develops integrated circuits that are used in many things, including electronic games and personal computers. This company has the distinction of being a leading manufacturer of advanced Graphical Processor Units (GPUs).

In its second-quarter earnings report, NVIDIA reported record revenue of $6.51 billion, an increase of 68%. Diluted earnings per share, according to accepted accounting principles, are $0.94, up 276 percent from a year ago. As for the non-acceptable accounting principles earnings, it amounted to $1.04 per diluted share, an increase of 89% over last year. NVIDIA paid quarterly cash dividends of $100 million in the second quarter.

From logistics hubs and autonomous vehicles to the understanding of recommender systems and natural language, from climate science and digital biology to the intersecting realms of physics, said Jensen Huang, founder and CEO of NVIDIA, Inc.

Technical Analysis

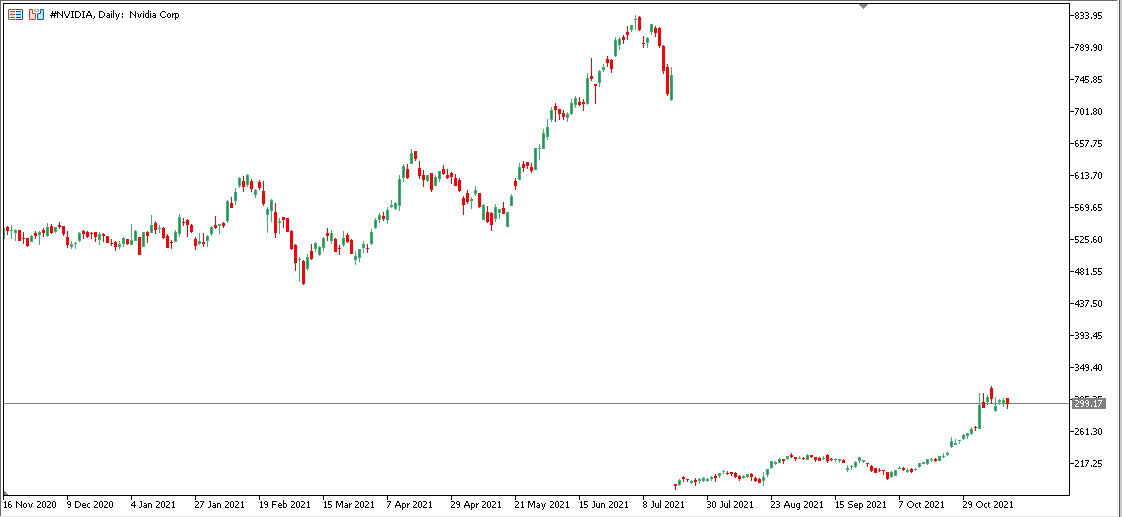

On a daily time frame, on July 20th, Nvidia did a 4 to 1 stock split and that doesn’t mean any change for the company after the stock split. This provides some investors with a much easier opportunity to get into NVIDIA stocks. The stock price closed at 299.95, yesterday (November 15).

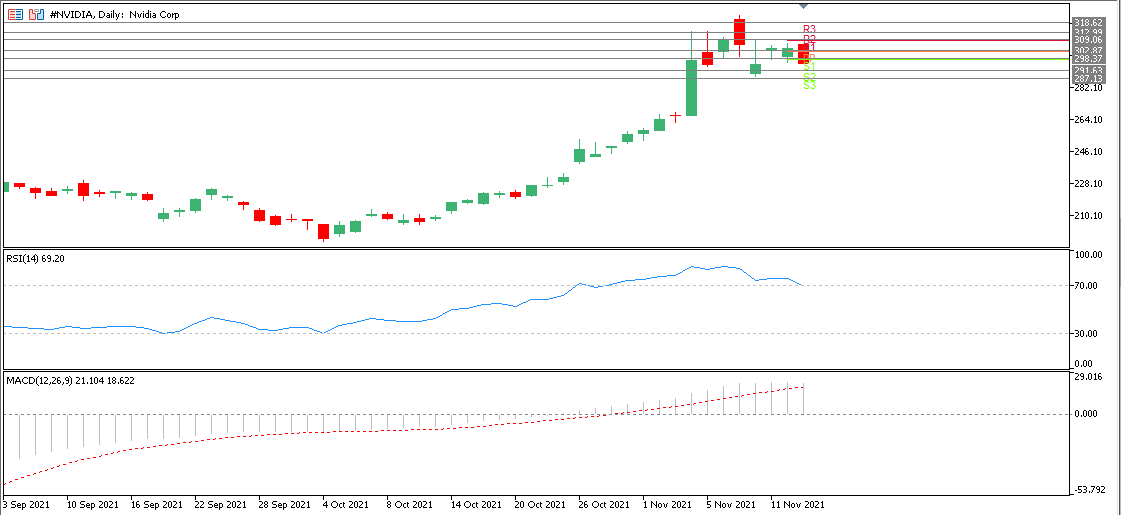

In the following picture, we find the pivot point, resistance and support, where the main pivot point is located at 302.87, and the first, second and third resistance, respectively, are located at 309.06, 312.99 and 318.62. We find the first, second and third support at 298.37, 291.63 and 287.13 respectively. The RSI is at 69.20 and rolling-over form highs at 86, earlier in the month.

MACD signal line and histogram are above the 0 line and continue to rise.

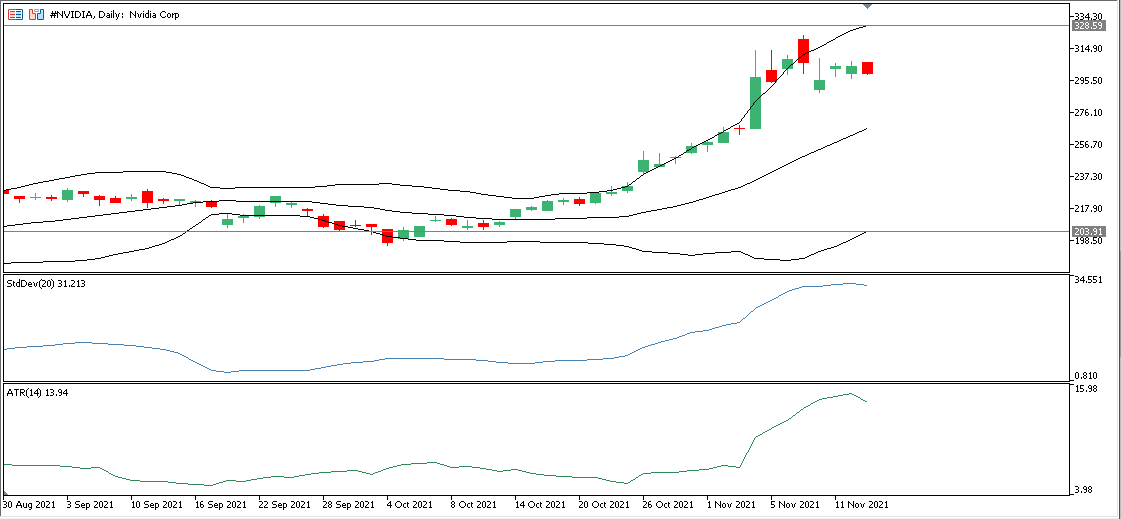

The Bollinger Bands indicator shows the upper band of the volatility channel at 328.59 and the lower band of the volatility channel at 203.91. The 20-day simple moving average is at 265.61. Here we notice that the upper, middle and lower bands are approaching each other, and this indicates a period of high volatility. Standard Deviation (20) is at 31.213 in overbought territory and Average True Range (14) is at 13.94.

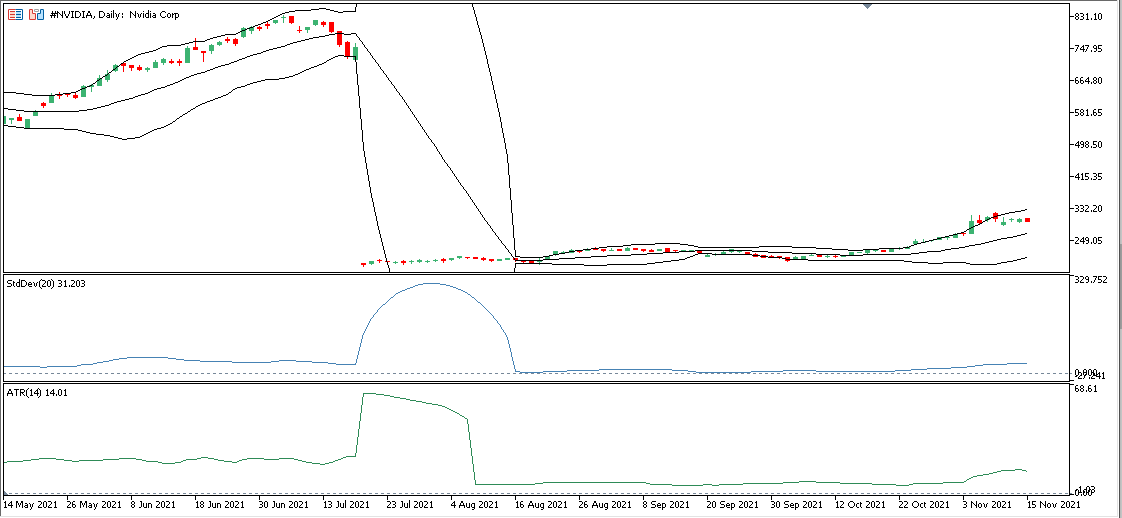

The asset is showing an intraday increasing negative bias ahead of the earnings release, with major support at 289.96. However, the medium-term outlook remains positive as the asset has been in an ascending channel since Oct 4 with a bullish crossover from the 20 and 50 day simple moving average and ascending MACD lines, indicating that the bulls are still in control. A break below 289.96 could open the door to a lower 197.13 (October low), while a further rise above 319.99 could draw attention to the 350.00, 463.00 and 540.00 area once again.

Click here to access our Economic Calendar

Eslam Salam

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.