- USDIndex pulled back again to 95.65 .

- Stock market stalled lower led by China tech stocks, which were under pressure as investors weighed global central bank outlooks and the prospect of a gradual withdrawal of monetary support.

- China Evergrande sells entire stake in streaming platform HengTen to ease debt burden.

- Safe havens such as government bonds, Gold and the Yen were supported in Asia, as a hint of uneasiness crept in over the outlook for interest rates and growth, particularly outside of the United States. – Japan’s 10-year rate up 1.0 bp at 0.68% – Japan’s stimulus package could hit record USD487bln.

- The RBNZ’s report on inflation expectations showed 2-year expectations at 2.96%, up from 2.27%, which will add pressure on central bankers to act ahead of the November 24 meeting.

- US Treasury Yields: The poor auction results were brushed off by the bond market that continues to waver amid inflation worries, Fed uncertainties, and positioning. Some of the selloff on the month has been seen as overdone after yields spiked to multi-month, if not better than 12-month highs. And rates have slipped amid short covering and dip buying. – 10-year Tr. yield at 1.59%.

- Equities: USA30 off 0.4%, the USA100 down 0.3%, and the USA500 off 0.2%. JPN225 fell 0.1%.

- #Target stock is down over 4.5%, despite earnings beats, as the company indicated it will be absorbing some of its cost increases, likely to pinch margins. #Lowe’s beat handily as well, with its stock up over 1%, as sales to contractors increased, and are expected to continue to improve.

- USOil down to $77.07 per barrel amid reports that China and US are working on a release of its oil reserves.

- Gold retests the 1870 area for a 7th day.

- FX markets – Yen sold off and USDJPY lifted to 114.96. AUD and NZD were well supported. EURUSD holds at 1.1330 area, GBPUSD spiked above 1.3500.

Focus today: The data calendar includes the US leading Index, jobless claims, Philly Fed.

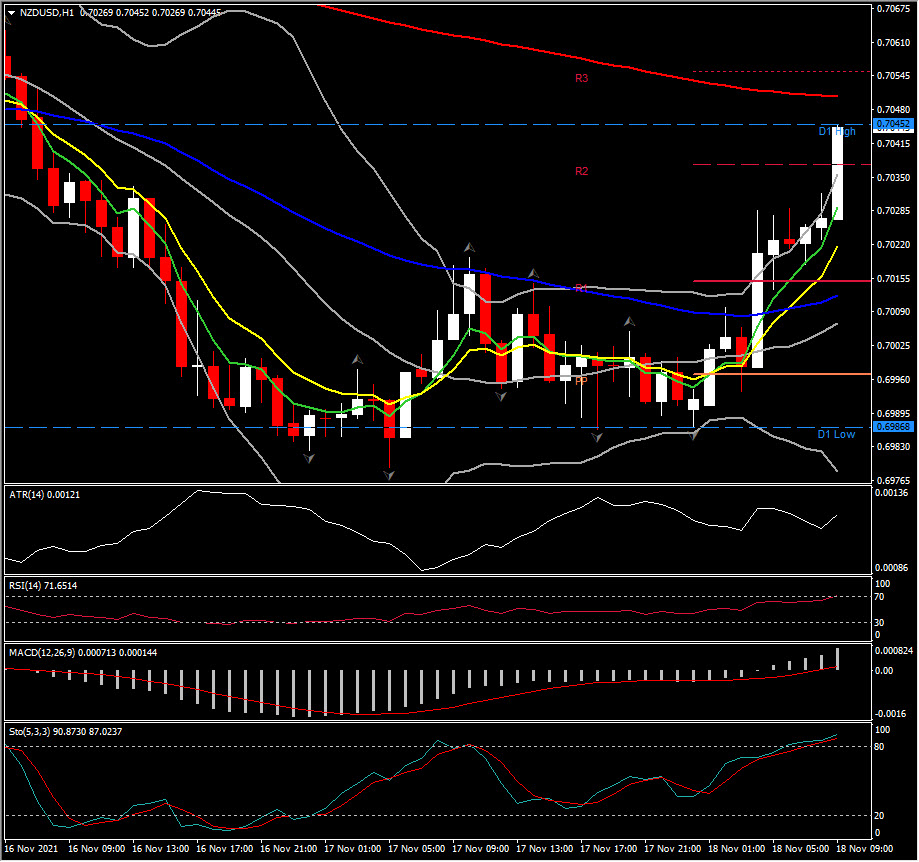

Biggest FX Mover @ (07:30 GMT) NZDUSD (+0.72%) topped to 0.7045, above R2. Faster MAs still aligned higher, MACD lines turn positive, while RSI and Stochastic are at 71 and 90 respectively and rising. H1 ATR 0.00112, Daily ATR 0.00638.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.