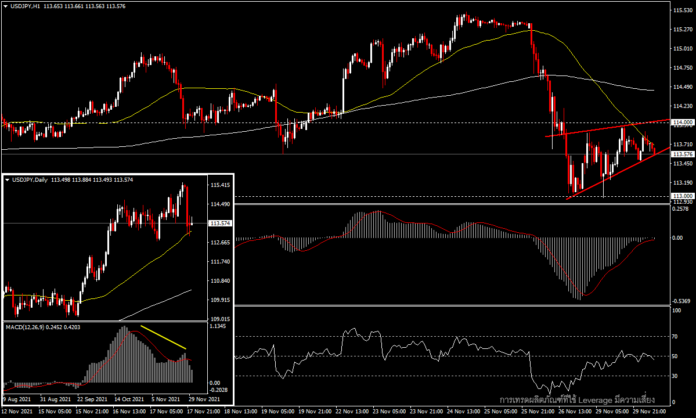

USDJPY, H1

Panic from the emergence of the Omicron variant resulted in the safe haven currency pair falling sharply on Friday from a high above 115.50 to a low of 113.00 and it is now trading back to this key 113.00 level after panic eased but uncertainty remains. The Omicron variant may not be as dangerous as initially thought, however, it is very early in its development. As a result, US stock markets recovered, with the S&P 500 +1.32%, Nasdaq +1.88% and Dow +0.68%, as well as the Nikkei 225 up +0.76% this morning at 28,498 points.

In terms of economic data, Japan’s October jobless rate fell to its lowest point since March of this year at 2.7%, lower than the 2.8% forecast, while October industrial production rose for the first time in four months at 1.1%, benefiting from the reopening of factories reducing supply constraints. However, this increase is still below market expectations of 1.8%.

While it is unclear how virulent the Omicron variant is, yesterday the Japanese government announced another lockdown after having just announced the opening of the country earlier this month, as opposed to the US where President Biden has announced that there are currently no plans to implement lockdown, meaning there will be no new restrictions on travel to and from the US.

US data to keep an eye on today is the Chicago PMI Index, Consumer Confidence Index, Fed Chairman Powell’s Testimony and Treasury Secretary Yellen’s Speech before the Senate Banking Committee on the CARES Act, as well as speeches by FOMC Williams and Clarida.

From a technical point of view, the USDJPY is currently undergoing a correction during the downtrend. The price has been rallying in a narrower frame with a rising wedge pattern trend, meaning the pair is likely to go further down if it breaks the lower band and target the downtrend at the original low of 113.00. Conversely, if the US data is good, the pair could move up to test the week high of 114.00.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.