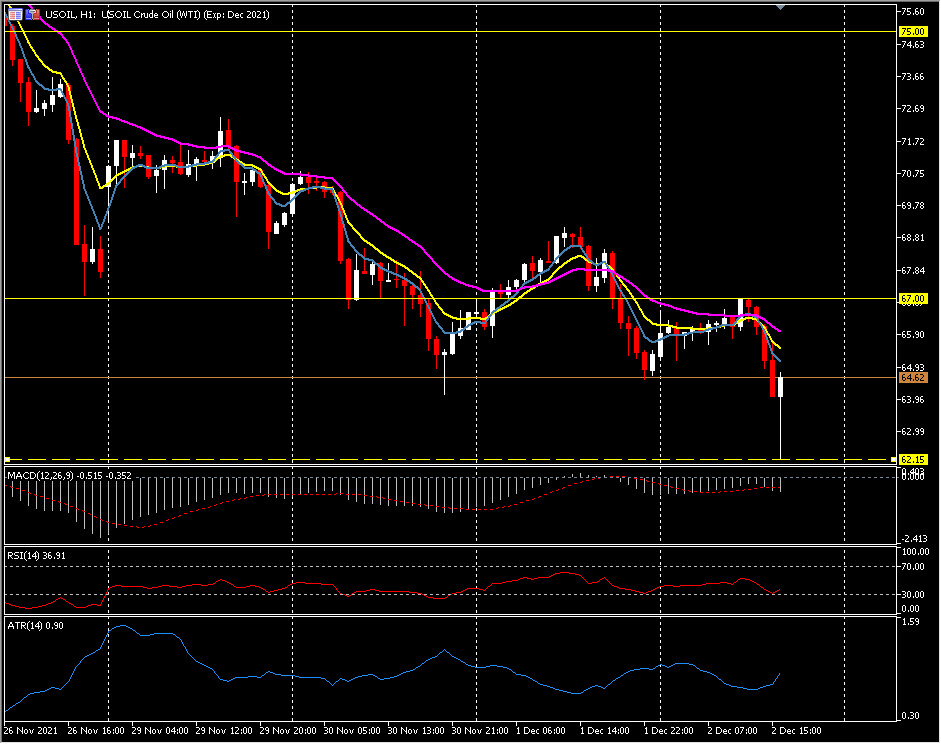

USOil, H1

Initial claims bounced 28k to a lean 222k in the final week of the month, hence trimming last week’s -76k plunge to a 52-year low of 194k (was 199k), while continuing claims fell -107k to a 1.956m new cycle-low, after a -46k drop to 2.063m (was 2.049m) prior cycle-low. The insured jobless rate fell to a 1.4% new cycle-low from a 1.5% prior low, versus a pre-pandemic 1.2% reading in March of 2020, and a 1.1% all-time low in April of 2019. Initial claims are averaging 238k in November, versus 285k in October and 341k in September. The 270k BLS survey week reading undershot recent survey week readings of 291k in October and 351k in September. Continuing claims fell -176k between the October and November BLS survey weeks, after drops of -572k in October, -97k in September, and -388k in August. Claims have tightened dramatically since September, though gyrations over the last two weeks have also reflected holiday volatility, which usually starts with the Veteran’s Day holiday and extends through the MLK week.

USOil was smashed down to three-plus month lows of $62.48, down from $65.92 at the open, and $67.15 overnight highs. Earlier headlines indicated OPEC+ ended its meeting with no decision made to increase production, though recent Bloomberg headlines said Russia proposes increasing output by the previously agreed 400k bpd. The front-month contract has since recovered to $64.00. A move under the August 23 low of $61.74 would take prices to levels last seen in May.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.