In his statement, BoE Governor reiterated that policy success takes time. Interest rate changes have their peak impact on inflation only after a significant delay – perhaps 18 months or more. The term “temporary” which the Central Bank uses to describe spikes in inflation does not mean that the effect will wear off in one, two or even twelve months. The question is whether the global factors driving the rise in prices of goods still exist at a time when policy decisions taken today can have a significant effect of their own. What is their prospective contribution to inflation in the next 18, 24 months and so on? ¹

Meanwhile, from economic data, the UK construction PMI rose from 54.6 to 55.5 in November, above expectations of 52.0. Markit noted the recovery was led by a strong and accelerated gain in commercial jobs. The number of companies reporting supplier delays continues to dwindle. Input cost inflation dips to seven-month low.² The Pound held off slightly against the US Dollar, hovering near the $1.3300 mark (December opening price), although the BoE Deputy Governor expressed his discomfort at higher interest rates. Ben Broadbent argued that inflation could exceed 5.0% in April, but that price pressures could fade before a potential rate hike has any effect.

Meanwhile, Eurozone Sentix investor confidence fell from 18.3 to 13.5 in December, missing expectations of 15.9 as the lowest level since April. The Current Situation Index fell for the third straight month from 23.5 to 13.3, its lowest since May. The Expectation Index, on the other hand, slightly increased from 13.3 to 13.8. Lockdown measures in Germany and Austria have reduced the current economic activity. The EURGBP currency pair , trading down yesterday by -0.53%, is holding up at the 0.8500 price level.

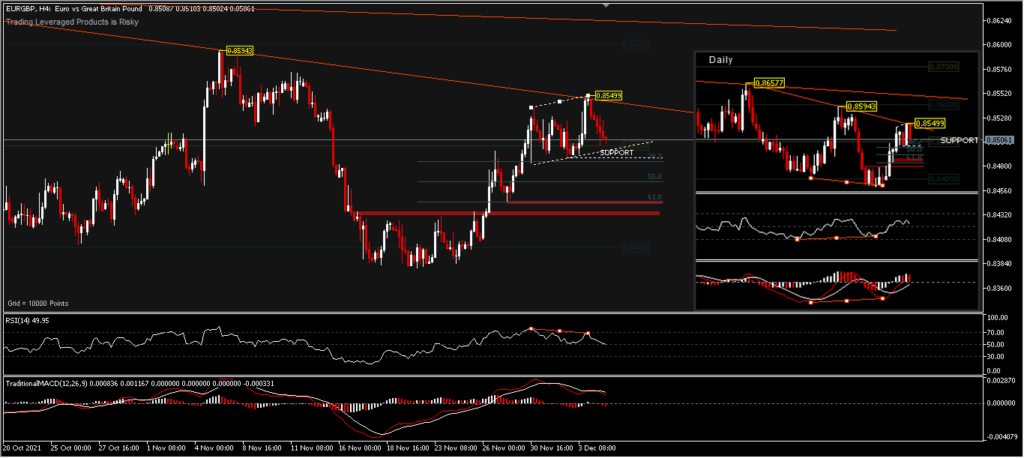

EURGBP,H4 – The pair’s intraday bias is back to the neutral side, having hit a lower high of 0.8549 bouncing off the descending trendline. A move to the upside would test the 0.8594 structural resistance. A sustained break would be the first sign of a bigger bullish reversal and further targets the 0.8657 resistance. On the downside, a break of the 0.8488 minor support would turn the bias back to the downside for the 0.8445 (61.8%FR) price and if it persists, the 0.8379 low would be the last resistance for the buyers. A bullish divergence bias is seen in the daily period, although the asset trend is still on the downside. However, efforts to strengthen to the upside began to gain attention as the prospect of a rate hike from the BoE receded.

¹) https://www.bankofengland.co.uk/-/media/boe/files/speech/2021/december/lags-trade-offs-and-the-challenges-facing-monetary-policy-speech-by-ben-broadbent.pdf

²)https://www.markiteconomics.com/Public/Home/PressRelease/58deb8a578974b91bb36c1e83284faab

Click here to access the Economic Calendar

Ady Phangestu

Market Analyst – Educational Center – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.