The Canadian Dollar has been one of the major overperforming currencies in 2021, but has been fading lately, with declines recorded against the Dollar, Pound, Yen and Euro over the past month. The National Bank of Canada said the Canadian Dollar’s recent decline in value only made it more undervalued compared to fundamentals, as they forecast a rise in 2022.

Canada’s economic growth is getting better, employment is strong and public finances are improving rapidly. Quantitative easing is over and inflation is high enough to warrant some rate hikes in 2022. Canadian exports rose 6.4% to hit a record CAD 56.2 billion in October. Exports grew in 8 out of 11 product sections. The combined gains in exports of motor vehicles and spare parts and energy products accounted for nearly 80% of total growth. Imports rose 5.3% to a record CAD 54.1 billion. Profits were observed in 7 of the 11 product sections. Motor vehicles and their parts accounted for nearly 2/3 of the monthly increase. The trade surplus widened from CAD 1.4 billion to CAD 2.1 billion, well above expectations of CAD 1.6B. It was also the biggest surplus so far in 2021.

Focus now shifts to the BoC policy announcement today. No change in the current 0.25% rate setting is widely expected. The outsized November jobs gain joined annual CPI growth running near 5% and a lofty housing market to make the case for signaling that rates will move above the lower bound sooner rather than later. Yet the uncertainty associated with the Omicron variant may stay their hand in terms of any hawkish shift in verbiage at this meeting. Deputy Governor Gravelle will present the “Economic Progress Report” (Thursday), which will detail the Bank’s view on policy, growth and inflation. We continue to pencil in an April 2022 rate hike, but uncertainties domestically and globally make the timing of liftoff more difficult than usual to pin down. The expectation is that policymakers will provide ample warning before they begin to raise rates.

The CAD traded higher against the US Dollar this week in line with the rebound in oil prices. The USDCAD pair posted a daily decline of -0.94% to close at 1.2636. This week’s slide has been driven by the sharp rise in USOIL, which is off the highs near $73.00/bbl seen yesterday, but at currently $72.46 remains far above the levels under $62.50 seen last Thursday. Against the Euro, the CAD also strengthened by 1.04%. Against the Pound, the CAD registered a gain of +1.04%, while against the Yen, the CAD garnered a gain of 1.03%.

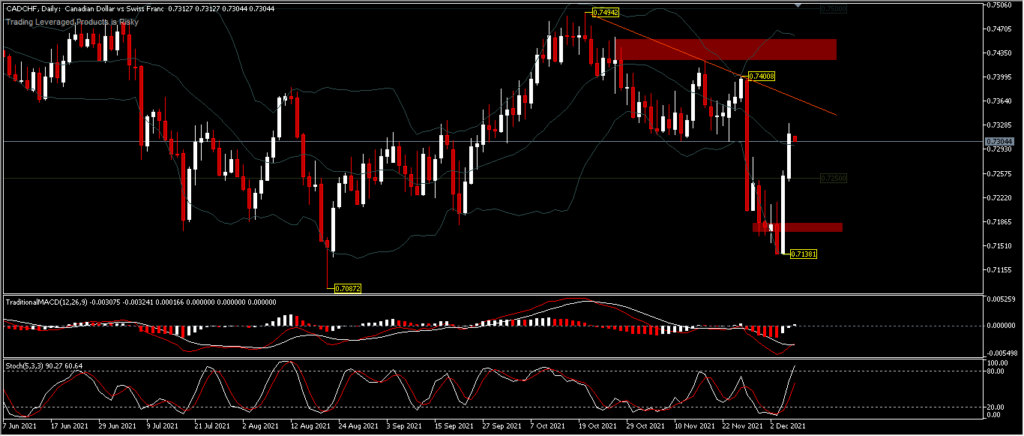

CADCHF,D1

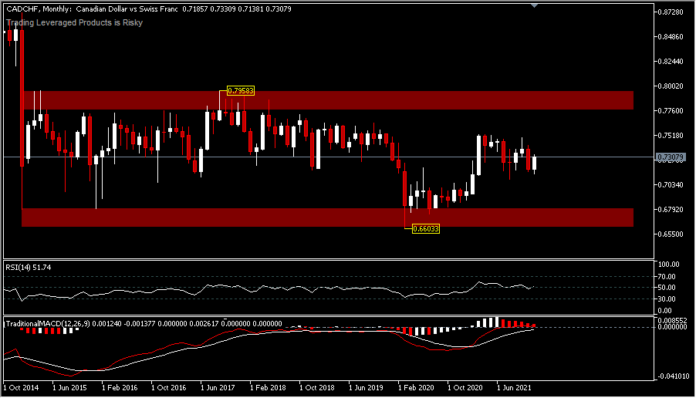

CADCHF, D1 – This currency pair has been stable for the last 7 years. It has been trading in a range between its Sept’2017 high (0.7958) and March 2021 low (0.6603). In the midst of uncertainty during the pandemic, ranging from the Alpha, Delta to Omicron virus variants, CHF has benefited as a safe haven. However, Canada’s massive economic recovery throughout 2021 has made the pair strengthen back to the 0.7300 price range this December. Intraday bias is neutral while gains are seen confined to midlines on BB. A move to the upside would target the 0.7408 minor resistance while the downside would test the minor support around 0.7250 before running towards the 0.7138 low. Broadly speaking the pair will tend to consolidate in a limited space.

Click here to access the Economic Calendar

Andria Pichidi & Ady Phangestu

Market Analysis Team

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.