EURUSD,H1

US PPI showed huge November gains of 0.8% for the headline and 0.7% for the core that rounded from respective increases of 0.835% and 0.685%. The y/y PPI gain climbed to 9.6% from 8.8% (was 8.6%) in September and October to leave an eighth consecutive all-time high, while the core y/y gain rose to 7.7% from 7.0% (was 6.8%) in September and October to leave a ninth consecutive all-time high. On a moving average basis, PPI headline and core gains are actually slipping from bigger gains earlier in the year. We have 6-month average price gains of 0.748% for the headline and 0.618% for the core that slightly undershoot respective 12-month average gains of 0.778% and 0.625%. In December, the consensus for PPI gains are 0.3% for the headline and 0.6% for the core. The y/y headline metric would then tick up to 9.7% from today’s 9.6% new all-time high. Also the expectations are for the y/y core price gain to climb to an 8.2% new all-time high from today’s 7.7% all-time high. The y/y gains should finally moderate starting in January due to much easier comparisons.

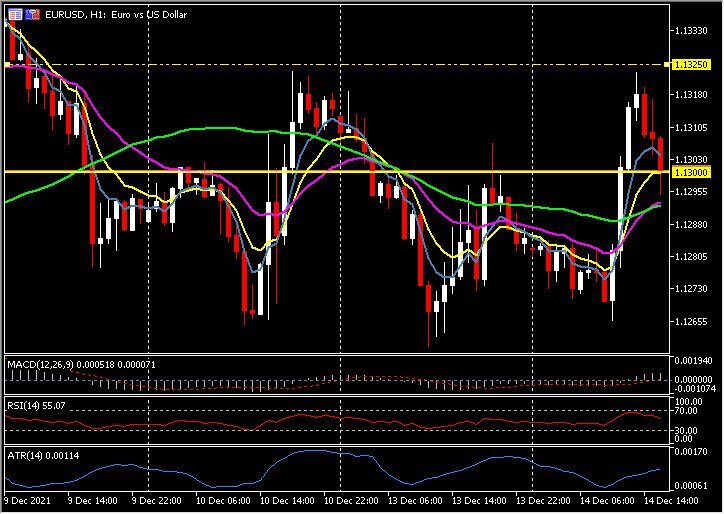

The Greenback was little changed, but a bit higher on net following the much hotter PPI outcome. USDJPY dipped to 113.44 from 113.55 before recovering to 113.60 while EURUSD edged up to 1.1318 from 1.1310 but has reversed back below 1.1300 at the opening bell. The main US equity markets have all opened in the red, with the USA100 once again the weakest, down by over -1.0%, and the USA500 shedding -0.3%.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.