The precious metal’s rally on Friday was due to safe-haven demand linked to a weak stock market and growing concerns about the omicron variant spreading. The price of precious metals on Friday was able to rally in the Asian and European sessions, although the Dollar strengthened. However, profit-taking colored the market towards the close, so that XAUUSD ended in a draw -0.06% and XAGUSD had to return below the surface at 22.34 for Friday’s total decline of -0.44%. But overall, the price of precious metals last week still remained higher. Gold closed up +0.90% to settle at 1798.39 slightly below the round number 1800.00 and silver closed up +0.81% after rebounding from 21.38 to settle at 22.34.

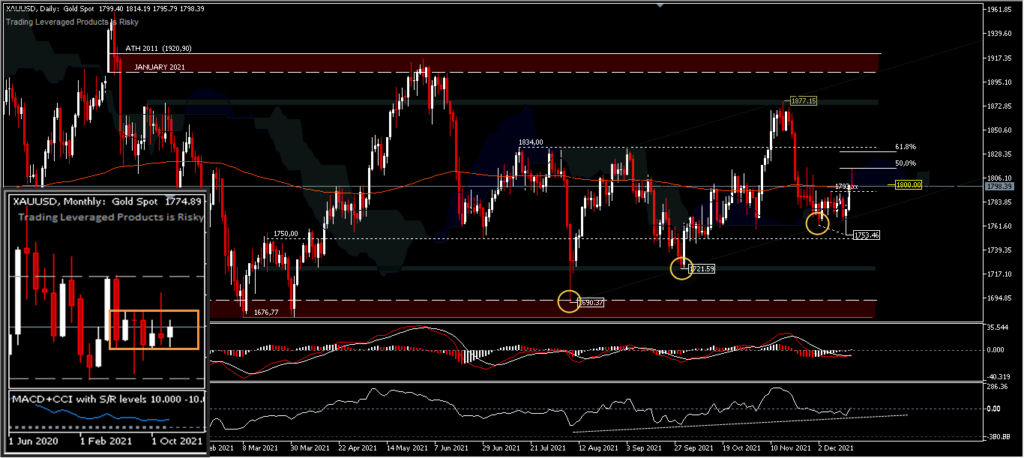

XAUUSD,D1 – Gold prices against the US dollar last week traded in a slightly widened range between 1753.46 and 1814.19 with a total strengthening of 0.90% in a weekly outside pin bar pattern. Signals favoring a rise in asset prices next week, would be a test of the trend line on the relative strength index (RSI) or a rebound from the latest low that served as minor support at 1753.46. Cancellation of the option goes up, the asset price will fall and a break of the 1753.46 price level will target 1721.59 before moving further to the support level 1676.77.

On the upside, a break of the 1814.19 minor resistance (50.0%FR) will target the 1834.00 resistance and the asset price will have to sit back above the 1834.00 resistance to confirm the value growth. However, the price of 1800.00 will temporarily serve as a reference, where we can see that the 200-day exponential moving average is still at this price level.

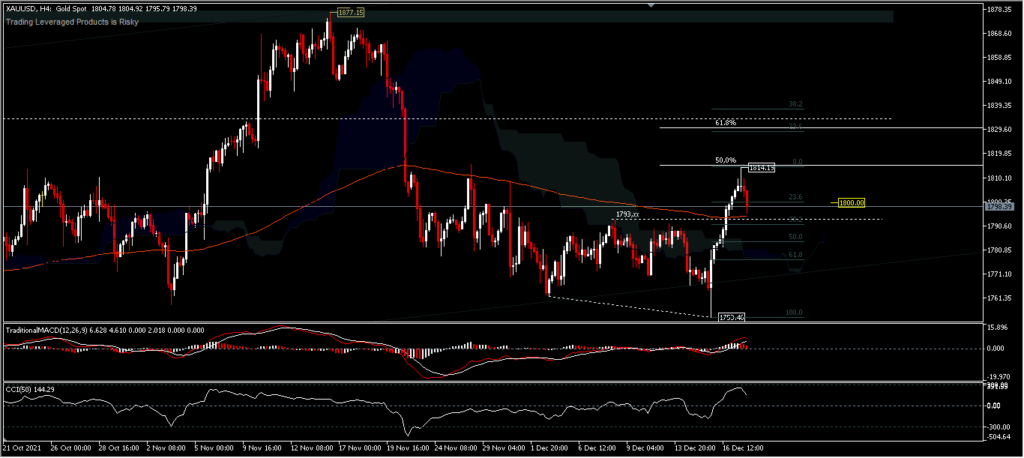

XAUUSD,H4

The intraday bias seems inclined to the upside around the round number 1,800.00 level. The selling pressure has eased after rebounding 1753.46 last week which broke the bearish structure of the break of the resistance at 1793.02. The price is currently sitting above the 200 EMA slightly above the minor resistance which is now support. A price move below this level should send the asset back to the downside to seek balance around the 50.0%FR level from the 1753.46 rebound. On the upside, a recent break of the resistance would confirm a continued rebound to 1834.00 (61.8%FR)

Overall, asset prices tend to be more towards consolidation which is confirmed from transaction data in the form of slim monthly body candles.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.