End-of-year trading was not kind to Treasury bulls as the month’s Omicron inspired haven purchases were unwound. The break of key technicals and very thin liquidity conditions exacerbated the climb in rates.

- The USD (USDIndex 96.37) was supported. US Yields sold off after key technical levels were breached and the 7-year auction was poorly subscribed. The 10-year penetrated the 50-day moving average at 1.526% and the 30-year pierced the 100-day moving average at 1.938%, which saw the yields rise to intraday peaks of 1.5548% and 1.9687% following the auction results. The 2-year yield, meanwhile, was fractionally higher at 0.752%.

- Equities – Broader indexes advanced to fresh all-time highs. The USA30 was up 0.25% to 36,488 and the USA500 rose 0.14% to 4,793 – 70th new high of the year. The USA100 lagged with a -0.10% loss. The GER30 future is up 0.1%, the UK100 future down -0.1%.

- USOil – at 75.80, bouncing within the 75-77 area.

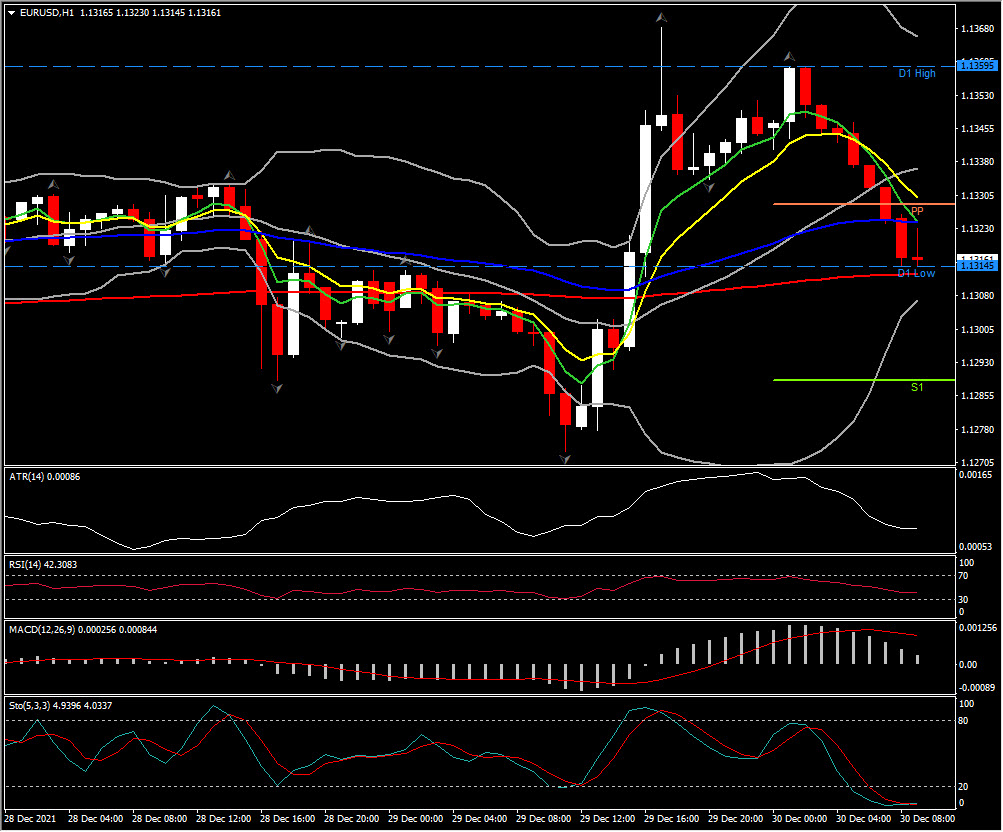

- FX markets – Euro and Sterling dropped back against a largely stronger US Dollar. EURUSD is at 1.1315 and Cable at 1.3473. USDJPY breached 115.20.

Today – Germany is on holiday again tomorrow, as the UK extends the weekend through to Monday, and volumes are likely to remain low today, although the calendar still has some interesting releases in Europe. Preliminary inflation data for Spain are due, and the Swiss KOF indicator will also be released. US Weekly jobless claims are the highlight.

Biggest FX Mover @ (10:30 GMT) EURUSD (-0.22%) pullback from 1.1398 highs to 1.1314. Fast MAs pointing downwards, RSI flattened though at 42. Stochastic are in OS area while MACD lines decline.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.