AUDJPY, H4

Market sentiment in Australia has improved; even though the daily number of coronavirus infections hit a record of more than 37,000 last Monday, the government said the impact was less severe than expected, which means that the country may reopen. The Australian stock index S&P/ASX 200 closed up 1.95% this morning at 7,570 points, behind US stocks, a positive close in the first trading day of the year.

In terms of economic data, the IHS Markit PMI showed that the Australian manufacturing sector in November was fixed higher at 57.7 from 57.4 in the initial reading. This indicates the continued growth of the manufacturing sector.

Like the Japanese stock market, the Nikkei 225 closed +1.77% at 29,301 today and the December manufacturing PMI was revised higher at 54.3 from 54.2 in its first reading after hitting a multi-year high of 54.5 in November. While the Yen is making a record for the new year, the weakest in five years against the US Dollar and over 116.30, due to the economic situation against the Australian dollar, the AUDJPY pair has risen again to a 83.90 high.

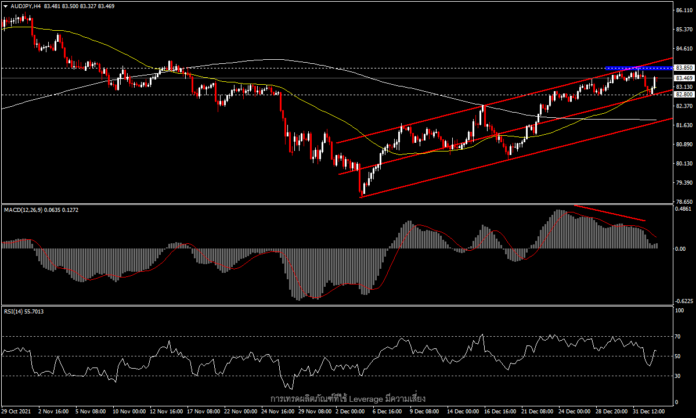

From a technical point of view, although a continuous divergence is visible in the H4 timeframe, the price is still supporting the bullish channel frame, in line with the MACD, despite its lower low. But it still held up in positive territory, as the RSI broke below 50 and is now back up at 55 again, giving the pair a short-term uptrend overall. The first resistance is in the original high zone at 83.85; if that can be broken and held it could pave the way for a five-year high test too in the 86.00 zone, while on the downside there is the first support at 82.80.

As a result of Japan’s continued low inflation, the BoJ’s policy implementation may be slower than other central banks. This could give the AUD an edge on improving market sentiment, including faster central bank policies.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.