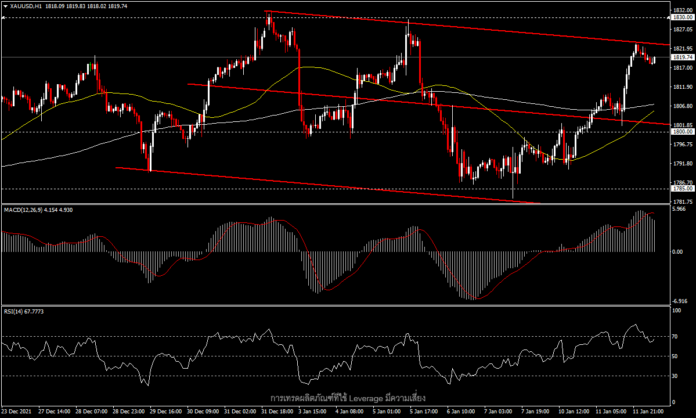

XAUUSD, H1

Gold prices have moved broader after a quiet last week of the year. This week, gold prices have risen more than $24 to stand significantly above 1,800 amid market volatility from the changing stance of the Fed Chairman Powell’s latest testimony to the Senate last night which has softened the heat for a potential interest rate hike after he said the road back to normal monetary policy may be long. So far, the Fed has yet to make a decision on the nearly $9 trillion account deficit.

Fed Chair Powell’s testimony came after Goldman Sachs had forecast the Fed will raise interest rates four times this year, once more than the originally expected three times. US inflation figures for December will be released today; the forecast is higher, at 7% year-on-year from 6.8% in November and 6.2% in October.

Gold yesterday retreated from a week high of 1,823 to currently trading at 1,819 as safe haven assets are losing buying power. However, the decline in bond yields is expected to help support the gold price before the inflation figures are reported.

Technically, XAUUSD in the H1 timeframe sees gold making new highs and lows, indicating a short-term bearish trend. The line is still pinned to the round 1,800, on the other hand, if price can break the zone high of last week, 1,823, then we might see a new high of the year above the 1830 zone. Meanwhile the RSI is entering the overbought zone, the MACD remains significantly above the 0 line and we still can’t see a reversal pattern. Therefore, if inflation figures are higher than expected we may see the price of gold continue to rise.

Click to view economic calendar or free webinars.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Warning: This content is provided for general marketing communications. For informational purposes only. and does not constitute independent investment research. No part of this communication contains or should be considered to contain investment advice or investment solicitation or solicitation for the purpose of buying or selling any financial instrument All information is collected from reliable sources. And every data contains an indicator of past performance. It is not a guarantee or a reliable indicator of future performance. Users should be aware that any investment In leveraged products, there is some degree of uncertainty. And investments of this nature are associated with high risks. for which the user is solely responsible We are not responsible for any loss. arising from the investment using the information generated by this communication This communication must not be reproduced or redistributed. without our written permission.