The US crude rally continued in the early part of the US session and reached as high as 82.36, a 2-month high. Weakness in the US Dollar was bullish for energy prices as the dollar index fell to a 2-month low Wednesday, after reports of US commercial crude inventories falling -4.6 million barrels in the week ended Jan. 7. Crude inventories were about -8% below the five-year average for the year, at 413.3 million barrels. Gasoline inventories rose by 8 million barrels. Distillate rose by 2.5 million barrels. Propane/propylene fell -3.4 million barrels. Total commercial petroleum inventories fell by -4.5 million barrels.

Crude oil prices received support amid comments from the Executive Director of the International Energy Agency (IEA), who said crude demand dynamics were stronger than many market watchers expected, largely due to Omicron’s milder expectations.

Crude oil prices rose, although OPEC+ decided to raise output by 400,000 barrels per day in February. According to The Energy Aspect, only 130,000 barrels per day of additional OPEC+ crude will hit the market in January, and only 250,000 bpd will reach global markets in February as some countries such as Angola and Nigeria struggle to reach their production targets. In addition, December OPEC crude production rose only +90,000 barrels per day.

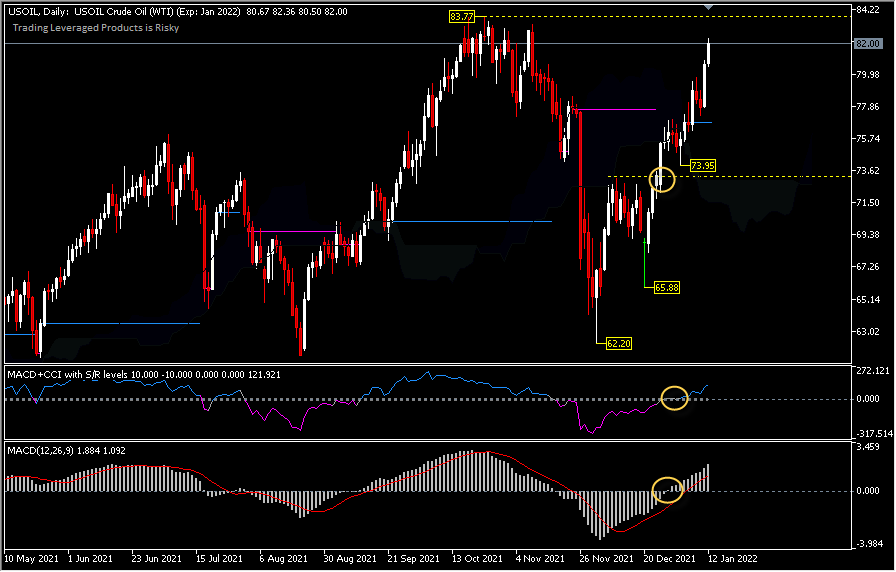

A further USOil increase is expected to catch up with the October 2021 price peak of 83.77. A strong break at 83.77 would bring oil prices higher for the price level of 90.00. As long as the resistance level persists, another drop must be seen before the consolidation is complete. The breaking of support 77.28 would return to the January 2022 opening price at 75.25.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.