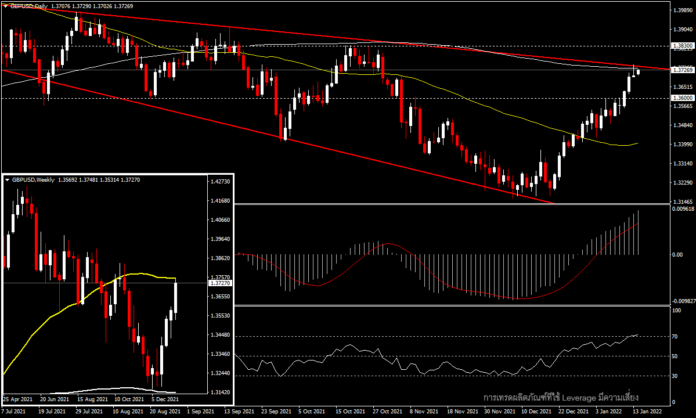

GBPUSD, Daily

The GBPUSD pair has surpassed the 1.3600 psychological figure and posted a two-month high above 1.3700 at 1.3727 after the US Dollar weakened this week as British Prime Minister Boris Johnson was questioned at the House of Commons regarding the party in May 2020, held during lockdown and during the time for mourning the death of Prince Philip, for which he apologized and admitted that he had actually entered the party area. Next week he may not be seen in the media again as his close family members have tested positive for the coronavirus.

On the British stock markets, the FTSE 100 closed up 0.2% at 7,565, its highest since January 2020, as investors continue to assess the outlook for stimulus measures and inflation risks.

There was continued depreciation for the USD following Fed Chairman Powell’s testimony, which was followed by December’s CPI inflation report, which continued to rise as expected at 7% a year. However, monthly inflation has fallen for a second straight month, at 0.5% from 0.8% seen in November. Coupled with the slowdown in inflation, the December PPI dropped to 0.2% from 1% (revised from 0.8%) in November. This may reinforce the Fed’s need to speed up interest rate hikes as previously announced.

Meanwhile, claims for unemployment benefits for the week ending Jan. 8 rose to their highest in eight weeks at 230K, well above the 200K expected by the market, as the outbreak of Omicron has begun to disrupt economic activities. However, the number of claims is similar to those before the pandemic at the start of 2020.

Following this week’s moves, the USDIndex is red for a fourth day at a two-week low of 94.66 this morning.

From a technical point of view it looks like the GBPUSD pair is facing a major resistance level. On the Day timeframe, the price is fighting the MA200 line, while in the Week timeframe, the price is testing the MA50 line. If the price can break through this zone, there will be the next resistance in the previous high zone seen in October at 1.3830, but if it cannot break through we may see the pair receding back down to 1.3600 again.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.