European stock markets have sold off across the board, as global equity markets were pressured by a rise in yields and stepped up tightening expectations that hit tech stocks in particular. In this environment strong data releases only add to pressure, rather than lifting sentiment in equities and GER30 and UK100 are currently down -1.2% and -0.8% respectively.

Core EGBs are little changed, with the 10-year Bund yield down -0.4 bp at -0.033%, after the paper pared earlier losses. The German 10-year clearly is preparing to move out of negative territory for the first time since early 2019, but not quite there yet it seems. The 10-year Gilt rate is unchanged at 1.18% now, while peripheral Eurozone yields remain up on the day against the background of a jump in the US 10-year rate by 2.5 bp to currently 1.809%. Confidence in the recovery is strengthen, but that is also boosting tightening expectations. The BoJ today tweaked its inflation outlook for the first time in a long while and while BoJ’s Kuroda clearly was eager to prevent markets from running away with tightening expectations. But that wasn’t enough to calm wider markets especially as European data today added to the arguments of the hawks at BoE and ECB. UK labour market data looked surprisingly perky, with employment picking up in December, despite the advent of Omicron. German ZEW investor confidence jumped to the highest level since July last year, despite a still difficult virus situation in Germany.

Against that background, the ECB in particular will struggle to keep tightening expectations at bay.

The German economy expanded 2.7% last year, after a contraction of -4.6% in 2020 (or -4.9% when adjusted for calendar factors). The stats office reported that the production sector expanded 4.4% and that the services sector also improved, although trade and hospitality sectors continued to struggle with the impact of virus restrictions. Only the construction sector, which hadn’t been too much impacted by the pandemic in 2020, contracted -0.4%.

Most sectors haven’t reached pre-crisis levels yet and public consumption was the key driver of overall growth. Private consumption stagnated after contracting -5.9% in 2020. Exports rebounded 9.4%, imports 8.6% in 2021, pretty much matching the contractions seen in the previous year. The labour market has remained robust and the number of those in jobs subject to social security contributions actually picked up. GDP per employed person lifted 2.7%, after falling -3.8% in 2020. Overall a report that is pretty much as expected and while the rebound last year doesn’t match those expected for France, Spain, Italy, the contraction in Germany in 2020 also wasn’t as pronounced as elsewhere.

Looking ahead, German ZEW investor confidence surged at the start of the year – with the headline reading coming in at 51.7 in January – much higher than anticipated and up from 29.9 in the previous month. The current conditions indicator still declined, but the jump in the headline left the confidence reading at the highest level since July 2021, suggesting that investors have already shrugged off Omicron and are expecting the world economy to bounce back quickly.

The data will keep the ECB in defensive mode with officials struggling to prevent inflation expectations from picking up, while trying to keep tightening expectations at bay. The official line remains that a rate hike this year is very unlikely and indeed, given that the starting point for Fed and ECB when Covid-19 struck was very different, the degree of policy correction the ECB plans this year is already pretty much on par with the Fed’s efforts. Nevertheless, the fact that the central bank still adds net asset purchases for most of this year means there now is the risk of a more permanent inflation overshoot that could undermine confidence in the central bank’s inflation fighting credentials.

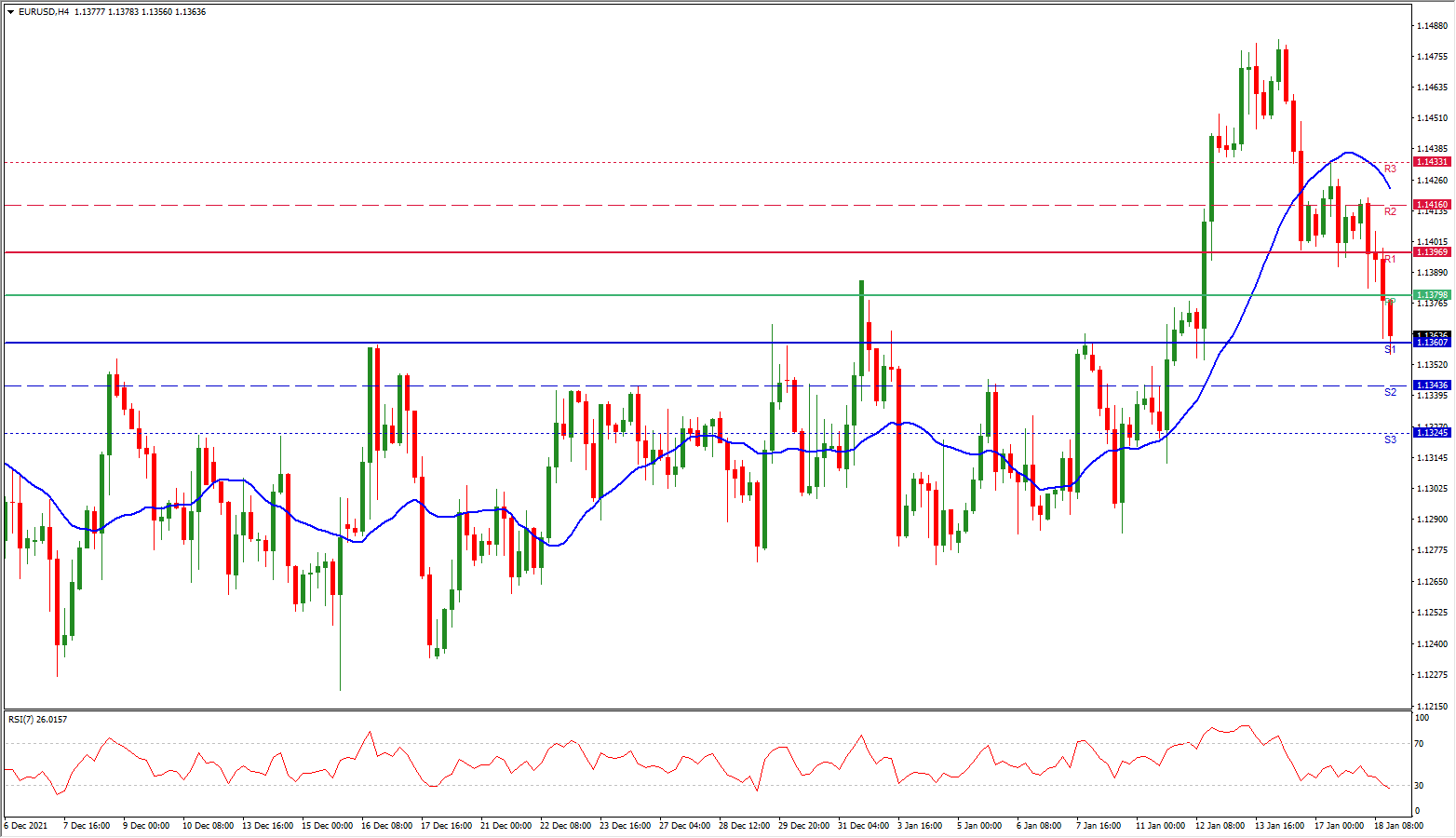

EURUSD failed to benefit from the stellar ZEW report and the EUR is trading well below the 1.14 mark. As the ZEW to a large extend reflects optimism that the US economy will bounce back quickly and looking ahead, as fundamentals in the form of faster growth, widening rate differentials, and an aggressive Fed, all point to a higher US Dollar, EURUSD is likely to continue lower in the coming weeks. Rate differentials and the much more hawkish Fed stance continue to limit the room on the upside. The Bund yield has come a long way, but may need more forceful support from the ECB to lift out of negative territory.

Click here to view the economic calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.