Stock markets sank again (Nasdaq -1.15%) Financials and Tech companies led the slide, USD slipped as Yields – slide from highs, Oil higher again, Gold was asset of the day charged higher to $1842, supported by further hot Inflation data from Germany, UK and Canada and strong housing data from the US. China cut its mortgage rate lifting Asian markets (Nikkei +1.11%). Lagarde: ECB has reasons NOT to act as quickly as the FED. Biden increased the rhetoric over Russia & Ukraine predicting Russia would “make a move”. Johnson holds on in UK, for now.

- USD (USDIndex 95.42) slips as Yields decline .

- US Yields 10-yr moved higher to spike at 1.90% & trades at 1.85%.

- Equities – USA500 -44 (-0.97%) 4532 – USA500 FUTS holds up at 4544.

- USOil – Spiked to $87.97 and subsequently collapsed to 84.00 after Biden comments and ahead of inventories today.

- Gold – charged to $1843 and holds $1838 now after inflation news & Biden comments. A hold of 1830 is key.

- Bitcoin back to test $42,400,

- FX markets – EURUSD back to 1.1360, USDJPY now 114.40 & Cable back to 1.3625.

Overnight – AUD JOBS better than expected, Unemployment 4.2% vs 4.6%, GERMAN PPI rocketed to 5.0% form 0.8%.

European Open – The March 10-year Bund future is up 5 ticks at 169.33, outperforming slightly versus US futures. The yield is up from the lows seen during the Asian part of the session though and especially for the short end, the trend higher will likely continue. The long end meanwhile should actually benefit from tightening steps as inflation continues to spike. DAX and FTSE 100 futures area posting gains of 0.4% and 0.6% respectively at the moment, and a 0.8% rise in the NASDAQ is leading US futures higher.

Today – Norges Bank & CBRT rate decisions, EZ CPI (final), ECB Minutes, US Claims, Philly Fed, Existing Home Sales. Earnings from American Airlines and Netflix.

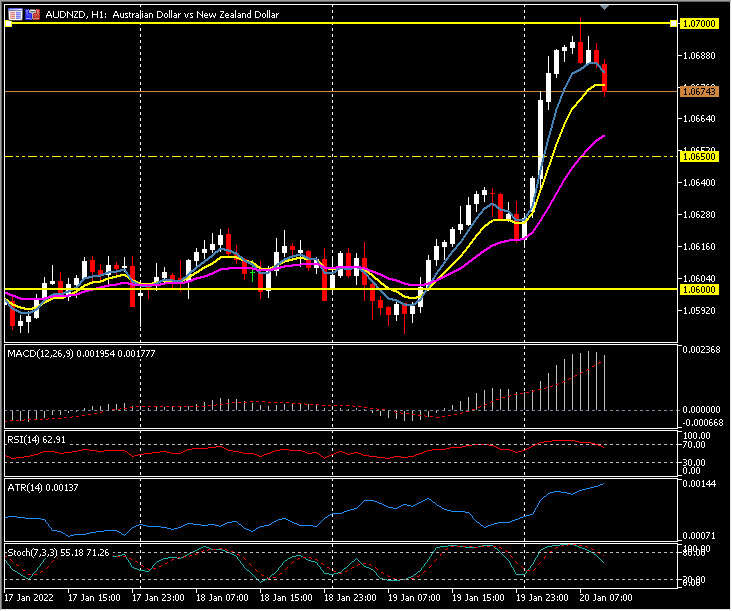

Biggest FX Mover @ (07:30 GMT) AUDNZD (+0.51%) Rallied from 1.0600 yesterday to breach 1.0700 earlier, although cooling now. MAs still aligned higher, MACD signal line & histogram higher. RSI 63 but cooling, H1 ATR 0.0014 Daily ATR 0.0053.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.