AUDJPY, H4

At the end of last week the markets closed with significant risks and the stock market plunged, with the S&P500 down –5.68%, the Dow down –4.58% and the Nasdaq down by -7.55% amid concerns about interest rates and a mixed Wall Street fourth-quarter earnings report. The worst performer of all was the small-cal Russell 2000 which lost –7.88%. Such concerns are expected to continue this week, with earnings reports from Wall Street giants like #Microsoft, #Tesla and #Apple as well as the Fed’s interest rate decision on Wednesday night. However, US futures has increased this morning.

The risk sentiment is evident in the VIX.F fear index, which hit a six-week high of 27.57 on Friday and is now trading at 26.27, while the US 10-year Treasury yield closed the week in the 1.76% zone. The highest tin the year was at 1.90% and is now 1.77%.

In the FX market, the safe haven sector outperformed the the main currency pairs last week, with the AUDUSD -40 pips and the USDJPY -45 pips, while the AUDJPY, which is another currency pair that acts as a measure of market sentiment, closed the week down -74 pips.

As for the movement of the AUDJPY pair last week, the BoJ kept interest rates and monetary policy unchanged as expected, but the 2022 inflation forecast was revised up to 1.1% from 0.9%, the first increase since 2014. December’s unemployment rate dropped to its lowest level since August 2008 at 4.2% from 4.6% the previous month. Employment rose 64.8K to the record high of 13.24 million jobs, higher than the 43.3K expected.

Australia’s January Services PMI fell again in four months to 45 from 55.1 in December, while the January Manufacturing PMI dropped to 55.3 from 57.7 in December, representing the slowest growth in five months. Meanwhile, in Japan, similar to the preliminary readings, January Services PMI contracted for the first time in four months at 46.6 from 52.5 the previous month. The Manufacturing PMI rose slightly to 54.6 from 54.3 seen in December.

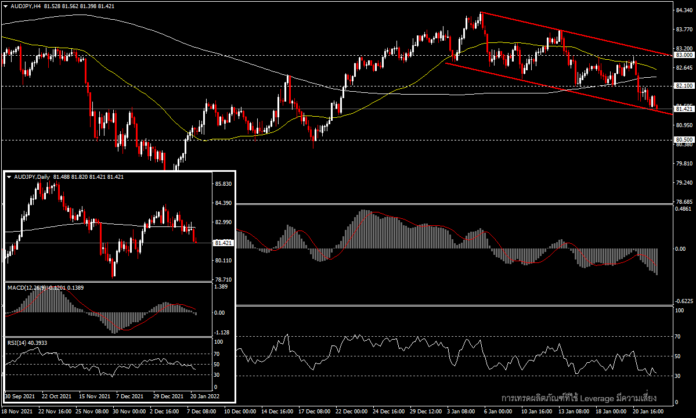

From a technical point of view, the AUDJPY pair is closing in on the negative for the fourth week. In the day timeframe, the price has clearly broken the 200 MA line and this could be a confirmation of a new round of downtrend where the MACD is now entering the negative territory and the RSI has dropped to the 40 level, while in the short-term trend if the price swings in a downtrend in the H4 timeframe the next support will be in the 80.50 zone if the price bounces off the bottom line again. There will be the first resistance at 82.10.

Economic calendar data to watch this week is Australia’s Q4 CPI inflation, which is expected to rise to 3.2% from 3.0% in the previous quarter.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.