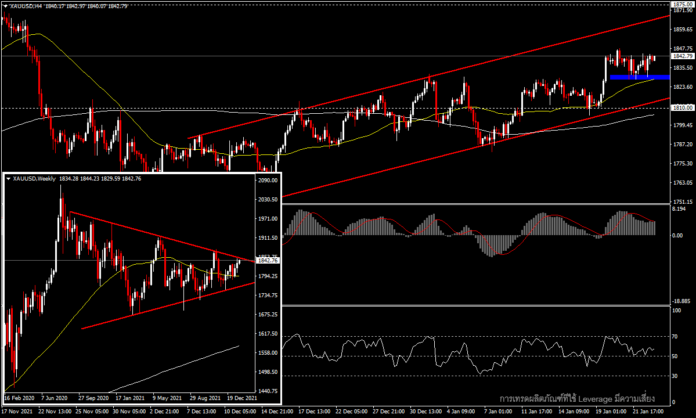

XAUUSD, H4

Concerns about inflation and the Fed’s interest rate hike have finally seen gold realize its safe haven and anti-inflation status as it moved up to a two-month high in the 1848 zone and is now holding steady at 1,840 after market volatility. This volatility sent US stocks on Monday to their lowest level in months before narrowly closing positive, with the Nasdaq +0.63 from -4.9%, S&P500 +0.28% from more than -3% and the Dow back up 99 points (+0.29%) after 1,100 point loss.

During last night’s volatility the VIX.F fear index hit a near-one-year high of 33.02 (now at 29.22), and the US 10-year Treasury yield hit a new weekly low of 1.71%, before returning to 1.77% this morning.

Interestingly, from a technical perspective, in the midst of severe volatility in the Day and Week timeframes, gold prices are testing the borders of a symmetrical triangle pattern, while in the short-term trend on the H4 timeframe the price maintains an upward outlook. With a break above the MA50 line within an uptrend channel, the MACD remains in positive territory and the RSI is at the 58 level, with the next key resistance at the November high zone of $1,875. If the MA50 line is broken, the next support will be at the MA200 line at the $1,810 zone.

Amid the inflationary situation at the highest record in decades, this week’s PMI figures for major economies, including the United States, are indicative of a significant slowdown in growth. The concern now falls on the Fed and whether at tomorrow’s meeting it will announce measures to control inflation and simultaneously maintain market confidence. Aside from that, the data to watch for this week are the preliminary Q4 GDP projections and the US PCE inflation index.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.