Hasbro, Inc, an American multinational play and entertainment company that designs and manufactures toys, games, movies, televisions, digital gaming and other entertainment experiences is set to release its earnings for the fourth quarter of 2021 on Monday February 7, before market opens.

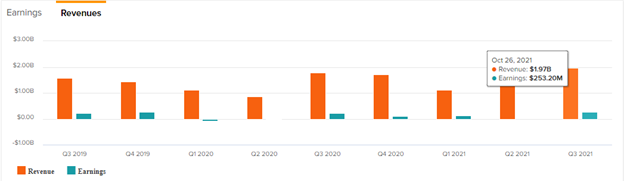

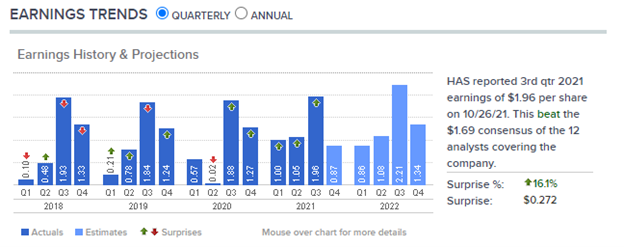

The creators of approximately 1500 brands including Littlest Pet Shop, Magic: The Gathering, Nerf, Monopoly, Power Rangers, PJ Masks, My Little Pony, Play-Doh and Transformers, with a market capitalization of $12.95 billion as of February 2022, has reported a strong year in 2021so far, beating earnings estimates in the first 3 quarters of the year – growing every quarter and seeing revenue grow after each quarter with the latest print (Q3, 2021) sitting at $1.97 billion – the highest since the same quarter in 2019.

Source: Tips Ranks

Source: Tips Ranks

Despite the good run so far, analysts at Zacks Investment Research expect a massive drop in earnings per share (EPS) compared to the previous quarter and the same period a year ago. EPS is expected at $0.87, significantly down from $1.98 in Q3, 2021 and $1.27 in Q4 2020 (a year ago) which represents a 56.1% and a 31.50% fall respectively. Revenue, on the other hand, is projected to come in better, with a year over year growth of 8.11% from $1.72 billion to $1.86 billion, although this is still down about 5.58% from $1.97 billion in the previous quarter.

Source: CNBC

Source: CNBC

Why do analysts estimate lower earnings per share and a lower revenue compared to the previous quarter for Hasbro, Inc?

$100 million worth of unfilled orders that were not completed in Q3 due to supply chain issues rising from capacity shortages and port congestions were completed in Q4, which then causes delay in completion of some of the orders in Q4 in addition to the usual holiday related delays. After the Q3 results, the company warned of supply chain factors which are out of their control that could impact their ability to fully achieve upside in revenue growth.

Despite the reassurance from Rich Stoddart, Interim Chief Executive Officer, that production and manufacturing operations were in overdrive so that Hasbro’s toys wouldn’t be in short supply during the holiday season, one cannot rule out the effect of Omicron late in the quarter especially during the holiday season as it slowed down overall consumer confidence, consumer spending and credit card balance.

Hasbro, Inc recently lost its highly lucrative license to produce dolls based on Disney royalty like Elsa and Jasmine to archrivals Mattel, which saw the competitor’s share price surge 11%, but subsequently announced a renewed licensing deal with Disney-owned Lucasfilm for Star Wars along with new incoming products based on Indiana Jones. Eric Nyman, Chief Consumer Officer, Hasbro, said in a press release, “In addition to a slate of new collectibles, figures, role play gear, and games for Star Wars and Marvel, it’s an honor to bring Indiana Jones back to Hasbro and help introduce the beloved franchise to a new generation of fans.”

Source: CNBC

Source: CNBC

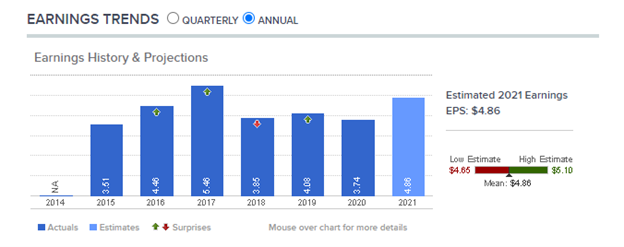

For the full year, analysts project a $4.86 earnings per share estimate – the highest in 4 years (y/y growth of 23%). Zacks’ Most Accurate Estimate sits at $0.89 which suggests that analysts have revised their estimates higher with more recent information, resulting in an Expected Surprise Prediction (ESP) of 2.50%, earning it a #2 Buy rank on Zacks. This, coupled with the company’s history of beating earnings estimates – beating in 5 of the last 5 quarters – and the low expectations for this quarter, means we may be in for another beat.

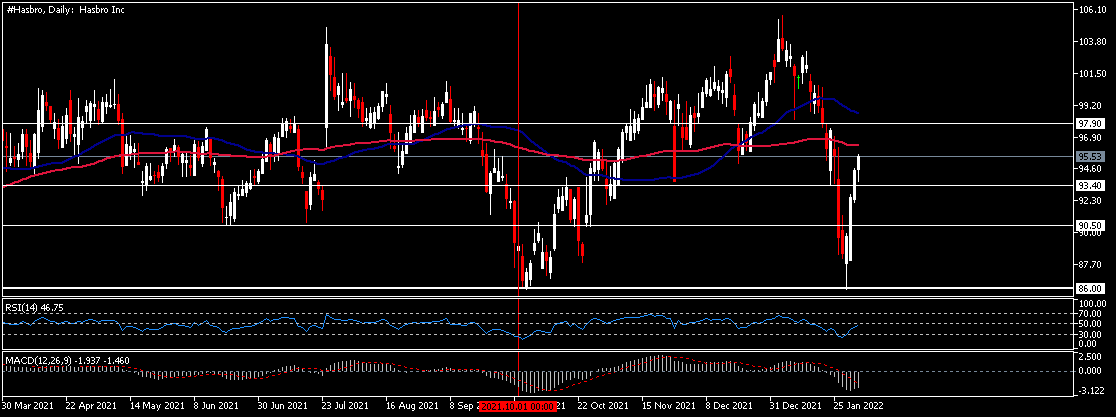

The expectation of a Fed rate hike and the general risk off environment seen for most of January pushed the equity market lower – Nasdaq (US100) initially dropped about 17% and individual stock names like #Hasbro have not been an exception. After retesting the low of 2021, set in early October around $86, the Hasbro share price has made a 10% recovery towards resistance around $95. Despite trading below both the 50 and 100 daily Moving Averages, and the MACD trading in negative territory while the Relative Strength Index proves neutral, close to the 50 level, the bounce has been impressive, and this upside is also in line with the overall equity market so far this month. A solid earnings report could help propel the price towards resistance around $98, but first it needs to clear the 100 DMA to put the technicals in a better spot.

Click here to access our Economic Calendar

Heritage Adisa

Market Analyst – HF Educational Office – Nigeria

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.