Cisco Systems, Inc, one of the world’s leading information technology companies, designs, manufactures, and sells networking hardware and software based on internet protocol as well as telecommunications equipment and other technological services. Headquartered in San Jose, California, the biggest internet hardware and software company carries about 85% of internet traffic, has a market capitalization of $237.40 billion and operates in more than 115 countries around the world with a gigantic workforce of over 75,000 workers.

Cisco Systems, Inc, which is commonly referred to as the backbone of the internet, is expected to release its financial report for the second quarter of 2022 on Wednesday February 16 after market close.

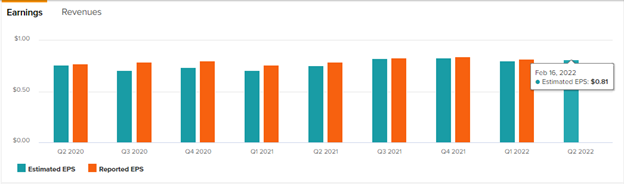

Looking back at Q1, the company’s earnings result showed an EPS of $0.82, beating market consensus estimates of $0.80 EPS, but printed only $12.90 billion in revenue, failing to live up to the $12.98 billion estimate. Supply constraints was a major challenge for the company according to CEO Chuck Robbins, as the company faced supply shortages and significantly higher logistics costs. Although Finance Chief Scott Herren expects the positive effect of raising prices to offset the impact of the supply constraint, it may only become evident in the later part of the year.

Analysts at Zacks Investment Research estimate earnings per share to print at $0.81, which is up about 2.53% from $0.79 in the same quarter a year ago, but down from $0.82 in the previous quarter (Q1, 2022).

For revenue, expectation is for a $12.65 billion print, up 5.79% from $11.96 billion in the same period a year ago but also down from $12.90 billion from the previous quarter (Q1, 2022).

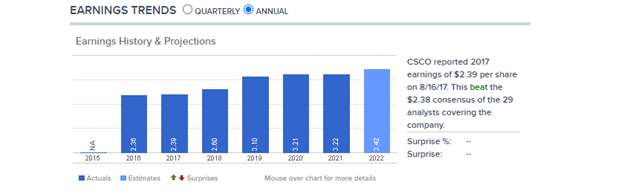

The stock holds a #2 Buy rank on Zack’s ranking despite seeing a -0.22% ESP (Expected Surprise Prediction) which shows that analysts have recently revised their estimates lower.

Source: Tips Rank

Source: Tips Rank

Despite the challenging supply landscape, the company recorded robust growth and strong demand in Q1 and remains confident in another strong full year of growth following a successful 2021 where they recorded $49.8 billion in revenue. The supply constraint in question is not a problem peculiar to Cisco Systems but the entire technology industry and the world at large, and with the company expecting the effect of raising prices to offset some of the supply strain, a miss in the report should not have a lasting effect on the share price barring any further gloomy outlook from the company, although one has to keep the entire equity space in focus too.

Source: CNBC

Source: CNBC

On the positive side, Cisco Systems have beat yearly earnings estimates every year since 2016, growing bigger with each year (the current year estimate sits at $3.42) and have beat quarterly earnings estimates every quarter since Q1, 2019, which highlights the company’s good track record with market earnings expectations. The strong demand for the company’s Catalyst 9000 computer network switches and higher campus networking demand as well as an increased need for improved security and mobility solutions for companies still working from home – which SecureX and Webex provide – adds to the positives for Cisco Systems while companies that are set to return to their offices also have a need for Cisco Systems in terms of increased corporate spending on data network.

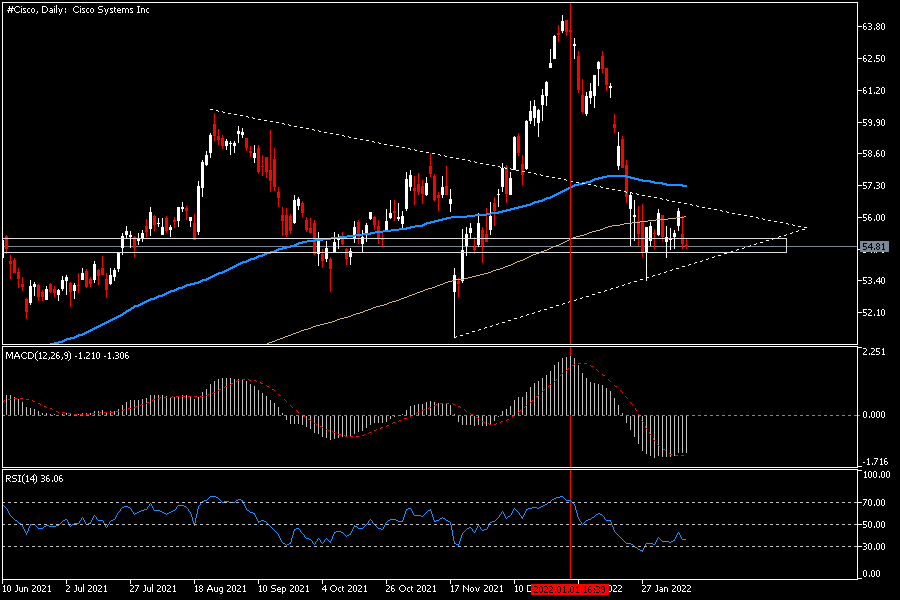

After rising about 41% towards $64.00 in 2021, #Cisco has fallen about 13% so far this year alongside the entire tech space with the tech-heavy US100 (NASDAQ) also down around 11% so far this year. This has been on the back of expectation for faster FED rate hikes as well as geopolitical tensions in Europe. The share price has since settled around the $55 support level, failing to break the key level which tracks back to June 2021. Although still below the 100 and 200 simple daily moving averages, price is converging at the tip of a symmetric triangle and a breakout is imminent with the earnings report a close catalyst. The MACD still holds a bearish bias while the Relative Strength Index trades close to oversold territory. A miss in the earnings and revenue result as well as a weak outlook from the company could be the catalyst to see the share price clear the floor it found around $55 and head towards the next support at $53 while a strong beat could see a lift off from $55 towards $57.50.

Click here to access our Economic Calendar

Heritage Adisa

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.