Viacom CBS Inc. (#ViacomCBS), a global media and entertainment company, provides streaming services, digital video products, premium content and experiences, and production, distribution and advertising solutions to audiences around the world. The company will report its fourth-quarter and full-year 2021 financial results after the market close on Tuesday, February 15.

In 2021, ViacomCBS’s performance was in line with market expectations. Despite facing stiff competition from media giants like Netflix, Walt Disney, Fox, and a forced sell-off in ViacomCBS stock following the Archegos scandal, the company has maintained its status as one of the top streaming companies, with revenues in every category (except theatrical revenue) increasing year-to-date every year since 2019, and even surpassing $1 billion in revenue for the first time in the most recent quarter (representing a 62% year-over-year increase). As the company stated in the last quarter, it has nearly 47 million streaming subscribers worldwide thanks to its effective strategy in global content, distribution and market expansion to drive scale.

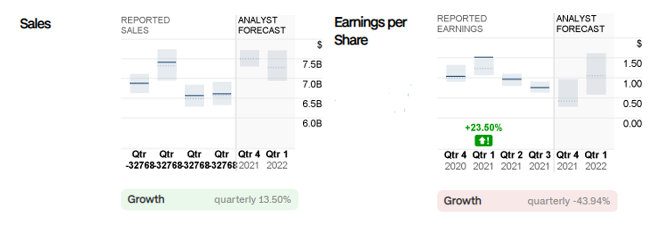

Fourth-quarter results could be “a combination of headwinds and tailwinds, ” as the company’s CEO Bob Bakish said, but consensus estimates remain mixed. Sales are expected to report $7.5 billion, up 13.6% and 8.7% year-over-year, respectively . However, EPS is expected to decline 76.7% sequentially and 141.9% year-over-year to $0.43.

Some positives that may continue to favor the company include its mastery of content creation, strong brand positioning, solid fundamentals (lower beta, faster user and MAU growth), partnership with T-Mobile, partnership with Comcast, etc. Some headwinds include declining licensing revenue, increased churn, low conversion rates, ongoing supply chain issues, and more.

Given the mixed outlook for the upcoming earnings release, #ViacomCBS has a Zacks Rank of #3 (Hold). Last year, following the Archegos scandal, the company’s stock price tumbled (it has been under 100-day SMA pressure since then), from more than $100 a share to a low of $28.28 on Dec. 20. In January 2022, #ViacomCBS stock formed an inverted V after failing to break above 100-day SMA (yellow) resistance before rebounding and forming a higher low at $29.82.

Last week, the 100-day SMA was challenged again, with the company’s stock successfully closing above it and breaking above $35.60 (38.2% FR, extending from the June 2021 high to the December low of the same year). As long as resistance turns to support unchanged, we may see upside potential in the stock and a test of the next resistance level at $37.85 (or FR 50.0%, which also intersects the 200-day SMA (purple). This could be a pivotal point where the overall trend direction could change from bearish to bullish.

Otherwise, if the market disappoints and sparks a sell-off, a close below $35.60 and the 100-day SMA could resume the bearish trend, with next support at $32.80 (or 23.6%) and $29.74 (FR 78.6% extending from the March 2020 lows to the March 2021 high).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.