Walmart Inc. (#Walmart), the multinational corporate giant of warehouses and supermarkets par excellence with a capitalization of $370,395,990,497, plans to publish its earnings reports for Q4 2021 on Thursday, February 17, 2022 before the market opens.

According to Zacks, Walmart is ranked #3 (Hold) in the Top 22%, at #55 out of #248 and in the Bottom 19%, at #13 of #16, in the Retail Sales and Supermarkets sectors, respectively. It is expected to have an EPS of $1.50 although the most accurate EPS is at $1.52 with a surprise ESP of +1.59%, compared to the same quarter last year of $1.39 (which missed expectations) which would represent a growth of about 33%. Earnings stand at $150.20B which is very similar to the same quarter last year of $152.08B. Walmart is one of the survivors of the pandemic and it seems that rather than being affected, it benefited.

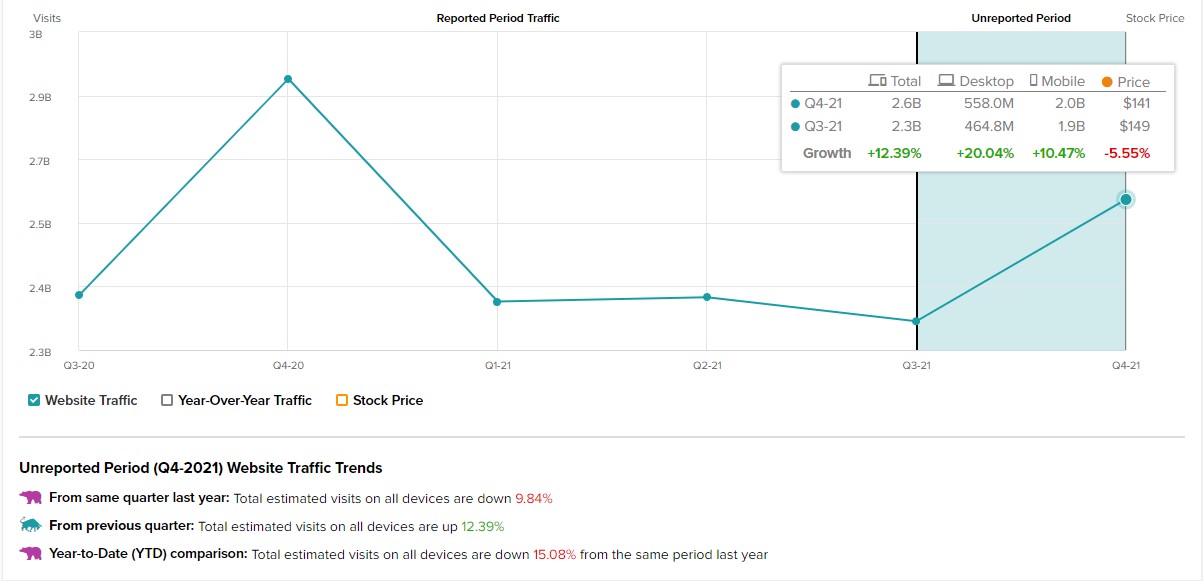

One of the reasons is that e-commerce sales increased by 37% (not the fastest growth) due to the shift in consumers from physical to electronic which forced retailers to change their way of doing business and implement more electronic methods , from customer service to more efficient ordering, transaction and shipping methods than before the pandemic. Website traffic has increased by 12.39% this quarter compared to last, however year over year it is down -15.08%.

Something of interest for investors is the growth of comparable sales which varied in the fiscal year 2021, at 6.2% for Q1, 5.5% for Q2, 9.9% for Q3 and a slowdown is expected for Q4 with a forecast of 6.1%, a reduction in the speed of growth for the full year compared to the past 7.0%. On the other hand, Walmart has provided a return of -6.6% which compared to the USA500 rise of +11.9% is really low.

The stimulus of the US government together with the savings produced by the pandemic in the months of lockdown made consumers prefer to spend on consumption for the home than travel, restaurants and outings, which has been beneficial to companies like Walmart in recent quarters. However, due to the progress in the pandemic, it is expected that the stimulus will be reduced, hitting savings in addition to the increase in inflation increasing the cost of basic products and more, which could jeopardize the income and current growth of all retail and consumer spending companies, including Walmart.

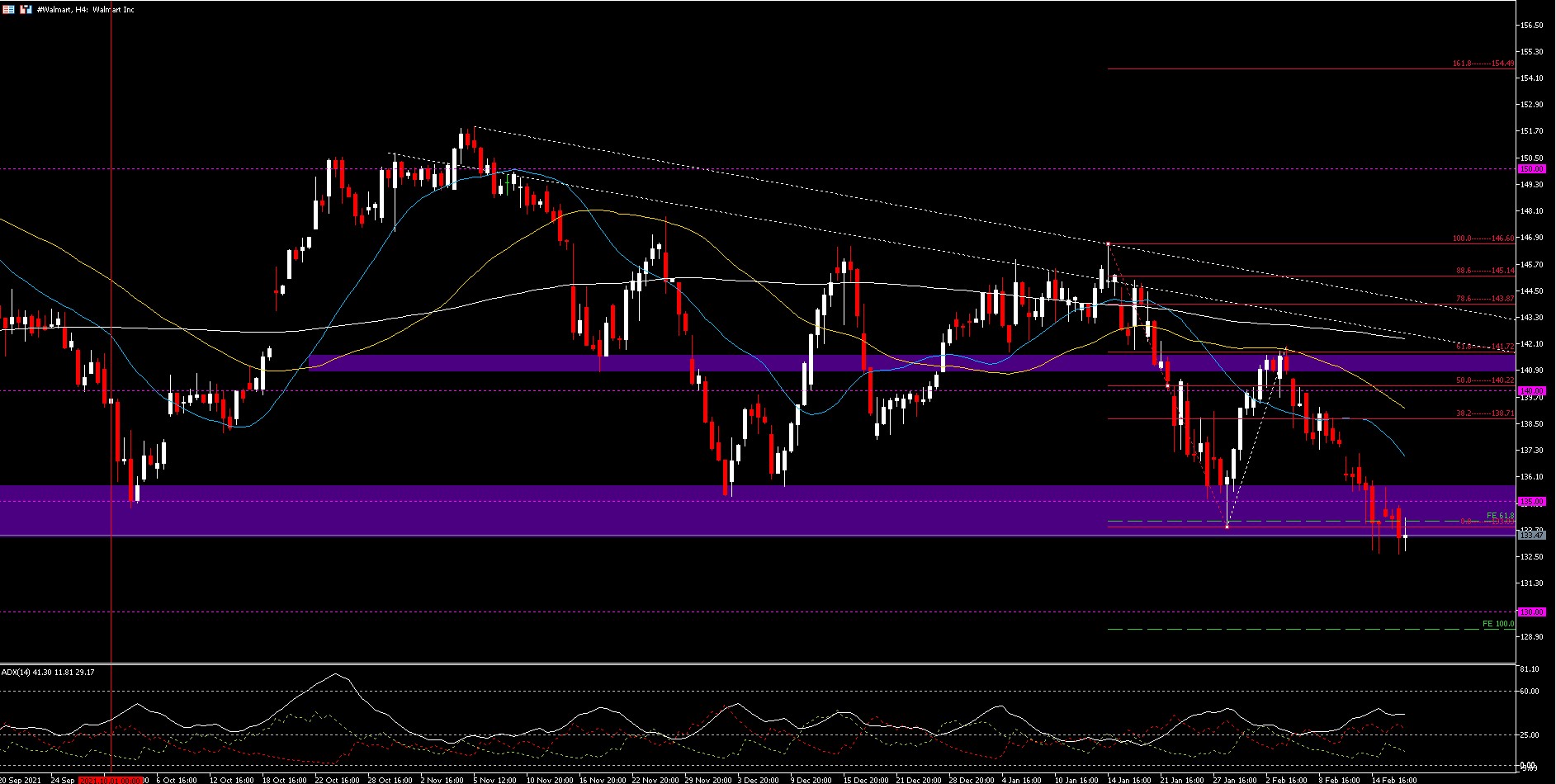

Technical Analysis – Walmart H4

From a technical point of view, Walmart started October with a bullish momentum to reach the $150.00 level for the fourth time but was unable to hold above it like past times, with the price turning and dropping from the November highs to near support $135.00. From there it made volatile moves from this support to $147.00 resistance though made lower highs, testing the 50- and 100-period moving averages at $141,700-$141,800. This bounce resulted in strong bearish momentum that has broken the 21-period moving average as well as the $135.00 support level, putting the price at values not seen since March 2021. If this level is not recovered, the next support is at the psychological level of $130.00 and from there until the March 2021 lows , followed by the psychological level of $120.00 and then the lows of July 2020 at $118.30.

Should all go well for the Walmart report, a price rally as usual is possible with resistance at $135.00 (the current broken support level), followed by the 21-period SMA at $137.00, the 50-period SMA at $139,160, the psychological level of $140.00 and above there the 100-period SMA at $140,574 continuing with the previously mentioned highs, in addition to the 200-period SMA at $142.36, which would be an area where the downward trend line is. If it manages to overcome the consequent maximums, the price would again face the area above 150.00, its 5th challenge of these maximums.

- ADX is at 41.30 with a +DI at 11.81 and a -DI at 29.17 with a break of lows currently. The Q4 results should reveal whether or not the downtrend will continue.

- All-Time High at $153.38 – 16/11/20

- Low minus from this high at $126.28 – 04/03/21

- If the descending triangle turns out as it should, it would be marking a price even below $120.00.

- https://www.zacks.com/stock/quote/WMT

- https://www.bloomberg.com/news/features/2021-12-21/online-shopping-curbside-pickup-amazon-walmart-and-the-covid-retail-shift

- https://www.investopedia.com/walmart-q4-fy2022-earnings-report-preview-5219093#citation-2

- https://www.marketbeat.com/stocks/NYSE/WMT/earnings/

- https://www.tipranks.com/stocks/wmt/earnings-calendar

- https://www.barrons.com/articles/walmart-stock-price-earnings-51645031380

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst – HF Educational Office – Mexıco

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.