The South African Rand against the US Dollar was still trading above 15,0000. The strengthening of the Rand has been going on since November 29, 2021. Rising prices of precious metals as Russia’s attack on Ukraine military bases saw investors heading for safety of Gold, and US Dollar. The USD rose against most other currencies as Russia staged a “full blown invasion” of Ukraine as Kyiv called it.Bullion is trading at $1950.15 at the moment as Ukraine developments overshadow central bank prospects.

Rising prices of precious metals could eventually support exotic currencies such as South Africa Rand and Mexican Peso, given also that South Africa is rich in natural resources. Markets will now be eyeing the possibility of the South African Central Bank raising its key lending rate by another 25 basis points next month, extending the tightening cycle that started in November to curb inflation.

The South African Reserve Bank

The central bank of South Africa raised its benchmark repo rate by 25 bps to 4% at its January 2022 meeting, the second consecutive increase as rising inflation risks are increasingly worrying. The Committee believes that a gradual increase in the repo rate will be sufficient to keep inflation expectations buoyant and moderate the future path of interest rates.

Headline inflation increased further to 5.9% in December, above market expectations of 5.7%, and moving closer to the top of the 3-6% SARB target range. The increase in interest rates slightly suppressed inflation, as seen from the report on the annual inflation rate in South Africa which fell to 5.7% in January 2022.

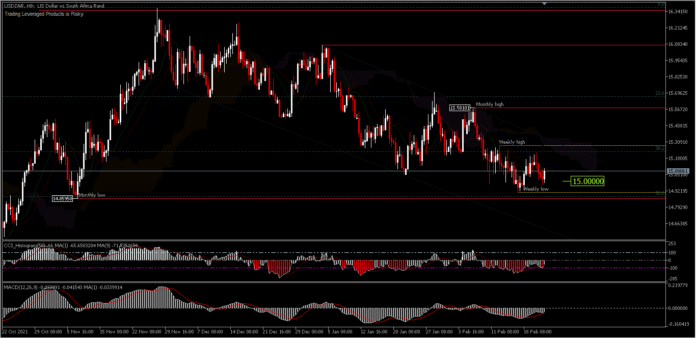

The US Dollar tried to rally against the South African Rand, with a gain of +0.50% and moved away from the psychological 15 level. From the hourly chart, the USDZAR pair’s price has started to stall its decline, having approached the November 2021 low (14.8595) and printed a weekly low of 14.9092. The emerging convergence bias gives some hope for the bulls, but the resistance is at 15.2790, last week’s high. Movement of the asset price above this level would open the door for the bulls to move to 15.5810. Meanwhile a move below the support at 14.8595 would invalidate the bullish scenario and extend the decline from the 16.3653 peak to 14.3492 and 14.0591.

USDZAR, H4

Overall, the hourly trend still shows a wave of correction to the rebound of 13.3823 which is currently stuck at the 50.0% FR retracement level (from a drawdown of 13.3823-16.3653). A break of the minor resistance and Kumo on the upside would change the bias the back to the upside, given that as long as the November low is not broken on the downside, the asset still has a chance to rally again. A break of the November 2021 low would confirm a deeper retracement to the downside.

Mexico

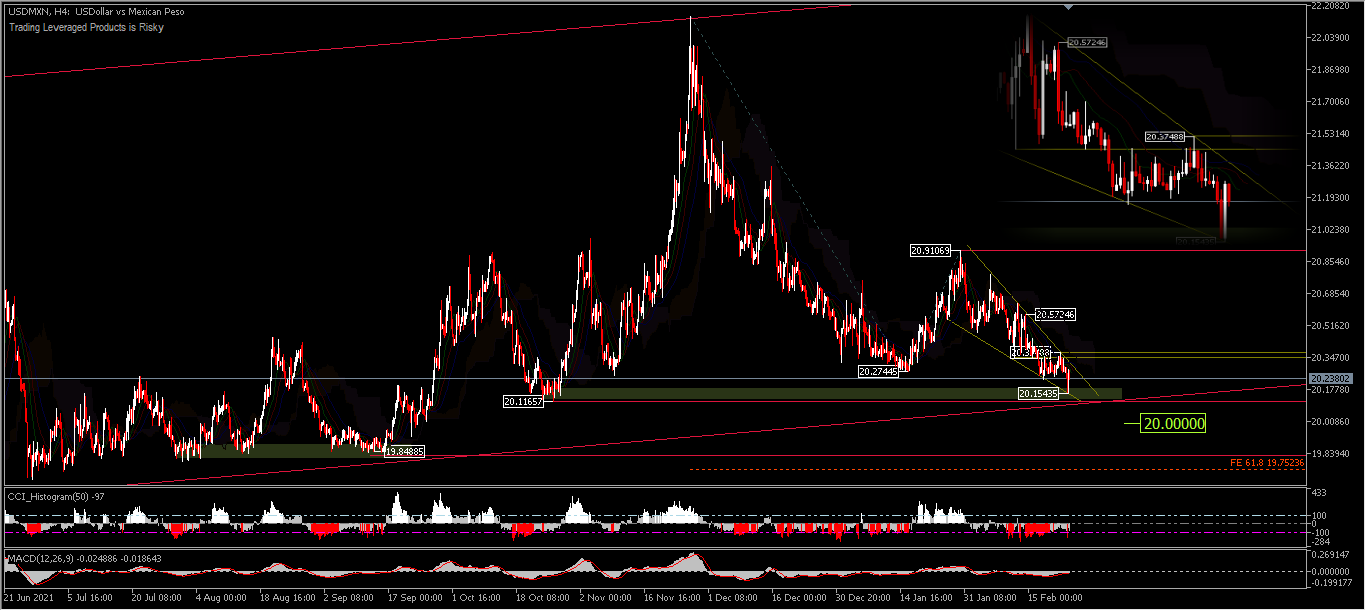

Elsewhere, in Mexico, the Mexican Peso against the US Dollar attempted to recover some of its daily losses by bouncing to the upside from the support zone, but the bears’ dominance still looks quite strong. In January the USDMXN pair briefly rebounded from a low of 20.2744 and rose 1.68% to the close of the month. However, in February, all these rebounds were covered by recording a decline to date of -1.97%. The bearish pressure faded a bit, in the falling wedge pattern as seen from the daily pin bar candle which left a fairly long lower shadow.

Bank of Mexico

Banxico raised its benchmark interest rate by 50 bps to 6% on February 10, 2022, as expected. This was the sixth straight increase, amid concerns over inflationary pressures and expectations the Federal Reserve will start raising interest rates in March. The balance of inflation risk is still trending upwards, as inflation expectations for 2022 and 2023 rebounded, while medium-term expectations eased slightly and remained stable in the long-term at levels above the target. The annual inflation rate edged down to 7.07% in January 2022 from 7.36% the previous month, the lowest in 3 months but still close to the more than 20-year high of 7.37% hit in November.

USDMXN, H4

In the hourly period, the price bias tends to be neutral within the falling wedge pattern after the bounce from the daily low of 20.1543 above the support at 20.1165. However, a break of this support level will open the opportunity to dive further to 20,0000 and not rule out the projection of FE61.8% at 19.7523. As long as the 20.1165 support holds, the outlook to the upside will be favorable in the short term. The obstacle for the pair’s rally is the resistance at 20.3749 but if this level is successfully overcome, the price bias will move to the positive side as the falling wedge pattern has been broken on the side of the upper line and opens the chance to test 20.5724.

Technical information from both CCI and MACD oscillation indicators have not yet validated the move to the upside, although the divergence bias is faintly visible. Sellers still dominate the game, but profit-taking also begins when prices reach their monthly low.

Data from Mexico that needs to be watched this week that will affect the movement of the Peso include Retail Sales for December, January Balance of Trade and Q4 Final GDP to be reported on Friday.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.