Baidu, Inc. (#Baidu), a China-based tech behemoth specializing in internet services (Baidu Browser and Cloud, Baidu Baike and Baidu Knows, Baidu Map etc), social networking sites (Baidu Tieba, Baidu Space, video streaming platform iQiyi and Haokan) and AI technologies (Baidu Brain, Apollo smart driving system, Apollo Go robotaxi, PaddlePaddle deep learning platform, Duer virtual AI assistant app and Baidu Kunlun 2 AI chip) with a market cap of over $53 billion, is scheduled to release its Q4 and fiscal year 2021 financial results on 1st March (Tuesday), before market open.

2021 was not a good year for Baidu, Inc. Although reported sales performed on par with consensus estimates, the company’s earnings per share (EPS) fell more than 35% below analyst expectations during the second and the third quarter. This could have been due to mounting regulatory pressure (including antitrust laws), budget slashing on advertisement by businesses during the pandemic, some investments that have yet to be proven effective (eg. driverless cars), an increase in research and development expenses, increased competition among peers, net loss in short video investment, etc. Furthermore, downsizing the number of staff and delayed payment of bonuses worsened the overall outlook of the company.

Following near-term ad industry weakness and some macro headwinds, consensus outlook for the upcoming announcement remains mild. It is estimated that reported sales will be at $32.3b, up 1.25% q/q and 6.6% y/y, whereas EPS is expected to hit $9.17, down 37.4% from the previous quarter and down 54.3% from the same period last year.

Relentless innovation in AI cloud, intelligent driving, mobile ecosystem and other growth initiatives, as well as mass market share in the cloud computing market may serve as a tailwind to the company in the longer term. Baidu has also ventured into the metaverse, however, as stated by vice president Ma Jie, it is “still in its infancy and there’s still a long way to go,” thus “requiring more collaborations (more investments?) to build the infrastructure collectively”.

Technical Analysis:

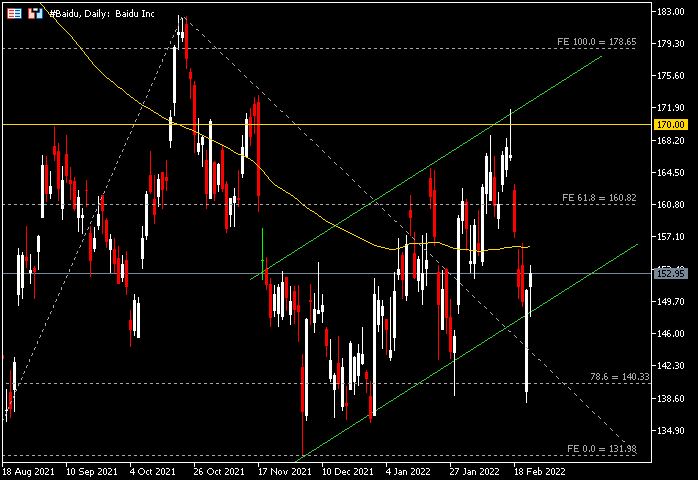

Technically, the #Baidu share price gapped low at $138.14 following the start of the Ukraine crisis last Thursday, the lowest level since January 28. However, the selling pressure was short-lived and the company’s share price managed to recoup its losses and closed the week a mere -0.3% from its open price. To date, the #Baidu share price remains 30% below the median estimate ($219.28) offered by analysts.

The 100-day SMA above serves as the nearest resistance. Breaking above the dynamic resistance may open up bullish opportunities for the price to continue testing the resistance at $160.80 (FE 61.8%), and psychological level $170. On the other hand, the lower trend line of ascending channel serves as the nearest support. A candlestick that closes below the line may trigger more selling pressure, pushing the price towards the next support at $140.30 (FR 78.6%) and last December’s low at $131.98.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.