Stock markets mostly moved higher across Asia, but GER30 and UK100 futures are down -0.14% and US futures narrowly mixed, with the USA100 underperforming, against the background of the Ukraine war. Yields jumped higher yesterday and Bund futures are little changed this morning, as are Treasury futures, while in cash markets the US 10-year rate has corrected somewhat. Aluminium hits record top; Oil, wheat at multi-year highs on supply woes. Longer-term Black Sea supply curbs lift wheat to 14-year high –Brent hit $118/barrel & Gold hit $1950/ounce. Russia is a top supplier in oil, gas, metals and grain, and Russia and Ukraine also account for 19% of corn exports and 80% of exports of sunflower oil, which competes with soybean oil and palm oil.

Reuters: The United States is preparing a sanctions package targeting more Russian oligarchs as well as their companies and assets, as Washington steps up pressure on Russian President Vladimir Putin.

New talks between Ukraine and Russia are reportedly slated for today. US “hugely important” delivery of Stinger missiles to Ukraine hailed “game-changer” – Fake News? Political propaganda? Who knows.

Overnight – Powell signalled a less aggressive pace of interest rate hikes than investors had feared. BoE’s Cunliffe and Tenreyro suggested that the war in Ukraine will change the outlook” – suggested the bank remains on course to deliver further rate hikes. The banks could remain on course to remove stimulus, but will move cautiously and maintain the flexibility to step in again if necessary. BoE’s Tenreyro says Ukraine war leaves “upside surprise” on inflation, but also delivered a trade shock. China Services PMIs down; Japan consumer confidence down. ADP data showed a stronger than expected 475k jump in private payrolls in February and a hefty upward revision in January to 509k from -301k.

- USD – USDIndex at 97.50

- US Yields 10-yr lower now, was over 13 bps higher testing 1.87%.

- Equities – Nikkei lifted 0.7%, USA500 jumped 1.86% – Energy was the best performing subsector on Nikkei (+3.2%), financials jumped 3.17%.

- USOil – Rallied to $112.00; Brent hit $118/barrel.

- Gold – Steady as risk appetite improved, trades at $1926; Copper at 4.76 ; Palladium at 2,721.

- FX Markets – EURUSD at 21-month low at 1.1055, USDJPY up at 115.72 and Cable down to 1.3390 now from 1.3416. USDCAD breaks below 200-Day SMA (Bank of Canada raised rates 0.25%). AUDUSD breaches and breaks 200-week SMA at 0.7320.

Today – Today’s data releases will continue to take a backseat, but include final services PMIs for the Eurozone and the UK. The account of the ECB’s last policy meeting is also due, but the highlights will be in the US session with Jobless claims, ISM Services, Markit PMI, Fed Chair Powell testimony and BoC Macklem speech.

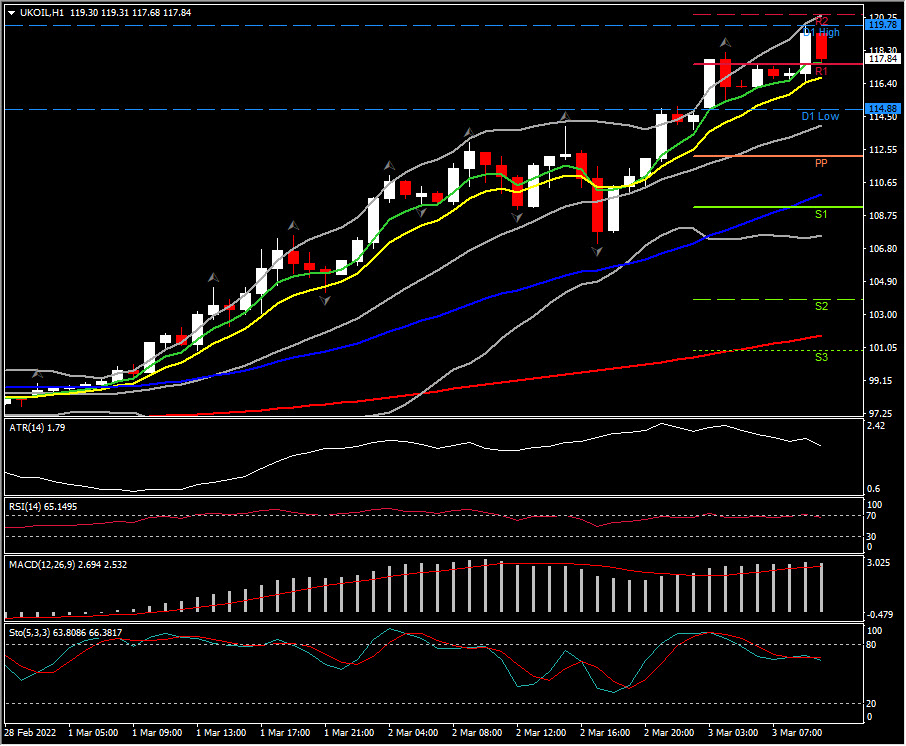

Biggest FX Mover @ (07:30 GMT) UKOIL (+4.83%) Spiked to 119.78. MAs aligned higher, MACD signal line & histogram extend higher, RSI 70 & rising with all suggesting further steam to the upside. H1 ATR 1.79, Daily ATR 5.07.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.