Founded in 1837, Procter & Gamble (P&G) which has a market cap of $370.01 billion, is one of the world’s largest consumer goods companies. The company specializes in a wide range of personal health/consumer health products, personal care products and hygiene products including Grooming, Health Care, Beauty, Fabric Care and Home Care, and Baby Care and Family Care. The Cincinnati-based company with a workforce of over 100,000 workers, represented in about 70 countries, is home to billion-dollar brands like Pampers, Head & Shoulders, Always, Ariel, Gillette, Oral-B etc.

In its latest financial report published January 19 2022 Procter & Gamble reported $1.66 earnings per share – beating market expectation – on revenue of $21 billion which was up 6.1% y/y while returning $7 billion to shareholders via dividend and common stock repurchases. Despite rising costs due to supply constraints, the company maintained a strong momentum and raised their estimates for sales growth, cash return to shareholders and cash productivity as the President and CEO, Jon Moeller, said “we delivered very strong top-line growth and made sequential progress on earnings in the face of significant cost headwinds”.

The numbers have supported the company so far but there have been a few concerns that the company could face a huge strain from currency fluctuation due to the tension in Europe between Russia and Ukraine. P&G has a big operation in Ukraine with about 500 employees in the local headquarters in Kyiv manufacturing products for export to over 30 countries. It also operates in Russia with a general office in Moscow and plants in Petersburg and Novomoskovsk. Back in 2014, P&G lost about $1.5 billion when the Russian Ruble fell about 58% against the USD from 33RUB per USD in January to 79 RUB per USD in December despite the Central Bank of Russia raising interest rates from 10.5% to 17% in attempt to stop the fall of the currency.

The Ruble has once again plunged about 30% as sanctions hit the country’s economy following its invasion of Ukraine and the Central Bank of Russia has similarly increased interest rates from 9.5% to 20% to try to limit the fall of the Ruble. When asked about the impact of this conflict on its operations, P&G played down the potential effect saying that both countries account for less than 2% of its global sales and less than 1% of its global profit. There is no doubt that the conflict will have an impact on the company as well as other companies operating in those countries but the effect may be limited having learnt from past experience. The recent price increase on some of P&G’s products should also help protect profit margins and cushion some of the effect of higher commodity prices and freight costs.

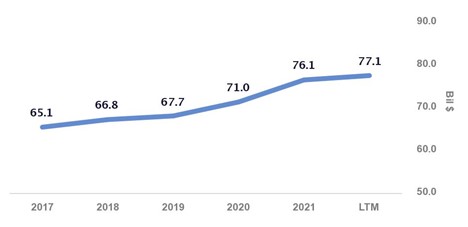

Source: TREFIS

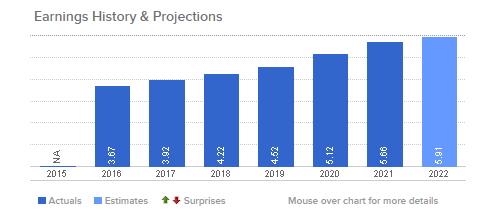

In recent times, the numbers for Procter & Gamble have come in solid as the company has recorded higher revenue every year since 2017, hitting $76.1 billion in 2021 (7.3% growth from the previous year), paid higher earnings per share every year since 2016 with the latest coming in at $5.66 EPS, and despite the downside in the share price this year (-5.64% YTD), similar to the overall equity market condition owing to incoming central bank tightening and recent tensions in Europe, P&G still outperformed global market benchmarks like the US500 which is down -9.03% YTD.

Source: CNBC

Source: CNBC

With the optimism and strong forecast from the company’s latest earnings release, the buy rating on P&G by analysts at Yahoo! Finance and the recent comments from CNBC’s Jim Cramer about the company’s ability to cope with rising raw costs by passing them on to the consumer because they have scale and superior brands that can command higher prices – he also went on to say “Procter and Gamble is the safest of safety stocks” – one can perceive the overall positive sentiment towards the consumer products giant and the company should prove more resilient to the recent strain.

After creating a low in early 2018 around $70.50, #Procter&Gamble has continued to trade in an upward trend, creating higher lows and higher highs till it reached a top in December 2021 around $165.00. The share price has since pulled back towards the 50% fib retracement level around $152.00 from the low of October 2021, finding support at the 100-day moving average. Although now heading towards the resistance around $156.50, a maintained break back above that level would be needed to put buyers back in the driver’s seat but until then, more downside could be seen if the current negative sentiment remains in markets.

Click here to access our Economic Calendar

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.