Instability from the war and uncertainties over global impacts made pricing extremely difficult, especially considering the extent of the moves over the last couple of weeks.

Markets are positioning for a series of rate hikes to deal with the spike in commodity prices, while in the Eurozone there is lingering speculation that the war in Ukraine and stagflation risks will prevent the ECB from a commitment to a phasing out of net asset purchases. Bonds as well as stock markets remained under pressure, as the Ukraine war is fuelling stagflation fears. The June 10-year Bund future is up 6 ticks, outperforming versus Treasury futures, which are firmly in the red once again, while the US cash rate has lifted 1.0 bp to 1.78%. The JPN225 is down -1.7%, with hefty losses of -3.62% on the USA100, -2.95% on the USA500, and -2.37% on the USA30. Oil is still trading at $120.00 after the wider jump to $126.30 – commodity prices will not just push up cost of living expenses but also weigh on production in sectors reliant on ready and cheap energy supplies.

- USD (USDIndex 99.31). Steady at 6-year highs.

- US Yields 10-yr up 1.2 bp at 1.785% – The JGB rate is up 1.0 bp at 0.150%.

- Equities – USA500 FUTS down at 4168 now.

- USOil – Rallied to $126.30 yesterday, $119.70 now. – The prospect of a ban on oil imports from Russia triggered investor fears over inflation and slowing economic growth.

- Gold – Rallied to $2020 earlier, $2018.30 now.

- Bitcoin trades at $38,350.

- Nickel at new record highs – more than doubled today to cross the $100,000-a-tonne level for the first time ever, as tension in eastern Europe showed no signs of cooling and growing sanctions against Russia fuelled fears of a disruption in supply. – Russia supplies the world with about 10% of its nickel needs, mainly for use in stainless steel and electric vehicle batteries.

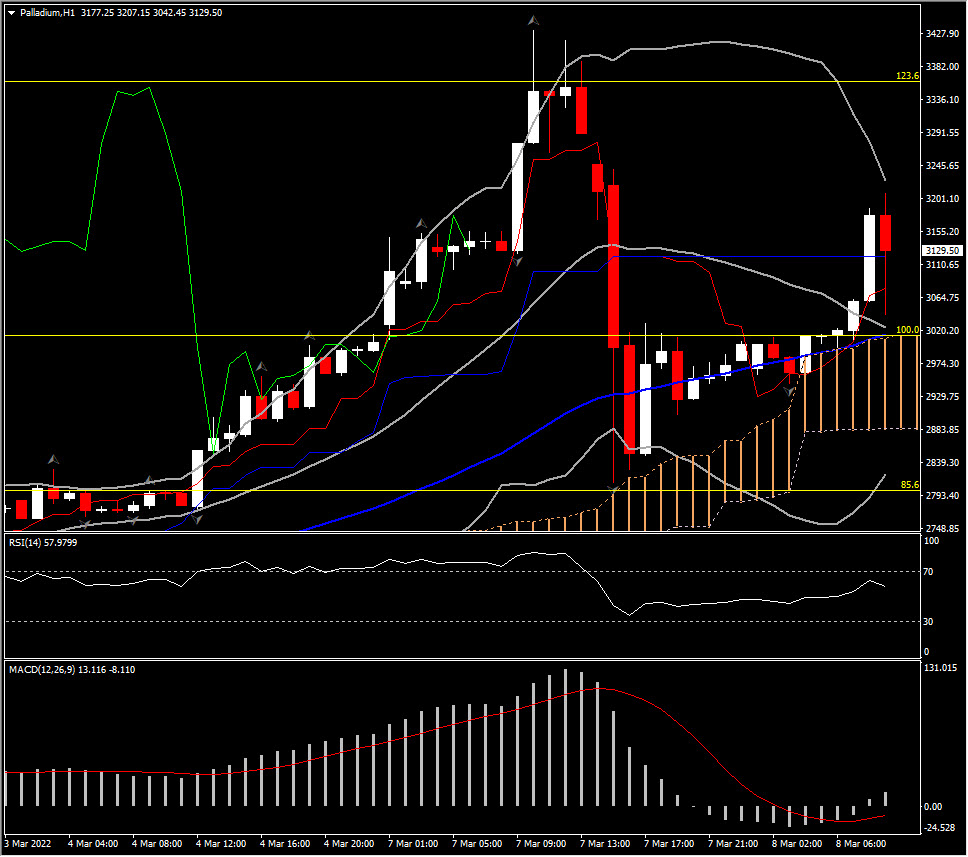

- Palladium surged to a new peak too. Wheat has paced the rise in key commodities since the invasion, having soared 52%. It surged 5.4% to a new high of $13.63 a bushel but finished down -7% at $12.02.

- FX markets – EURUSD at 22-month low at 1.0847, USDJPY holds 115.50 and Cable down to 1.3080 now.

Overnight: Japan reported its biggest current account deficit since 2014 in January. President Joe Biden’s administration is willing to move ahead with a US ban on Russian oil imports even if European allies do not, Reuters reported on Monday, citing people familiar with the matter. Crude has already hit 14-year highs and Russia warned that prices could surge to $300 a barrel and it might close the main gas pipeline to Germany if the West halts oil imports over the invasion of Ukraine. Germany has rejected plans to ban energy imports. The biggest buyer of Russian crude oil is accelerating plans to expand its use of alternative energy sources but cannot halt imports of Russian energy overnight, German Chancellor Olaf Scholz said on Monday.

Today – EU Q4 GDP, US Trade, Wholesale Trade, and the NFIB Small Business Optimism Index and Japanese Q4 GDP.

Biggest FX Mover @ (07:30 GMT) Palladium (+7.52%) Spiked to 3200 again recovering from 2810 lows last night. Currently MAs flattened, MACD signal line & histogram steady at 0 line, RSI 57 but pointing lower, all implying a short term potential correction lower. H1 ATR 56.87, Daily ATR 215.19.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.