It was all about inflation for the central banks this time around. Both BoE and Fed lifted rates a quarter point, with the latter plans for six more quarter-point hikes on the year. The Fed policy statement indicated that the implications from the invasion of Ukraine and related events are “highly uncertain,” but in the near term “are likely to create additional upward pressure on inflation and weigh on economic activity.” The new quarterly estimates revealed boosts to PCE chain prices and reductions for growth, with a wide dispersion in the dot plot given the huge uncertainties to the outlook. The balance sheet reduction could begin as soon as May.

Though all of this was priced in, the BoE and Fed’s overall aggressiveness and the tone of Chair Powell’s press conference caught the markets off guard. Treasuries sold off on the FOMC’s stance, though losses were pared and bonds managing small gains. Wall Street closed with solid gains after wobbling on the Fed, though hope for a Ukraine ceasefire provided support.

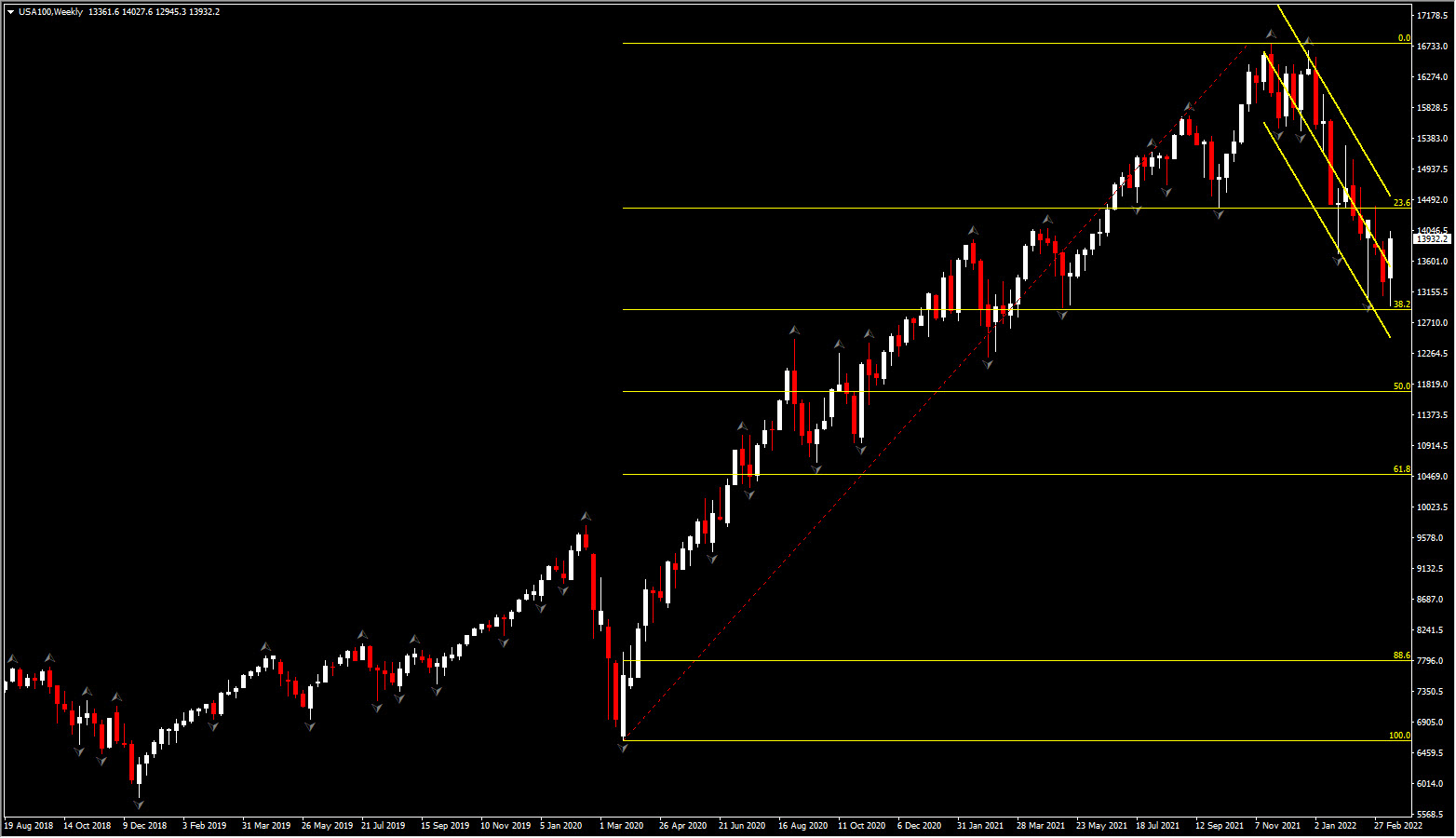

US stock indexes rose to 2-week highs while sustaining their gains so far today. The USA500 index closed up +2.24% with EPAM System Inc. jumped 25.19%. US30 closed up +1.55% with The Boeing Company up 5.06% and USA100 closed up +3.70% with Pinduoduo Inc. skyrocketed 56.06%. The yield on the 10-year US Treasury bond fell back to 2.19% on Wednesday, having briefly risen to near a 2-year high of 2.24%.

However there are facing increasig negative momentum on the mix geopolical picture, with positive and negative headlines holding the volatility on its feets, with the latest report stating that Russia dismissed reports of substantial progress in talks with Ukraine. Risk appetite remains shaky amid fading hopes of a quick agreement between Ukraine and Russia.

In the medium to long term however , US Indices expected to be supported regardless of the hawkish Fed. Fed funds futures were priced for 7 quarter point rate hikes this year and that’s what they got from yesterday’s outcome. The futures are a little firmer currently but is still pointing to another 50 bp in tightening by June and 100 bps more over the second half of the year.

As stated by V K Vijayakumar: “Even though a hawkish Fed is normally regarded negative for equity markets, history tells us that market returns following the rate tightening are good. A Deutsche Bank study of 13 rate hike cycles shows S&P delivering 7.7 per cent average returns in the year following the hike. Since rate hikes happen in the context of economic recovery, the consequent corporate earnings growth justify resilient markets.”

The Fed stressed inflation over jobs yesterday with Powell underscoring the robustness in the labor market. He also discounted the chances of recession over the next 12 months. The job of the markets now will be to weigh the risks of inflation versus growth. Given the supply shocks from covid, the war, and geopolitical tensions, inflation is likely to remain elevated and for a longer period of time than previously expected. That should keep the Fed on a hawkish rate path, especially with balance sheet reduction likely to start in May. However, there is increasing uncertainty whether the economy will be able to weather the tighter financial conditions. Of note, the BoE came in on the less hawkish side of the coin amid growth.

The vote was 8-1 with the hawk Bullard dissenting in favor of a larger half point increase. The policy statement also indicated further increases will be “appropriate.” In his press conference Powell stressed that the Committee is “acutely aware” of the need to return to price stability, and that the Fed will do what it needs to do to make sure inflation does not become entrenched. “Price stability is an essential goal.” He emphasized that in fact it is a “pre-condition” to achieving a sustained strong job market, which is the other half of the dual mandate. Policymakers will be watching inflation “report by report.”

Powell stressed that the Fed has a plan and the tools to make sure inflation does not become entrenched, and to ensure a strong labor market. He characterized the labor market as “very, very tight…tight to an unhealthy level” and noted the need to slow it down. He expects a pick up in labor market participation this year, which should help temper inflation. He does not see a wage-price spiral developing. The underlying strength in the labor market suggests to him that the probably of a recession this year is “not particularly elevated.” All signs are that this is a strong economy that can “flourish” in the face of tighter policy.

The FOMC forecast revisions for growth, inflation, and the unemployment rate were all in the directions anticipated. Yet, there were bigger than expected downward GDP growth revisions, and much larger than expected hikes in the PCE chain price estimates, leaving a much more “stagflationary” path than we had assumed. Downward GDP revisions were concentrated in 2022, but inflation forecast hikes surprisingly extended through the 3-year period. March marks the sixth consecutive SEP with upward inflation revisions. The jobless rate estimates were tweaked only slightly lower in 2022.

For GDP estimates, the 2022 central tendency was sharply lowered to 2.5%-3.0% from 3.6%-4.5%, versus our own 2.9% estimate. For chain prices, we saw huge upward revisions in the 2022 central tendencies to 4.1%-4.7% from 2.2%-3.0% for the headline, versus our 5.2% estimate, and to 3.9%-4.4% from 2.5%-3.0% for the core, versus our 3.9% estimate. We saw hikes in most of the 2023 and 2024 inflation metrics.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.