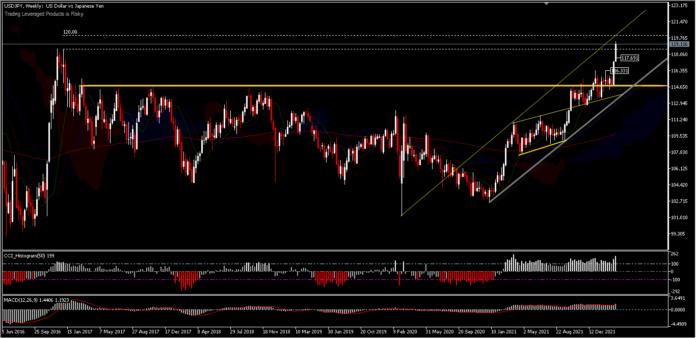

USDJPY, Weekly

BOJ Governor Kuroda said on Friday that there was absolutely no need for Japan to raise interest rates and that the BOJ would take additional relaxation measures without hesitation if needed. The Japanese yen surpassed the key level of $119 for the first time in 6 years, as the BOJ maintained its huge incentive and warned of the growing risks of a fragile economic recovery due to the crisis in Ukraine. While inflation appears to be approaching or exceeding the central bank’s 2% target for the coming months, the BOJ is in no mood to withdraw stimulus measures. This steady aggressive stance is in stark contrast to other major central banks that have begun to tighten monetary policy.

USDJPY closed the week with an increase of +0.42%. The Yen weakened, after the BOJ policy meeting left interest rates and asset markets unchanged and revised down its economic valuation due to the effects of Covid. Friday’s Japanese economic data for the Yen was also down, as Japan’s tertiary industrial index fell -0.7% m / m, its biggest drop in 5 months. Japan’s former fresh food and energy CPI also fell -1.0% year-on-year in February. The JPN225 rose +2.47% to close at 27,335, while the broader Topix index rose +0.54% to 1,909 on Friday, with the two benchmarks showing their best weeks in almost two years following the the Federal Reserve’s measured move to tighten policy and Japan’s decision to maintain an extremely easy policy.

Technical Analysis

The USDJPY has strengthened +3.58% since the beginning of January 2022 until now, after the break and breach of the technical level at 116.33 at the beginning of the month and the peak level of 2017 at 118.60. An upward move would target the technical level of 120.00 and the top of 121.68 from 2016. The indices continue to validate the rally wave and there is still no sign of impending change. On the downside, there is support at 117.69 in the event of a short-term correction. In general, the uptrend is beginning to enter an extreme wave, near these annual peaks, but it could take take a long time for the reversal to consolidate. In general, the bulls are still in control.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.