USDJPY is still showing a strong upwards channel for the 4th week in a row, while last week it appreciated by +2.4%, after closing down -0.22% on Friday. The pair retreated slightly from fresh 6 1/4-year highs on Friday and moved slightly lower after BOJ Governor Kuroda said that a weaker Yen is benefitting the Japanese economy as a whole, but it could hurt household incomes and imports. He added that stable inflation was needed to trigger a policy change at the BOJ. The Yen also found support from Japanese government bond yields, after the yield on the Japanese 10-year JGB bond rose to a 6-year high on Friday at 0.241%.

The Bank of Japan is the only major central bank not expected to raise interest rates this year and remains committed to a yield curve control strategy, which prevents Japanese yields from rising beyond a certain level and therefore makes the Yen less attractive as foreign yields soar.

BΟJ tries to cap yields amid global sell off in bonds. The BΟJ announced today that it would buy 10-year notes on March 29, 30 and 31. It already tried to cap yields with two offers earlier in the day that seemed to have limited impact and the announcement highlights that officials are struggling to keep a lid on market speculation. BΟJ Governor Kuroda has stressed that policy will remain on hold, even if inflation jumps in the short term, but after the minutes to the last meeting showed some discussion on the risk of inflation overshoots and the official CPI number for Tokyo came in higher than expected on Friday, pressure on JGBs has been mounting. Still, while JGBs are down on the day, they have outperformed versus Treasuries and Australian bonds today.

The BOJ will release its quarterly Tankan survey on Friday. Forecasts suggest businesses are becoming less optimistic as they grapple with soaring energy prices and geopolitical uncertainty.

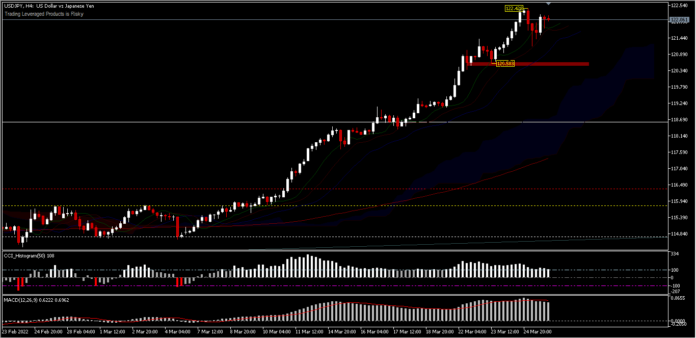

Technical Overview

USDJPY, H4 – The pair accelerated further to 122.42 levels last week, and as long as the 120.58 support holds further gains will still have some strength, as reversal will take time amid massive Yen weakness. Sustained trading above 123 would extend the rally to the 125.85 year resistance. On the downside, a break of the 120.58 minor support will turn the intraday bias to neutral and bring consolidation first.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.