After starting 2022 with a left move, Apple stock (MT5 DMA: #Apple) is seen gaining upward momentum once again. Apple shares have been seen rising for 11 consecutive days since March 15, the longest series of gains for Apple shares since 2003.

The fall in stock prices especially in the technology sector in 2022 due to concerns of rising inflation, as well as pressures from world geopolitical issues, are now seen to have come to an end. Apple shares are now back to levels last seen in early January. Apple’s share price had found a floor at $150 a share in mid-March, after which it recorded a series of consistent and lengthy gains as investors returned to investing in the technology sector and demand continued to rise.

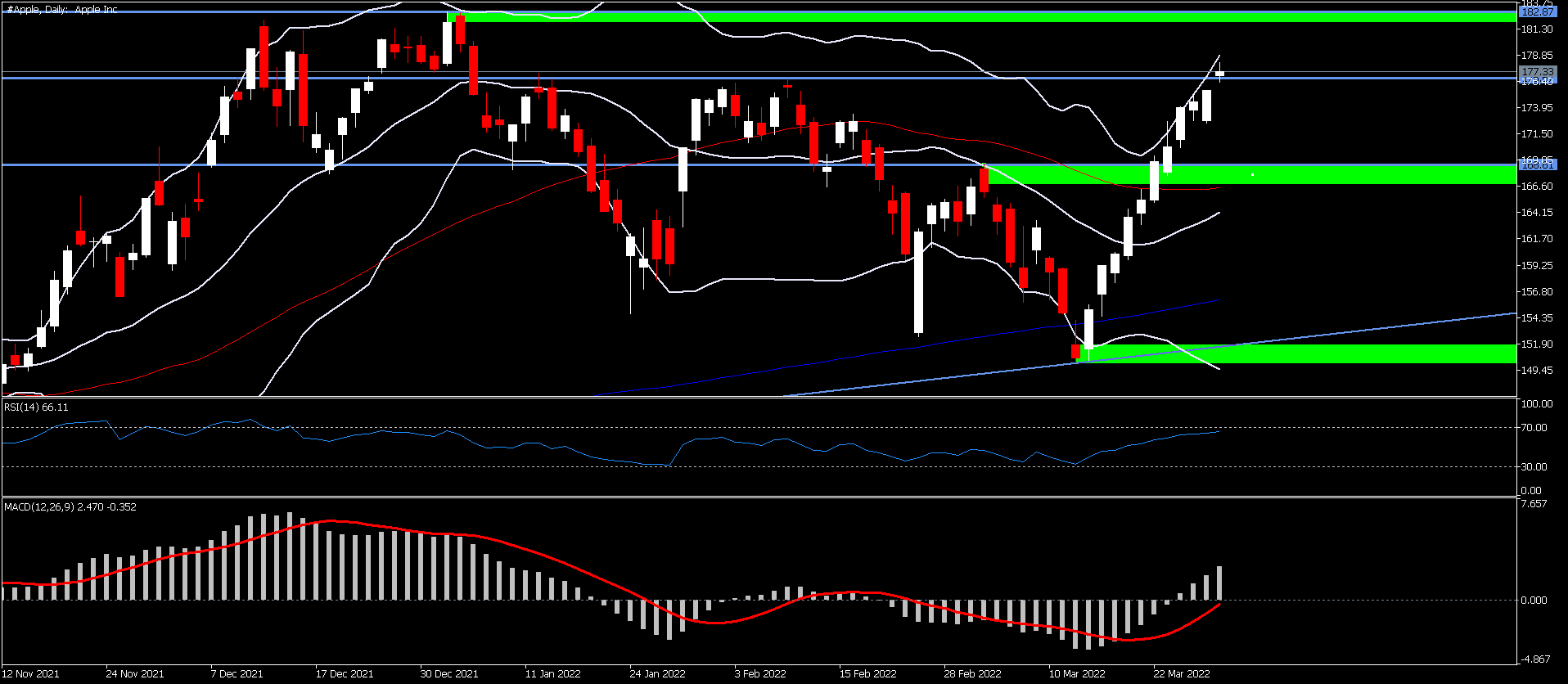

The 2022 highest price is at $182.87 which is now the Bulls’ target for the next test level. It is trading comfortably above the 50-day SMA and 200-day SMA and is seen to still have momentum with the RSI-14 still below the overbought levels, while the daily MACD level is still below 0.

Fundamentally, Apple’s price increase is the best of all the tech stocks from the Trillion Dollar Club. The situation of Apple’s share price increase, which coincided with the Federal Reserve’s action which is now seen as aggressive in formulating policies to control inflation, as well as the 10-year yield increase which has reached 2.50%, is very rare and very interesting to study. Apple is currently trading at its 2022 opening breakeven at $178 per share. This has allowed the market value of Apple’s capital to rise again and approach the elusive figure of $3 trillion.

CNN Business is putting the next 12-month median price forecast for Apple at $193.50, with the highest price projected at $215 and the lowest at $160. Meanwhile the census results from 42 investment analysts put Buy as the top projection (27 analysts), with 6 analysts projecting Outperform, 8 analysts projecting Hold and only one analyst projecting Apple as Underperform.

With Apple set to complete its first financial quarter of 2022 this weekend, investors are seen increasingly optimistic that Apple will report earnings reports that exceed market expectations on April 27.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.