Tilray Brands, Inc, a leading global cannabis-lifestyle and consumer packaged goods company that deals in cannabis research, cultivation, processing and distribution in Canada, the United States, Europe, Latin America and Australia is set to release their financial result for the third quarter of fiscal year 2022 on April 6, before market open.

On Friday, April 1, 2022, the US House of Representatives voted on the MORE (Marijuana Opportunity Reinvestment and Expungement) Act, a bill to remove cannabis from the list of controlled substances, effectively decriminalizing it at a federal level – eliminating penalties for an individual who manufactures, distributes, or possesses marijuana. Lawmakers approved the bill in a 220-204 vote with House Speaker Nancy Pelosi saying the law will deliver justice for those harmed by the brutal, unfair consequences of criminalization, and open up opportunities for people to participate in the industry.

There are concerns that the bill will struggle to pass in the Senate like in previous attempts, following Republicans’ opposition to the social justice aspect of the bill as well as to the legalization cannabis. The evenly split Senate will make it difficult to hit the 60-vote threshold required to pass the legislation as democrats will need all their members – some of which oppose the bill – and an additional 10 Senate Republicans. If passed, it would be a game-changer for the industry as the current structure limits payment options for customers, ease of accessibility across the country, easy access to capital for companies like Tilray and large investments from institutional investors.

Source: TipRank

Source: TipRank

In Q2, the company recorded a $0.01 EPS, beating the earnings estimate of -$0.09 and also beating the EPS from the same period in the previous year by about 165%; it also reported a $6 million net income, bouncing back from a loss of $89 million in the same period the previous year and seeing net revenue increase by 20% to $155 million. Chairman and Chief Executive Officer, Irwin D Simon, credited the improvement to the scale of the company, operational excellence, and broad global distribution of its high-quality and highly sought-after cannabis despite industry and macro-economic challenges.

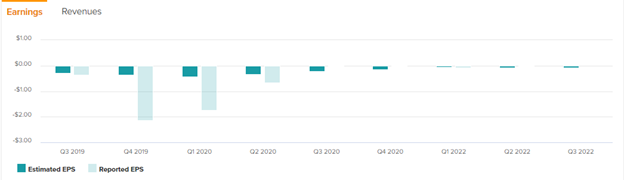

The current expectation of a cyclical slowdown in the global economy and possible stagflation amid geopolitical tensions in Europe, as well as the low probability of the MORE Act passing in the US Senate, have seen analysts’ forecasts for Tilray’s financials drop once again. Zack’s consensus estimate is a loss of $0.08/share on a higher revenue of $160.57 million (up from $155.2 million in Q2), earning the stock a #3 Hold rank. However, for the full year, the loss per share is expected to reduce to $0.24 from -$1.19 in 2021, -$2.15 in 2020 and -$3.20 in 2019.

Despite the Federal ban, Cannabis is legal for medical use in 36 US states and legal for adult use in 19 US states, with New York among the latest to legalize pot. The industry has seen staggering growth over the last year, hitting $25 billion in legal sales (up 43% from 2020), and is expected to grow by 160% to $65 billion in 2030 according to Forbes, with more Americans now admitting to using it. Simon announced back in August that the company was on its way to $4 billion in revenue by 2024 and federal legislation would only help them reach the target faster.

Investors in the $3.91 billion in market cap company have struggled with mostly negative EPS since 2019, recording a loss of $2.14 per share in Q4 that year, and with little prospect of the MORE Act passing the senate, the immediate future for earnings remain dour as US Federal Legislation remains fundamental to the industry.

The Stock price has been in a downward slope since peaking in February 2021 around $67, before finding support at $4.76 in March, which was also its previous swing low back in September 2020. #TilrayInc rose about 90% from its lows as traders priced in the positives from the MORE Act but has since seen pullback from the highs to the $7.40 support level and mid-February high, coinciding with a 38.2% Fibonacci retracement level when drawn from March lows. A beat of earnings and revenue estimate could see the $7.40 level hold, providing bulls with a short term support with the next resistance level at $8.70, while a miss as well as growing expectation for the MORE Act to stall at Senate could see the $7.40 level fall as the price is near the overbought region with next support at the 2 year low at $4.76.

Click here to access our Economic Calendar

Heritage Adisa

Market Analyst – HF Educational Office – Nigeria

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.