Australia has an important week ahead, with Retail Sales on Monday and the RBA rate decision on Wednesday. Arguably the biggest risk is a change in forward guidance by the RBA and bringing rate hikes forward. The RBA remains ultra-dovish despite a string of strong data pointing to bubbling inflation, and a change in guidance could spur a big and swift rally in the Australian Dollar.

At its last meeting, the RBA left interest rates unchanged at 0.1%, amid rising energy-related and supply-side inflation, while also noting the uncertainty of the outlook due to the Russia-Ukraine conflict. RBA members see inflation to peak around 3.25% before dropping to 2.75% in 2023. As such, they say they will remain patient until actual inflation is sustainably within the target range of 2% to 3% before they raise interest rates. Although the Australian economy has bounced back strongly from the Omicron wave and the labor market is tightening, policymakers are in no rush to raise borrowing costs. The RBA previously stated that they will not raise interest rates until 2024. However, as inflationary pressures have continued to increase recently, perhaps there will be slightly hawkish tone on Wednesday.

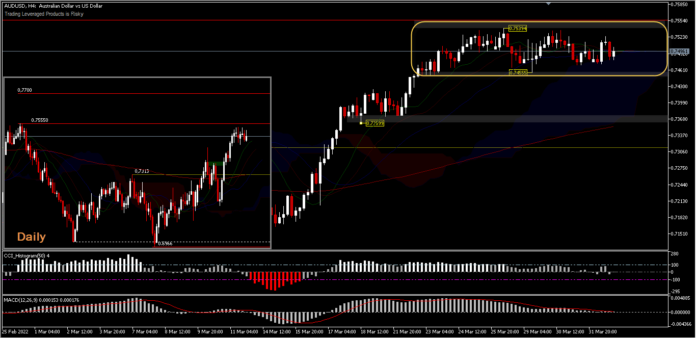

Technical review

AUDUSD posted an interim top at 0.7539 last week, below the 0.7555 resistance and still sideways with 0.7455 support. The intraday bias will remain neutral until a break occurs on the upside or on the downside. Further rally is expected as long as the 0.7313 support holds, while a decisive break of 0.7555 would confirm that the entire corrective slide from 0.8006 has been completed at 0.6966. Further gains should be seen returning to test 0.7700 first. However, a price move below 0.7313 will dampen the bullish view and change the bias back to the downside to the support at 0.7164.

The consolidation that took effect last week will be tested by the RBA’s decision, although there are no surprising forecasts. The Australian Dollar will be guided by the broader market mood, as well as by the direction of commodity prices.

Click here to access our Economic Calendar

Ady Phangestu

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.