- FED Minute Highlights – “Many” members see “one or more” 50bp rate hikes, agree balance sheet sell-off at $95 bln/mth (may start in May). “Many” also wanted 50 bps hike in March but War in Ukraine delayed that decison.

- Stocks tank (NASDAQ) -2.2% worse performer – Asian shares & European FUTS lower.

- Yields perked up again, OIL fell to 3-week low and GOLD rotates at key support level.

US imposes new sanctions on Putin’s inner circle including his daughters and prevent all US firms from Russian investments, USDRUB back to pre-War levels, but Russian defaults loom.

Overnight – AUD AIG Services Index misses (56.2 vs 60.0) and Trade balance shrinks significantly (7.46b vs 11.79b) to 11-mth low. Japan’s leading index came in at a 5-mth low. German Industrial production better than expected (0.2% vs 0.1%) but BIG revision last month, down to 1.4% from 2.7%. UK House price inflation leaps to 1.4% from 0.5% (Average prices rose 11% y/y) as cost of living rises to 54-yr high.

- USD (USDIndex 99.46) – rallied to highest since May 2020 topped at 97.77 yesterday.

- US Yields 10-yr closed at 2.60% , now back to 2.57%.

- Equities – USA500 -44 (-0.97%) at 4481. – Under key 200-day MA. US500 FUTS 4474. Technology stocks led the broad-based decline, Consumer Discretionary lead value stocks higher. TSLA -4%, AMZN & FB -3%; PFE +3%, LLY +4.56% & WMT +2.32%.

- USOil – Trades at $97.60 following a dip to 95.70 following Fed mins. Inventories grew by 2.4m barrels last week.

- Gold – gyrated from $1937 highs to $1915 lows yesterday, before holding at $1925.

- Bitcoin continued to decline from key 45k to trade at 43.4k now.

- FX markets – EURUSD back to 1.0915 now from 1.0875 yesterday. USDJPY holds at 123.70 now from at test of 124.00 yesterday and Cable back to 1.3085 now, form a test of 1.3050 yesterday.

European Open – The German 10-year Bund yield is down -1.8 bp at 0.625%. Bonds sold off yesterday on FOMC minutes, but while the Fed laid out a plan towards accelerated tightening, including a paring of the balance sheet, it seems much of that was already priced in and the minutes didn’t prompt a further inversion of the U.S. curve.

For the Eurozone the picture is somewhat different, and peripherals continue to underperform, which will leave ECB chief economist Lane wishing back the PEPP program as he frets about market fragmentation. DAX and FTSE 100 futures are up 0.3% and 0.1% respectively.

Today – EZ Retail Sales, US Weekly Claims, ECB Minutes (March), Fed’s Bullard & Evans, BoE’s Pill

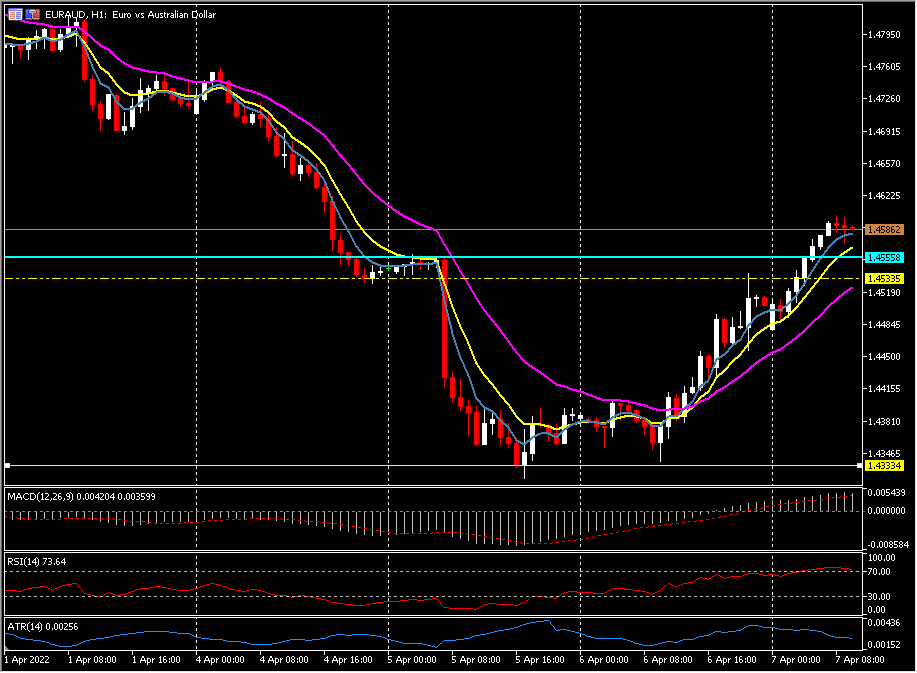

Biggest FX Mover @ (07:30 GMT) EURAUD (+0.51%) Continues to rally off 1.4330 lows this week. Next resistance 1.4600. MAs aligned higher, MACD signal line & histogram higher & over 0 line, RSI 74, OB but rising, H1 ATR 0.0026, Daily ATR 0.0163.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.