USD continued to unwind, Yields dipped on profit taking and moved lower, Stocks very mixed; worst was NASDAQ -1.22%, NFLX -35%, FB -7.7%, IBM +7.10% and TSLA –4.96% (but recovered all of that after hours). Asian Markets also mixed (Nikkei +1.24%, Shanghai -1.77%). Oil & Gold tested key support areas before recovering. Fed officials Daly & Evans talk 50 bp hike necessary in May.

The West is preparing a new military aid package for Ukraine. Ukraine calls for talks on Mariupol withdrawal, Russia tests new ICBM in show of strength says Mariupol will fall on Thursday. Macron & Le-Pen TV face to face – no clear winner but Macron came out better. World faces hunger ‘catastrophe’ as food prices could rise by up to 37% from invasion. Xi, Modi & Serbia restate opposition to Russian sanctions. Johnson in India, calls dealing with Putin like dealing with a “crocodile”.

- USDIndex spikes lower to 100.20 from a test of 101.00 yesterday as USD & Yields cool.

- Equities – USA500 -2.76 (-0.06%) at 4459. – Holds 4400. US500FUTS tick higher at 4470. NFLX wipe out (down –67.7% from Nov. highs as Pandemic stay at home winners suffer.) Ackman’s Pershing Square fund sold entire stake losing $430m from January $1.1 bln investment. TSLA significantly beat EPS & Revenue, profit up $3.3bln, deliveries up 68% at 310K, & supply chains not an apparent problem. MUSK pockets $23bln on results.

- Yields moved significantly lower following 10-yr closed at 2.84% from the attempt at 3% earlier in the week. Trades at 2.87% now

- Oil & Gold both had a volatile session pressured lower. USOil tested under $100.00 and trades at $103.40 now, having tumbled from $109.40 this week. Gold fell to test $1940 zone and trades at $1950 now, having rejected $2000 this week.

- Bitcoin continued to recover from sub 38.5k on Monday to over 41.6k now.

- FX markets – EURUSD has recovered 1.0850 and now tests 1.0900 zone. USDJPY cooled from decade highs to trade at 128.00 and Cable recovered from 1.3000 lows to 1.3075 now.

Overnight – NZD – surprise miss for CPI (1.8% vs 2.0% & 1.4%) PBOC reduced Yuan to November lows after holding off Intertest rate changes.

Today – EZ CPI (Final), US Weekly Claims & Philadelphia Fed, EZ Consumer Confidence (Flash), Speeches from Fed’s Powell, ECB’s Lagarde, BoE’s Bailey & Mann. Earnings from Meggitt, Nestle (in-line), American Airlines, AT&T and Phillip Morris.

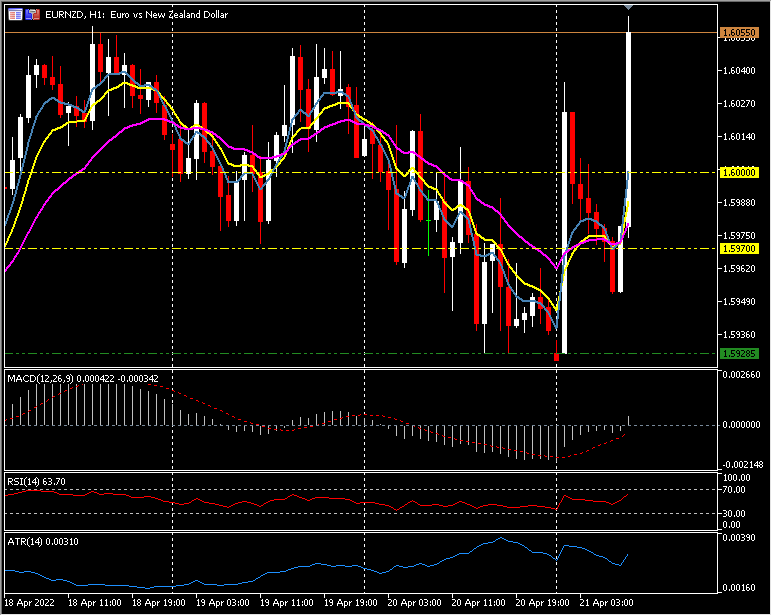

Biggest FX Mover @ (06:30 GMT) EURNZD (+0.67%) Rallied from lows under 1.5930 yesterday to 1.6055 highs today. Next resistance 1.6100. MAs aligned higher, MACD signal line & histogram moving higher, RSI 64 & rising, H1 ATR 0.0031, Daily ATR 0.01571.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.