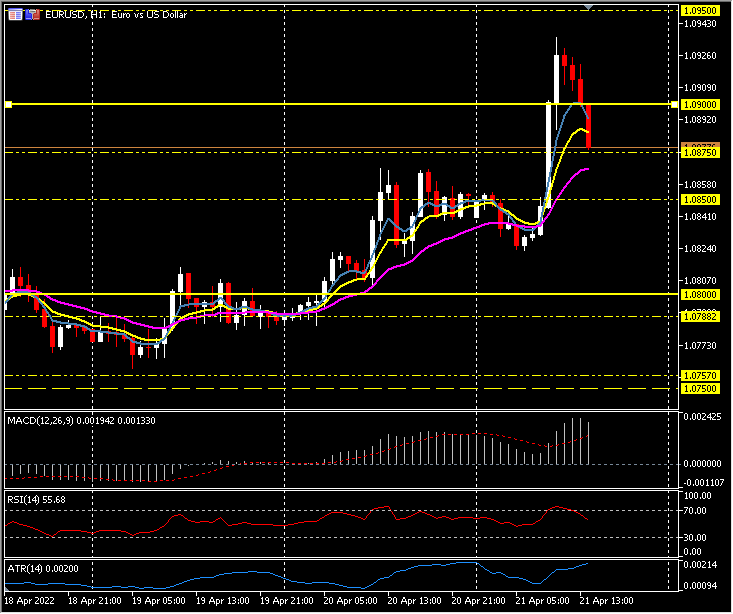

EURUSD,H1

Eurozone HICP inflation revised down to 7.4% y/y from 7.5% y/y in the previous month. Not a total surprise after the Italian headline rate was revised lower last week, and the annual rate is still sharply higher than the 5.9% y/y in February. Core inflation was revised down to 2.9% y/y from 3.0% y/y, but the slight revisions won’t change the case for the hawks, who have become increasingly vocal in their demands for rate hikes later in the year. The target is 2%, 7.4% or 7.5% remains well above this target rate and the very hot German PPI numbers yesterday continues to add to the hawks call. Although the ‘peak inflation’ story could start to gain traction (New Zealand CPI earlier, although a record high was less than expected) the peripheral data remains spiky globally. US Housing Starts and Building Permits, both beat expectations on Tuesday and Existing Home sales were in-line yesterday but above seasonal and long term averages, for example.

That net ECB asset purchases will be phased out early in Q3 is pretty clear now, but for the rate outlook, it will also be key what happens with Russian energy deliveries to Europe, as a sudden cut off, especially of gas supplies could leave Germany for one heading for recession. Today’s CPI numbers confirmed that the bulk of the uptick is still due to energy prices, which were up 44.4% y/y in March, but there are also increasingly signs that this is feeding through the product chain, with prices for non-energy industrial goods rising 3.4% y/y and services price inflation hitting 2.7% y/y. It seems only a matter of time before wage growth accelerates.

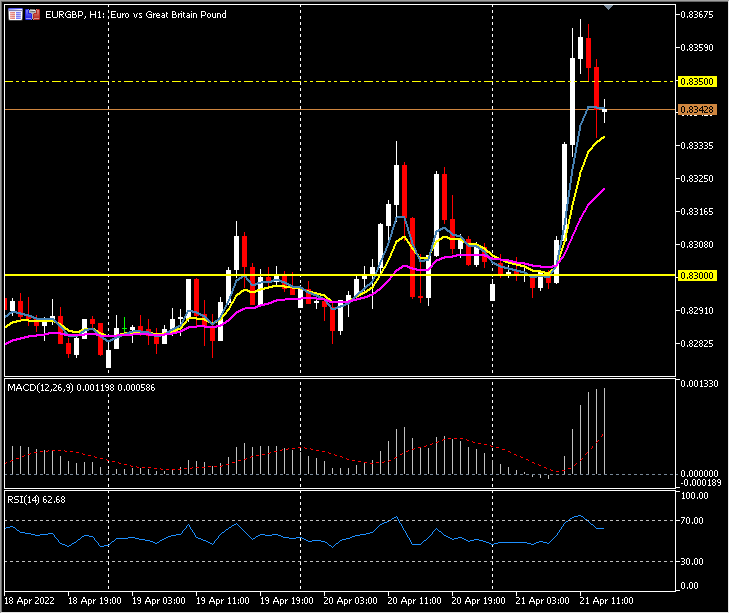

The EUR outperformed today and EURUSD lifted to 1.0936 & EURGBP to 0.8366, after a number of hawkish ECB comments that counterbalanced Lagarde’s growth warnings from last week and confirmed not just that net asset purchases will be phased out early in Q3, but also that the hawks are pushing for a series of rate hikes to start shortly after. The yen remained weak but at 128.07, USDJPY is below recent highs amid some cautious verbal intervention from Japanese officials and against the background of a mixed dollar. The USDIndex saw lows under 100 earlier in the session as investors prepared for G7 comments on recent dollar strength, but has since lifted to 100.587. Japanese Finance Minister Shunichi Suzuki suggested the G7 likely stuck to the view that markets ought to determine currency rates, that the group will closely coordinate on currency moves while highlighting that excessive and disorderly forex moves would hurt growth.

Still to come today are key speeches from FED Chair Powell (x 2), ECB President Ms. Lagarde and BOE Governor Bailey, along with Weekly Claims and Philadelphia Fed. Manufacturing Survey.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.