UK100, H8

The sell-off in commodity-linked stocks and financial stocks has put the UK market under high selling pressure. The sell-off led the FTSE 100 index to fall sharply for a series of 3-day losses, in view of the profit reports for the first quarter of 2022 for some of the leading banks in the United Kingdom.

Reckitt Benckiser, Unilever, Pearson and Hikma Pharma recorded marginal gains with the 6 shares listed on the FTSE 100 in the green, three hours after the session. Only the advances of Polymetal prevented the FTSE 100 from falling even further with the stock rising 3.7% at the beginning of trading, after reporting a 4% increase in annual revenue to $616 million, due to the rise in gold prices. However, after the dip for Gold prices under $1900, Polymetal has opened -2% today.

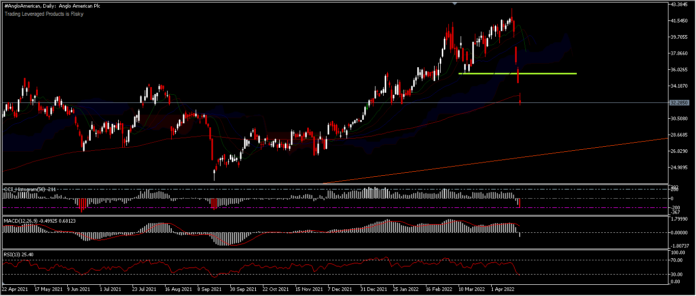

Significant shares experienced losses, including BP (-5.37%) and Shell (-5.33%). Shares of metal producers such as Rio Tinto plunged -4.89% at the start of trading, Aveva Group -5.8% and Glencore -5.61%. Anglo-American was at the top of the losing charts with a deficit of over -22% for 5 consecutive days, with a slight reprieve today with the share price moving higher by 1.5%. Shares of Lloyds, Natwest and HSBC all traded lower ahead of Earnings later this week.

Technical Analysis

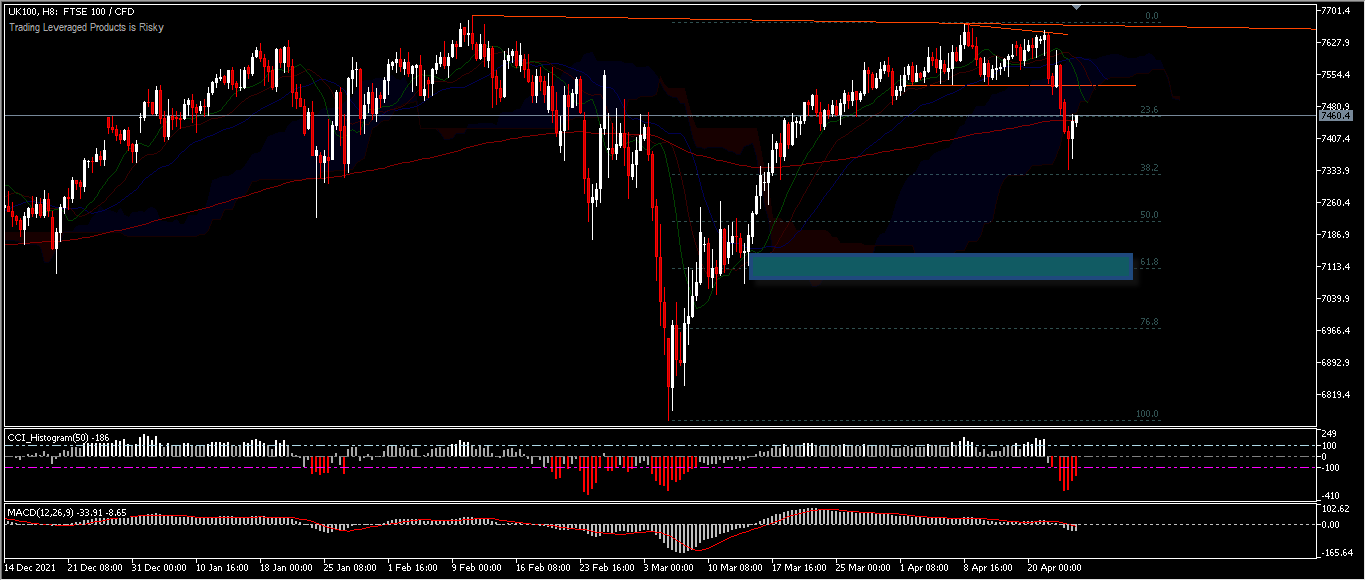

UK100, intraday bias on the second day of the week seems neutral after Monday’s acceleration. The index was temporarily corrected to 38.2% FR at 7335, which will be a small support.

A move back below these levels would put the index in correction mode for 50% FR and 61.8% FR or at least the 200-day EMA. The upward movement will be limited by the small resistance to 7527, before returning the pointer to the downward side. However, a move above this level will bring the indicator back to resistance levels at 7608 and 7654. In the H8 chart, the value is currently around 200 EMA with an oscillation histogram that tends to be lower in the middle line, indicating a correction effort from the 3 consecutive days of losses. Currently today, the UK100 trades lower again at 7240.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as general marketing communication for information purposes only and does not constitute independent investment research. Nothing in this communication contains or should be deemed to contain investment advice, investment recommendation or solicitation for the purpose of buying or selling any financial instrument. All information provided is collected from reputable sources and any information that contains an indication of past performance is not a guarantee or reliable indication of future performance. Users acknowledge that any investment in leveraged products is characterized by a certain degree of uncertainty and that any such investment involves a high level of risk for which the Users are solely responsible. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or distributed.