Meta Platforms, Inc. will release its Q1 2022 earnings report on Wednesday 27 April 2022, following market close, with many market watchers and analysts looking for signs of recovery. Markets expect Meta to earn $2.56/share on revenue of $28.23 billion. This compares with the same quarter last year when earnings were $3.30 per share on revenue of $23.67 billion. The slowdown in users and the growth of ads on the core products Facebook and Instagram have made the market question the future of Meta, plus the ban on Meta products in Russia with its millions of users, is adding to the pressure. Russia blocked Facebook and Instagram in March, calling Meta an extremist organization.

Meta lost a record $230bn market value, after disappointing earnings reports in February. Facebook recorded its first ever drop in daily user count, which will affect Meta’s progress after the big stock drop in the last quarter. The historical loss of users on the platform is one of the most impactful results of the final quarter of 2021 report and underscores that Meta’s biggest near-term challenge is stemming the decline in usage. Apple’s new privacy rules are thought to be one of the culprits in lost sales this year, alongside stiff competition from Tik Tok for Meta’s share of the market. Apple’s new privacy rules prevent Meta from collecting certain user data and have prompted the company to change some of its core advertising business models.

The Meta platform achieved impressive growth and revenue during the pandemic, recording $118 billion in revenue last year, up 37% y/y, while EPS $13.77 was also a record compared to $10.09 in 2020. But the momentum quickly evaporated, amid a rebranding and major shift in its business model. User metrics slowed, and operating margin in Q4 was last reported at 37% down from 46% due to the rising trend of cost pressures. The virtual reality platform Metaverse siphons huge sums from core businesses like Facebook and Instagram. Meta funneled $10bn in funding to the platform in 2021, more than 10 times what it paid to acquire Instagram in 2012.

During its Q4 earnings report in February, the company forecast Q1 2022 revenue growth of only between 3% to 11% which spooked the market. The result is expectations that EPS 2022 will fall by 11% compared to 2021 with a series of lower-than-consensus revisions over the past few months.

Zacks expects the social media company to post quarterly earnings of $2.60/share, representing a -21.2% year-on-year change. Revenue is forecast to be $28.3 billion, up 8.1% from last year quarter. The EPS consensus forecast for the quarter has been revised 2.31% lower, over the last 30 days to current levels. Zacks ranks Meta Platform shares at 3 (HOLD).

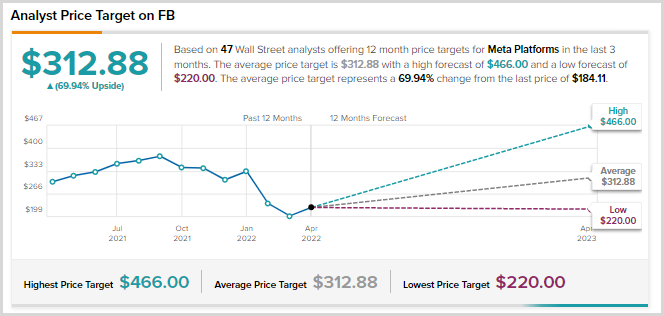

Meanwhile, Tipranks offers a 12-month price target for the Meta Platform in the last 3 months with moderate buying. The average price target is $312.88 with an estimated high of $466.00 and an estimated low of $220.00. The average price target represents a 69.94% change from the last price of $184.11.

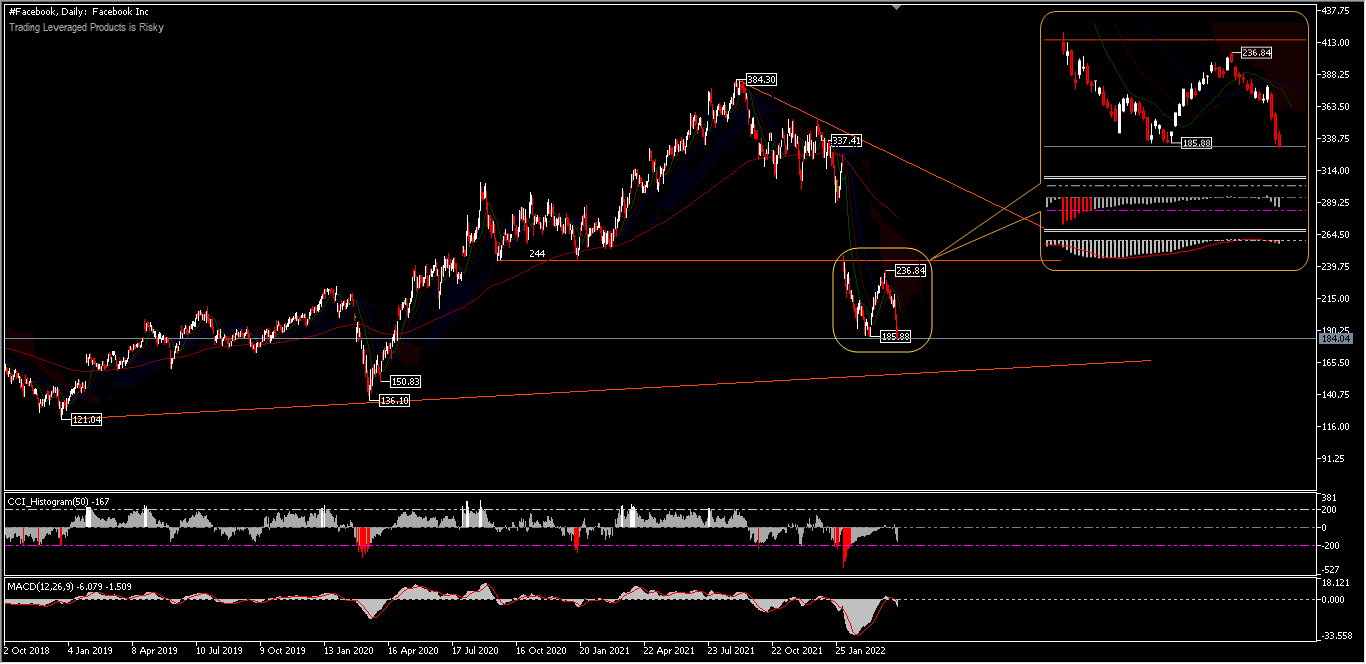

Technical Analysis

Amid the recent tech sell-off, Meta shares have fallen 18.4% for April and 45% since the start of 2022 to date. Considering the kind of aggressive selling we’ve seen, the stock has lost more than 52% in value, since hitting a high of $384. Stocks have been sold off with a reassessment of earnings prospects, while questions about the direction of the metaverse have added new risk. The stock sell-off found some support in the 2019 trading range before the pandemic.

Last week, the asset price closed again below the minor support of $185.88, registering a fresh low of $183.26. Along with the $236.84 resistance the asset price outlook will remain to the downside with the possibility to test another low around $168 and $150 near the ascending trendline, however traders should be quite cautious, as the asset is currently in the oversold zone. On the upside, a price move above the $236.84 resistance would invalidate the downside options and the bias would turn to the upside for the $300 round-figure mark. Broadly speaking, technical indicators are still validating the asset’s price weakness, after the $185.88 rebound failed to rally higher.

The earnings report could help stocks move higher, if key numbers are better than expected. On the other hand, if it misses the stock could move lower. Sustainability of immediate price changes and future earnings expectations will largely depend on management discussions, about business conditions on earnings calls.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.